USDC vs. USDT: Which of the Two Stablecoins is a Better Choice?

A while ago, convenience beat decentralization even in crypto, and USD stablecoins became uncompromisingly the most popular type of asset in this market. A glance at the trading volumes and usage statistics reveals a clear leader — Tether USD (USDT) but a runner-up is getting closer by the day — USD Coin (USDC). What is the key difference in the first place, and why checking both out is worth your time? Read our new comparison guide to find out.

Key Takeaways

- Stablecoins are a widespread type of crypto assets: tokens tied to the price of a fiat currency or other asset. These days, the most popular stablecoins are fiat-backed stablecoins Tether USD (USDT) and USD Coin (USDC);

- Tether USD (USDT) is massively popular and widespread, accounting for a huge part of all activity on the crypto market. However, its issuer Tether Ltd. has a history of controversy surrounding it;

- USD Coin (USDC) is the runner-up, seeing humbler but nonetheless considerable network activity and trading volumes. Its issuer Circle maintains a stronger focus on regulation and transparency.

Stablecoins: Fiat currency-backed Crypto assets

Today, it is hard to imagine the crypto market without USD-pegged stablecoins. They make up the most trading volume on both centralized and decentralized exchanges and are an easy and obvious solution to payments with cryptocurrencies. Their design is simple enough to understand intuitively: stablecoins are tokens that represent a fiat currency unit (usually, USD) on a 1:1 basis. It’s like dollars but make them crypto!

Photo by Alexander Schimmeck on Unsplash

As the name implies, stablecoins are crypto “coins” that are supposed to remain “stable”. To understand where the label came from, we will have to have a brief history lesson.

Why Stable the Coin?

The original intended use for cryptocurrencies was payments and value transfers. While the early Internet-era digital currencies relied on databases that tracked users’ balances and deposits, much like banks, cypherpunks tried to create a system that would not rely on fiat currencies at all. With Bitcoin, they succeeded in that mission but by not making it tied to any real-world asset, BTC became a digital asset that was very prone to market conditions and volatility.

By definition, volatility is the lack of stability or predictability, and when talking about assets or markets, it refers to the prices. Volatility can vary in how often the prices change and how drastically. In the case of cryptocurrencies, which are traded round the clock without the markets closing, both frequency and the magnitude of the price change contribute to their reputation. An asset that is volatile is poorly suited to be a payment method because all market participants would have to keep track of the rates and prices and change them accordingly. Of course, it is easier in the digital age and with automated technologies but adjustments still need to be made.

The degree to which the price is able to change — no matter the quality — is also important for a medium of exchange. This can often be a result of low liquidity in an asset, among other things. Liquidity refers to the ability of a market to move assets and respond to changes in supply and demand. High liquidity is better because more of an asset is immediately available, and the transactions will not affect the rest of the market.

In a market, rising prices disincentivize buyer participation, and declining prices discourage sellers or goods and services providers. Both forces are equally vital for a healthy market, in which ideally they are in an equilibrium. Constant shifts between the sentiments and conditions simply make it hard to participate in such a market, which is why cryptocurrencies like Bitcoin are not finding mass adoption as a medium of exchange.

The answer came around a few years after the launch of Bitcoin when the first layer-two protocols for the Bitcoin blockchain were developed. As it is, the BTC blockchain could not support other digital assets with rules different from BTC without any workarounds. In colored coins and the Omni protocol, the solution to this problem was starting to take shape, giving way to tokenization. It would still be a couple of years before the blockchain that natively supported smart contracts would be launched after years of research and development. Of course, we are talking about Ethereum.

The launch of Ethereum and token smart contracts marks the real beginning of the history of stablecoins. Tokenizing assets such as fiat currencies became more accessible, although it did not solve the challenges of custody and issuance. This is where Tether and Circle seized the opportunity and launched USD-pegged stablecoins: Tether USD (USDT) and USD Coin (USDC), respectively.

There are a lot more types of stablecoins, depending on the kind of asset they are pegged to or how their stable value is maintained. However, in this article, we will be focusing on these two most popular dollar-pegged centralized stablecoins.

Tether USD (USDT)

/>

©Wikimedia Commons

Although Tether USD traces back to 2014, when it used to be known as Realcoin, it was not the first stablecoin on the market. However, it most certainly is the most long-standing by now. Tether launched on the Bitcoin blockchain through the Omni protocol but today spans across 14 blockchains and L2s and issues tokens pegged to four fiat currencies and precious metals.

