Bitcoin Cash hard fork as explained by Bitcoin.com

Bitcoin Cash hard fork as explained by Bitcoin.com

Bitcoin Cash: A true peer-to-peer Electronic Cash?

Back in 2008, and even before that, enthusiasts like Satoshi Nakamoto were coming up with ways to give the power of the money back to the people. The one that came to be the most prominent — Bitcoin — was envisioned as an “electronic cash” system. While a lofty goal in itself, it eventually was up to the followers to make this goal true. For that purpose, through polemics and discord, a few visions have risen up — now known as Bitcoin forks. This time we‘re going to have a look at one of those forks, Bitcoin Cash, to tell you how and why it came to be and how it works.

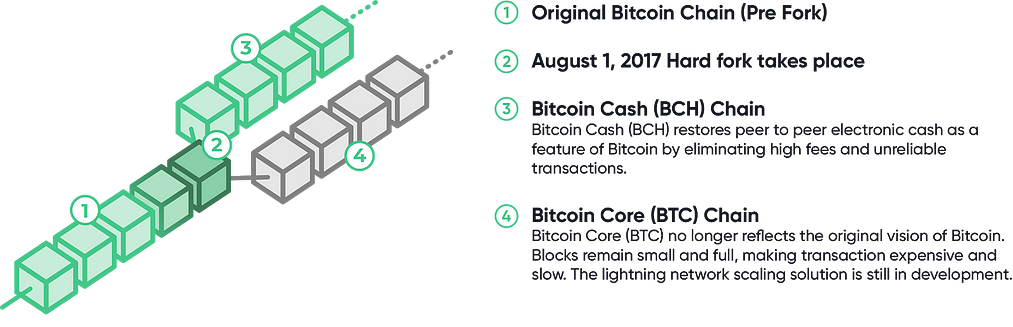

Let’s start with a brief explanation of what a fork is. You can think of a fork as an update for the blockchain. It usually puts new protocols in place. Forks can be divided into soft forks and hard forks, which irreversibly change the blockchain. However, there are times when a hard fork is not supported by the entire community. If the divide is significant enough, it is possible that after the update both original and updated versions will continue to exist. However, in this case, the new records on the divergent chain will not be supported by the original one, and vice versa.

The Block Size Dilemma

While in 2017 Bitcoin was on the rise, but mainly as a trading asset and a unit of value storage — it didn’t really go mainstream before that. However, the debate about the future of the network has been going on in the community for about three years. The block size in Bitcoin blockchain was only 1MB, and the increasing load was not going too well for the network. The community started pushing the idea of increasing the block size, but not everybody agreed. Alternatively, SegWit was offered as an option. SegWit, or Segregated Witness consensus layer, separates digital signature (input that verifies the sender has enough Bitcoin to send) from the transaction, which makes it take up less space. On top of that, second-layer solutions like Lightning Network (a network of off-chain channels) would have to be further implemented.

Why would the idea of a bigger block be controversial, though? The thing is, Bitcoin is based on the Proof-of-Work. A larger block in a PoW blockchain means increased mining maintenance. While it would do wonders for scalability and increase the transaction speed significantly, it would also make mining more demanding and therefore, less decentralized.

After a years-long back and forth, it became evident that a compromise could not be reached, and so, on August 1st, 2017, the fork took effect. The new chain was backed by large mining pools like ViaBTC, mostly based in China. ViaBTC investor, Jihan Wu, co-founder of Bitmain, is often called a leading proponent of the fork. Bitcoin.com also supported the split by virtue of Roger Ver.

The Voices of the Community

Often called a “mastermind” behind the fork, Jihan Wu is a co-founder of Bitmain and has been running his own company, Matrixport, since 2019. His influence over the cryptocurrency industry in China is peerless — Bitmain has been the largest provider of hardware for Chinese miners for a long time, and his net worth makes him the second richest person in China in the sphere, second only to his fellow co-founder Micree Zhan.

Bitcoin Cash is also strongly associated with the name of Roger Ver. While surely not the only individual behind those, he’s one of the most prominent figures associated with these events and Bitcoin Cash itself, as its most vocal and influential supporter. He ran his own company Memorydealers for 13 years and served as a CEO at Bitcoin.com until 2019. Among his investments are Kraken, Ripple, blockchain.info and Bitpay. An early Bitcoin adopter and investor, he is also known for his anarchist and libertarian views.

Roger Ver. Source: Forbes

Roger Ver. Source: Forbes

BCH Essentials

Bitcoin Cash is designed to recreate the original vision for the Bitcoin: peer-to-peer electronic cash. If we compare it to the digital payments of today, it certainly has its advantages: generally lower fee for transactions, more reliability thanks to the confirmation mechanism, permissionless and higher speed of transacting.

How does Bitcoin Cash work, anyway? Unsurprisingly, in a lot of ways it is similar to its “parent” currency, Bitcoin. It also uses the Proof-of-Work consensus mechanism, its block size and difficulty is adjusted in the same way as with BTC, to produce a new one every 10 minutes. However, the block size limit is maintained at 32MB, and the difficulty adjustment algorithm is more effective than that of the original. Theoretically, this will allow to process up to 280 tx/s.

At the time of writing the article. Bitcoin Cash is ranked 5th with the market cap of $4,053,160,495, price $220.76, traded volume $3,200,825,776 and 18,360,300 BCH in circulation according to CoinMarketCap.

Bitcoin Cash is all about utility, so much so that they aim to compete with or even replace fiat currencies. This is why they promote their solutions to businesses worldwide, and now thousands of vendors accept payments in Bitcoin Cash. The ecosystem also includes social sites like Memo — Bitcoin Social Network or Honest Cash. And as expected from a major cryptocurrency, you can buy or sell it on most exchanges, in apps and services.

What’s In Store for BCH: Roadmap and Halving

According to the roadmap of Bitcoin Cash, they sure are aiming for the Moon. Jokes aside, they do have such large goals as adoption on the global scale and exceptional extensibility planned. But that’s a really long term plan. Right now, the community is working on blockchain pruning, faster block propagation through the means of improving hardware, fee improvements and pre-confirmed transactions for merchants. The BCH blockchain upgrades twice a year on a timestamp rather than when a certain number of blocks is created. The next update is expected to be on May 15th. Among the other proposals, it is going to include the Infrastructure Funding Plan, the first and rejected version of which made news in January earlier this year, dubbed “mining tax” by the media.

At the time of writing, in about a week or less, BCH mining rewards are going to be cut in half as a part of a hard-coded process called “halving”. Since out of the major SHA256 networks (others being BSV and BTC), BCH is going to experience halving the first, the hash rate is expected to drop since the miners will be switching to more profitable networks. As for the price, there is no confidence that BCH will follow the same positive trends that occur around BTC halving.

Summary

In November 2018, another hard fork occurred, resulting in further split of the community and inception of BSV. So now, in 2020, does any of the existing Bitcoin forks succeed in realising the original vision? We guess this is a question only Satoshi Nakamoto can answer. If not for the ongoing debates and discord within the community, Bitcoin Cash wouldn’t have the reputation that it has now, but it also wouldn’t even come to be. Some maximalists call this fork a scam abusing the name of the largest cryptocurrency. Others support the cause of BCH to enable convenient P2P transactions globally.

Bitcoin Cash is one of the cryptocurrencies you can exchange with ChangeHero with no sign-ups, at the best rates and extremely fast — just like envisioned, isn’t it?

If you liked the article, let us know: comment, clap, subscribe and/or share! For more content from our team, bookmark ChangeHero Blog, and follow us on Twitter, Facebook, , Telegram and be the first to get notified.