Contents

Money is as old as the civilization, and likewise it is moving forward with it. In our previous article, we have looked at the history of money until the digital age. In this second part, we will recap the modern technologies connected with money and explain how digital currencies can become the future.

History of Digital Currency

In the first article on the history of money, we defined money as a unit or a verifiable record. When talking about coins, commodity money or paper money, we can vividly imagine the units. Digital currencies are more about the record in a ledger. It exists as bits of information, but we accept it as money nonetheless.

How does digital currency work? Usually, digital currencies would be assigned to an account. From this account with the help of a record keeper, we can communicate the transactions. (This record keeper is usually the bank, payment service provider or any other third party). The most used channel of communication with the record verifier is the Internet. For example, we want to make a purchase with a card at a shop. The shop verifies our purchase and tells the issuing bank how much they have to subtract from your account. The bank verifies that you have this sum and can make the purchase.

How long has digital currency been around? The idea is as old as the Internet, so the concept was out there at least since the 1980s. Since it makes use of the Internet, the history of digital currency truly began in the 1990s.

Bank Cards

However, before the digital currencies came digital records of operations with real money. In the late 1960s, automatic teller machines (ATMs) were invented and became commonplace. To use one, a client needed to have a bank card. ATMs communicated with the banks through interbank channels. In the next decade, smart cards which could be used for payments, were invented.

Bank cards are technically not units with which we pay. Instead, each card is connected to a bank account and is used for client identification. It is hard to imagine, but the first ATMs did not use PIN protection. The information was encrypted with a magnetic strip only. More modern cards utilize more sophisticated security methods, out of which one of the first was an integrated-circuit chip.

E-gold

In the 1990s, it was safe to say that the history of digital currencies truly began. It became clear: in the Internet era, the banks were not the only ones who could keep a verifiable record.

The idea behind the first digital gold currencies was simple. Users deposited money into the company’s custody, the company bought gold to back the deposit. After that, the users had access to a means of payment where the proof of gold ownership was accepted. Of course, cross-account transfer was also available. That was the model that e-gold Ltd. used, a company founded by Douglas Jackson in Florida in 1996.

It was not the only one digital currency in the time it operated, but it was by far the most popular one. In 2009, there were five million accounts opened with e-gold Ltd.

This enterprise not only operated on a familiar premise, but actually introduced advances inspired by its digital medium. E-gold allowed transactions as small as 0.0001 g of gold, making it the first successful micropayment system. It also had one of the first APIs developed by non-credit-card service providers which let online shops accept e-gold.

Cypherpunks and Early Cryptocurrencies

Both early digital currencies and banks have had a glaring problem: centralization. These systems operate on trust that the deposits will be kept secure and the services will be provided.

In the late 1980s, it became clear in the digital age, privacy would be a matter of personal interest. Libertarians and cryptography enthusiasts came together in a movement which would be dubbed cypherpunks.

Cryptography was applied to communications first and only lastly to the ideas for money. However, the technologies devised for communication would end up making it into history of money. For example, proof-of-work was initially used to deter spam emails.

The idea of hashcash proposed by Adam Back suggested performing some computational work before an email could be sent. To an end user, it looked like a one-second lag, unless they tried to send hundreds of emails in bulk. Proof-of-work came back full circle to become one of the pillars of cryptocurrency.

Since libertarianism dictates the government shouldn’t have any business with the lives of individuals, they theorized how money could work. For example, Wei Dai came up with the idea of b-money. It is a unit, transactions with which would be verified not by a single entity but by all participants.

Nick Szabo proposed bit gold. To solve the centralized control of money issuers, he suggested a system that would use an unforgeable registry. In this registry, transactions could be tracked by the timestamps and digital signatures. Needless to say, all cypherpunks were very well acquainted with the private and public key cryptography invented by Whitfield Diffie.

The first digital currency which was a complete product was actually developed by a cypherpunk. What was the first digital currency? It was David Chaum’s DigiCash. It was more than a simple registry of transactions because it utilized encrypted keys to validate transactions and was anonymous. However, DigiCash did not take off like e-gold did, and Chaum had to file for bankruptcy and sell the company in 1998.

Cryptocurrencies and Bitcoin

Fast forward ten years. The cypherpunk community had had more than enough time to work on their ideas and develop the concepts. Moreover, they had more reasons to do so. The privacy and economic situation was not getting better, take the dot-com bubble or the 2008 financial crisis.

The governments’ solution to support the economies in decline involved stimulating it by issuing large amounts of the national currency. The situation was made egregious by the fact that most of this money ended up in banks and large enterprises. The “trickle-down” principle only ended up helping the richest, while the people felt the supply dilution and devaluation.