The stack of Tether USD and most other centralized stablecoins somewhat resembles e-money: Tether is the entity that controls the smart contracts, making sure that the circulating supply of tokens is equivalent to the value of their reserves. They also handle the custody of reserves, provide attestations or respond to legal requests, and redeem tokens to fiat currencies. What makes it different from the centralized digital currencies and e-monies is the underlying blockchain. Thanks to it, the movement of funds is fully transparent, and therefore, auditable. Not to mention other perks such as lower costs, borderlessness, and the ability to plug into the crypto economy with a familiar unit of exchange.

USD Coin (USDC)

/>

The main competitor of Tether Ltd. at the time of writing is USD Coin (USDC) issued by another company: Circle. It works largely in the same manner as Tether: they maintain reserves and provide attestation, issue and redeem USD for the USDC tokens (and vice versa), and have access to the functions of the smart contracts.

USDC stablecoins are available on 9 blockchains natively and bridged to a few more: Polygon, Fantom, NEAR, and Cosmos.

USDC contract has a few features that give it more flexibility than Tether. For example, it supports state channels, which take transfers off-chain and use the Ethereum blockchain only on settlement, making USDC transfers more economical. Centre’s (defunct consortium of Circle and Coinbase, and the original entity behind USD Coin) documents outlining the design of USD Coin also have a stronger emphasis on regulation and AML/KYC measures.

USD Coin vs. Tether: What are the Key Differences?

On a surface level, the two stablecoins, USDT and USDC are more or less the same. To an end user, they work almost in the same manner and for all intents and purposes might as well be the same thing. Or not? Let’s try to see how USDC and USDT are doing on the crypto market today and whether these differences are valid or arbitrary.

Volume and Liquidity

The opening statement that it is hard to get by in the crypto space without knowing about stablecoins is not an exaggeration. By trading volume, Tether USD is far ahead of any cryptocurrency on the market: according to CoinGecko, today it has a $20.4B 24H trading volume. Ethereum (ETH) is second but its 24H volume is $6.9B, roughly a third of Tether’s. USD Coin is fourth, behind Bitcoin (BTC), with a $3.9B trading volume. It is fair to say that well over half of the total trading volume of all crypto for the past day ($34B) is attributed to Tether USD (USDT).

We already briefly talked about liquidity and why it is important. Liquidity is connected with volatility, but does it matter for a supposedly stable digital currency? Of course! Robust liquidity will ensure that the asset stays close to its target price.

According to both reports on USDC and attestations of Tether, the reserves have a positive liquidity ratio (obviously). Finding out the accounting liquidity of the companies can be tricky but we can assess the market liquidity for USDT and USDC. High trading volume is one sign of high liquidity but looking at a bid-ask spread is also a helpful measure. USDT’s spread ranges from 0.01% to 0.58% and USDC’s varies from 0.01% on CEXs to 0.6% on DEXs.

Adoption and Availability

The best measure to check how useful these assets tied to the U.S. dollar are is to check the network activity and review the services where one can put the stablecoins to use.

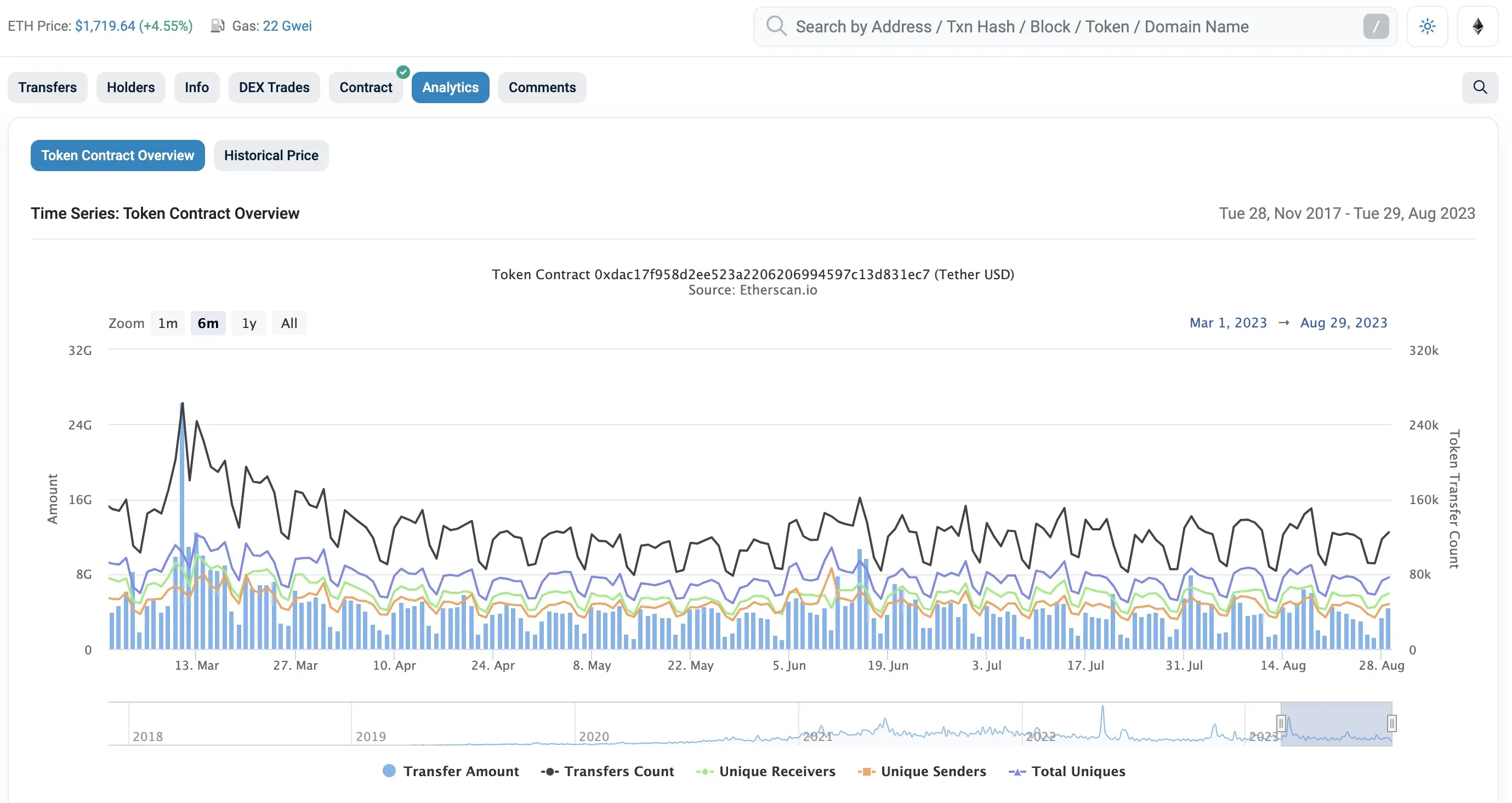

Source: Etherscan

We will be looking at the past six months, since in this time frame the crypto market did not experience considerable changes and therefore, this period is more or less reflective of the current situation. At the peak, on March 11, 2023, Tether USD (USDT) on Ethereum saw 262,754 transfers totaling $26B. At the same time, the number of uniques (sender and receiver addresses) remained more or less on the average level, suggesting that the increase in value transferred through the network was not caused by an influx in users. If we exclude obvious deviations like that spike in activity, on average $4B USDT is being transferred daily in about 110 thousand transactions (on Ethereum alone). But in case you are curious about the network activity of USDT on TRON, the average total value transacted there is around $10B over 1.7 million transfers.

Another pattern observable on the chart is a regular decrease in activity every seven days (particularly, on weekends). This could mean that USDT is being used in professional settings, like financial institutions.