The first cryptocurrency, which was neither centralized nor needed policing was invented in 2008 by Satoshi Nakamoto. The whitepaper was released to the rest of the cypherpunk community on October 31, 2008. Finally, on January 3, 2009, Bitcoin blockchain was set in motion. The message in the first block reads, “The Times Jan/03/2009 Chancellor on brink of second bailout for banks.” It is thought to be both a time reference and a reminder for the ideological history of Bitcoin.

The blockchain is still running uninterrupted to this day, supported by thousands of nodes worldwide. The code is open-source, and over the years hundreds of developers have contributed to it. The original model for Bitcoin served as a template for many other altcoins and forks.

The narrative around Bitcoin has shifted significantly over the years. While it was originally intended to be a peer-to-peer digital cash, due to its qualities it found another use. Instead of a digital currency for daily use, it has been adopted as a store of value. The hard-coded scarcity of the asset made it attractive to the institutional investors seeking to hedge against inflation.

Bitcoin and Properties of Money

Bitcoin was designed to be “peer-to-peer digital cash”. To fulfill this purpose, it had to have most or all of the properties of money.

- Durability: as Bitcoin exists only as data, it is immune to weathering;

- Divisibility: BTC is divisible into 10^-8 units, called satoshi;

- Portability: Bitcoin does not require a tangible medium;

- Uniformity: BTC does not exist in units per se, but all of them are assigned equal worth;

- Scarcity: BTC has a hard cap of 21 million.

However, there are several properties that Bitcoin has not yet achieved fully:

- Fungibility: Bitcoin uses unspent transaction units, so theoretically, “tainted” there is a problem of “taint”;

- Acceptance: Bitcoin is not recognized as legal tender in many parts of the world;

- Cognizability: there is no public consensus on the worth of Bitcoin, though most populations are aware of it.

Digital Currency VS. Cryptocurrency

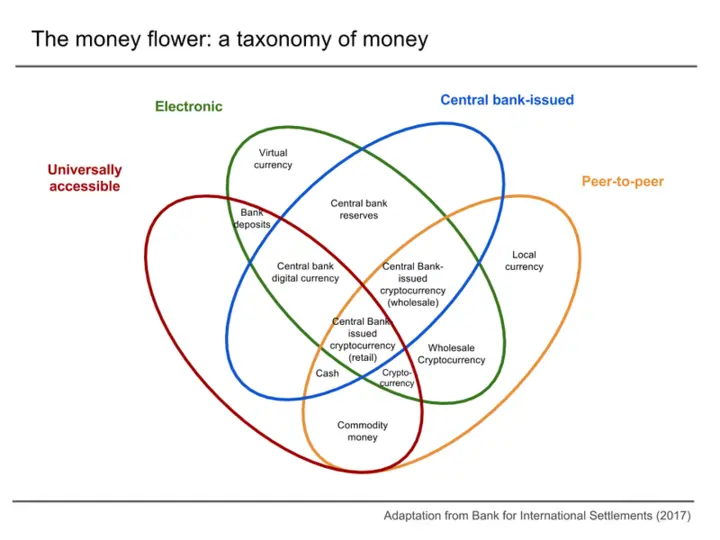

As far as the history of money goes, cryptocurrencies and digital currencies went almost in parallel. However, cryptocurrency is only one of the types of digital currency, akin to virtual currencies or central bank-issued digital currencies.

Unlike most digital currencies, cryptocurrencies are:

- Decentralized (generally);

- Borderless and universally accessible;

- Pseudonymous or anonymous.

Cryptocurrencies rely on cryptographic technology to sign transactions and propagate the network. It is a digital currency, but not all digital currencies are cryptocurrencies.

Key Takeaways

- History of digital currency is preceded by bank cards. The shift in the history of money from units to verifiable records happened in the 1970s;

- The next step in the history of money was digital currencies. The first ones relied on centralized entities to run them, like e-gold which was founded in 1996;

- At the same time, cypherpunk movement was devising privacy-securing forms of money, free from the government influence: b-money, bit gold, DigiCash;

- Their developments culminated in the creation of Bitcoin in 2008, the first true cryptocurrency. By Satoshi Nakamoto’s design, it has most of the properties of perfect money;

- Cryptocurrencies are one type of digital currency, which are less dependent on trust and less prone to excessive control.

Conclusion

In these two articles, we have covered the history of money up to the current day. Cryptocurrencies evidently have a bright future, considering how developing a central bank-issued digital currency is a race between governments these days. In the most likely scenario, Bitcoin and other cryptocurrencies will exist in parallel to the digital national currencies. However, they always will be a more privacy-oriented and independent mode of money.

This is it for the history of money, but in our blog you will find more educational content like this. The notifications about updates are promptly posted on Twitter, Facebook, Reddit and Telegram.

Learn more:

Quick links:

- Exchange Ethereum to Bitcoin

- Exchange Bitcoin to Ethereum

- Exchange Bitcoin to Bitcoin Cash

- Exchange Bitcoin Cash to Bitcoin