/>

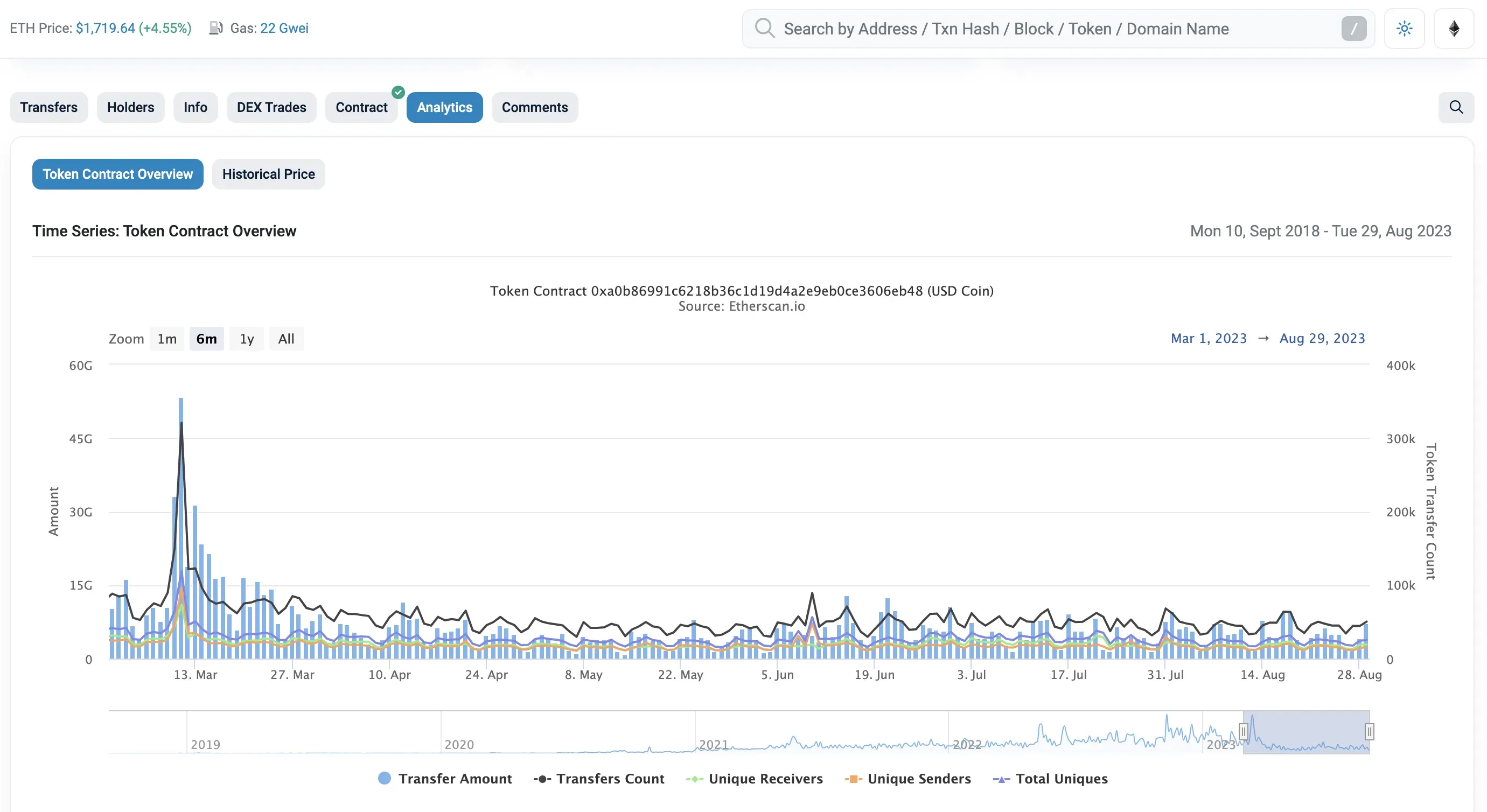

Source: Etherscan

USDC is showing roughly the same patterns, although two differences are clear from the get-go. The spike on March 11, 2023 is more noticeable, and the weekly network activity pattern is less apparent.

At the March peak, over $53B in USDC was transferred through 321 thousand transactions. The unique addresses also spiked, unlike in USDT, pointing out that with USD Coin, something caused a lot of holders to move funds. In case you have not connected the dots by now, around that time Silicon Valley Bank (SVB) and a few more tech- and crypto-friendly American banks went under. Part of the Circle’s cash reserves was kept in SVB, which caused a mild panic and a rush of redemptions, all of which it was able to fulfill. Dealing with a crisis like this, a threat of a bank run, without considerable losses is a sign of a decent accounting liquidity of Circle’s reserves.

What about the average day for USDC? On average, $7B in USDC gets transferred across Ethereum in 50 thousand transactions. The higher total value of USDC transactions spread over fewer transfers may be another sign of financial institutions using the stablecoin.

USDT is trading on 141 crypto exchanges, centralized and decentralized. The number of USDT markets is so high that you would be hard-pressed to find a platform that does not support it. USDC is available on 96 exchanges, which is also rather accessible but less so than Tether. A repository of businesses that accept crypto Cryptwerk lists 1,523 points of purchase where USDT is accepted vs. 901 shops accepting USDC.

Cumulatively, USDT is seeing more use and network activity than USD Coin. On the surface level to an end-user, both might as well be the same, so it is not surprising that even more new users pick the most popular one.

Security and Concerns

Stablecoins like USDC and USDT often get criticized for their centralized design, and for a good reason. These stablecoins require trust in the companies that handle minting, burning, and maintaining reserves, which is barely different from a bank. Moreover, while convenient, pegging a cryptocurrency to a fiat currency defeats the purpose of having an asset that is not issued by a central bank or government.

Tether Ltd. has been controversial for pretty much the entirety of the USDT history. It has been sued, its reserves are endlessly doubted, and it was even accused of market manipulation and fraud. Their PR tactics and off-shore leanings do not particularly help to cement it as a trustworthy organization. Sure, it can be argued that they do provide first-party information on reserves (the so-called “proof of reserves”) and have settled the legal cases. Nevertheless, their conduct is rarely brought up because so far, the cases which would have stirred unrest with USDT holders (such as depegs, or the loss of a peg) have not been serious enough, and as long as the status quo is maintained, this stablecoin would remain relevant.

What is the alternative like, though? USD Coin has a better reputation at least when it comes to its relationship with the regulations. They are more strict about KYC/AML measures, and the reserves are attested monthly and their composition is transparent. The official Circle website has a hub for news on the digital dollar and where the company stands in the conversation with the U.S. government. All this is a stark contrast to Tether which allegedly is not even supposed to serve the U.S. citizens. USDC positions itself as a digital dollar issued by a private company, not as a cryptocurrency in the first place. Consequently, to crypto denizens who for one reason or another do not want to see any government near their funds, all these strengths of USDC turn into a huge drawback.

As we already mentioned, in March 2023, USDC took a huge hit but the company managed to keep the peg and, by their own reports, manage the redemptions. So, at the very least, in comparison to USDT, USD Coin has been battle-tested and proved its liquidity.

Which is the better stablecoin?

So there you have it: a choice between a stablecoin that everyone uses or a “digital dollar” that is harder to get and use but with a better reputation. A ton of stats support the idea that USDT is in the lead, although USDC is not doing poorly, either. Still, why should you take a moment to reconsider picking the most obvious option in favor of the stablecoin issued by Circle? We addressed this question to ChangeHero’s CMO Alex, who provided us with his unconventional opinion on the subject:

First off, my observation is entirely subjective but going off all my experience in the market, there is a good chance that even if USDC does not flip USDT, at the very least, their share of the stablecoin market cap will eventually get equal. I am largely basing my thesis on the faster pace of growth of USDC: from its market cap to integration campaigns. USDC is clearly a centralized stablecoin but so are the platforms that until recently claimed to be decentralized and now cave in to regulators’ demands one after another.

Think that crypto is about decentralization all you want, but actually, it is the survival of the fittest. In my opinion, with better transparency of audits, a U.S.-based issuer, and the lack of volatile assets in the reserves, USDC seems like a safer and more stable option. After another USDT de-peg (and I am sure one is coming) you would have better chances of keeping your assets safe in USDC or coins like BTC and ETH. Splitting your stablecoin stash in at least a 50:50 ratio and if need be, swapping them 1:1, would cost you nothing but it would bring you a lot more peace of mind.

Conclusion

The debate about the best stablecoin will continue as long as there is choice, and healthy competition is great for everyone involved. USDT seems fine as a fair-weather pick but if you see clouds on the horizon, USDC can serve you better. After all, you can always exchange them in any direction on ChangeHero!

If you found this article helpful, the rest of our blog is equally full of insights and knowledge about the crypto industry. To be updated daily on the state of crypto, follow us on Telegram, X (Twitter), and Facebook.

Which is better, USDC vs. USDT?

Both stablecoins, USDT and USDC, have their own advantages. USDT token is more ubiquitous: it is available on almost any crypto exchange and sees fewer limitations by jurisdictions. On the other hand, USD Coin has a better reputation, a stronger composition of reserves, and its liquidity has been battle-tested.

Is USDC more trustworthy than USDT?

Both USDC token and USDT share a similar design with a centralized entity managing the reserves and smart contracts. USD Coin has a stronger emphasis on following regulations, particularly, in the USA. Tether Ltd., the issuer of Tether USD and a few other stablecoins, has a weaker track record because of its history of legal proceedings and investigations into its reserves and conduct.

What is the difference between USDC and USDT in crypto?

USDC and USDT are both U.S. dollar-pegged stablecoins, the value of which is maintained near $1 at all times. The main difference between them is that they are managed by different companies: Circle and Tether Ltd., respectively. Due to being two separate crypto tokens, they find slightly different degrees of adoption and availability, as well as use.

Why hold USDC instead of USD?

USDC can provide the usefulness of dollar transfers (and hedge against inflation over less stable national currencies) without the hassle of opening a bank account or purchasing USD. Some limitations may arise depending on if the recipient accepts crypto payments but the benefits of using USDC include 24/7 usability, lower transaction fees, higher transaction speed, and transparency through the underlying blockchain.