Even when you are dealing with digital assets, at times you need things like escrow. Although there are a lot of blockchain-native features that help make the process more secure and less reliant on the middleman, crypto escrow still largely resembles the traditional kind. So, in this guide, we are going to explain everything you need to know about crypto escrow and review some of the services to help you find a solution to meet your needs.

Key Takeaways

- Escrow usually implies a financial arrangement when a third party keeps a payment in custody unless both parties complete their side of the transaction. Crypto escrow is no different, only pertaining to digital currencies like Bitcoin or Ethereum;

- Usually, escrow requires a trusted setup but thanks to some features of blockchain, in crypto the degree of trust in a middleman can be reduced. For example, the sender and receiver can use a multi-signature wallet or the escrow can be managed by a smart contract;

- Therefore, there are multiple types of crypto escrow services depending on the setup and purposes. There are not a lot of legitimate and proven services or agents active as of 2023, making the process of choosing one more difficult.

What is Escrow and How Does It Work?

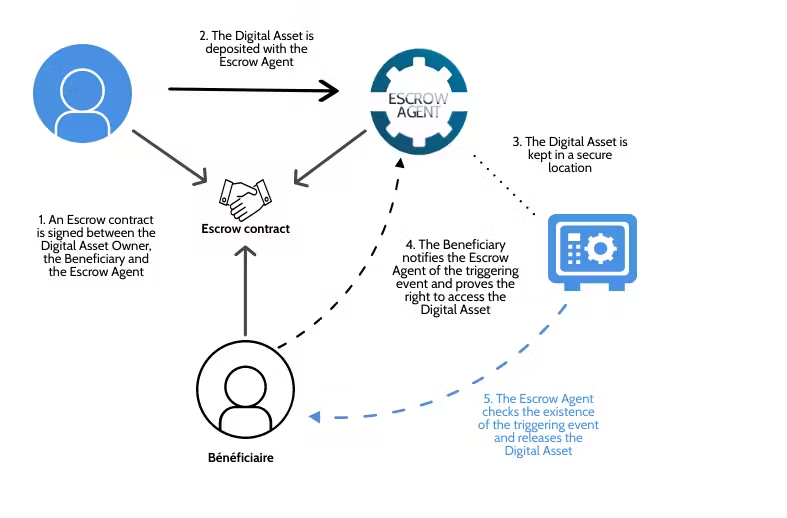

In case you came across the article while not familiar with the concept, escrow is a financial arrangement where a third party, known as the escrow agent, holds and regulates the payment of funds or assets between two parties involved in a transaction. It acts as a safeguard to ensure that both parties fulfill their obligations before the funds or assets are released.

In a typical escrow process, the buyer submits the payment to the escrow agent, who holds it until all the conditions outlined in the agreement are met. This could include verification of product quality, completion of necessary paperwork, or satisfaction of any other agreed-upon terms. Once all conditions are met, the escrow agent releases the funds to the seller.

Escrow is commonly used in real estate transactions, where a buyer deposits money into an escrow account to demonstrate their commitment to purchasing a property. The funds are held until all necessary inspections, appraisals, and other contingencies are satisfied.

Escrow provides a level of security for both parties involved in a transaction, reducing the risk of fraud or non-compliance. It ensures that the buyer’s funds are protected until they receive what they paid for, and it gives the seller confidence that the buyer has the necessary funds to complete the transaction. Its purpose is to facilitate smooth and secure transactions in various industries.

Are Crypto and Bitcoin Escrow Services a Thing?

With the rise of cryptocurrencies, particularly Bitcoin, the concept of escrow has expanded to include crypto transactions.

Crypto escrow works similarly to traditional escrow, but instead of holding fiat currency, the escrow agent holds the cryptocurrency until all the agreed-upon conditions are met. This can be particularly useful in situations where buyers and sellers want to ensure a secure and transparent transaction involving cryptocurrencies.

While absolutely possible, real estate purchases are not yet a common use case for crypto escrow. It does find use in alternative scenarios:

- Peer-to-peer crypto exchanges: When trading cryptocurrencies directly with another individual, their service can be used to hold the funds until both parties confirm the completion of the transactions.

- Initial Coin Offerings (ICOs): During an ICO, where a new cryptocurrency is being launched, an escrow can hold the contributed funds until the project meets specific milestones or conditions.

- Any goods or services paid for in crypto. An agent can hold the payment until the service or product is delivered as agreed.

A crucial role in building trust and security in the crypto industry is reserved for crypto escrow. By using such a service, both buyers and sellers can have confidence that the transaction will be completed fairly and transparently, reducing the risk of fraud or non-payment.

What is BTC Escrow Service?

In the same vein, Bitcoin escrow services are intermediaries between participants in a transaction dealing with BTC. A person who decides to make a purchase in BTC sends the assets to an escrow service. Then, the bitcoin is held until the seller provides the goods or the service. Finally, the agent closes the escrow account and the BTC is automatically transferred.

An important distinction between a purely Bitcoin escrow and an altcoin one is that BTC cannot benefit from some of the features of other blockchain networks — namely, smart contracts. It still has the technology such as multi-signature accounts to reduce the involvement and influence of the third party over the transaction.

How Does Bitcoin Escrow Work?

There are multiple steps involved in a typical transaction that uses a crypto escrow. They are mostly the same as with a traditional escrow. Nevertheless, crypto has some features that are handy for such processes and arrangements.

- Agreement: The buyer and seller agree on the terms of the transaction, including the price, quantity, and any specific conditions or requirements.

- Escrow Setup: The parties select an escrow provider who will act as the intermediary. The escrow service provider creates a multi-signature Bitcoin wallet, which requires multiple signatures to authorize any transactions.

- Funds Deposit: The buyer sends the agreed-upon amount of Bitcoin to the escrow service provider’s wallet. The seller can verify the deposit and confirm the availability of funds.

- Verification: Once the funds are deposited, the escrow provider verifies the transaction and confirms that the funds are valid and available. This step ensures that the buyer has the necessary funds to complete the transaction.

- Fulfillment of Conditions: The buyer and seller proceed with the transaction according to the agreed-upon conditions. This may involve the delivery of goods or services, as well as any necessary inspections or verifications.

- Release of Funds: Once the conditions are met, the buyer and seller notify the provider. The escrow service provider then releases the funds from the escrow wallet to the seller’s Bitcoin address.

- Dispute Resolution: In the case of a dispute or disagreement between the buyer and seller, the service provider can be involved as a mediator who would decide how to resolve the transaction.

Crypto escrow in its current form is a curious phenomenon: on the one hand, it is barely any different from a transaction in fiat currency. Essentially, it migrated as is into the crypto practice. On the other hand, while not very ubiquitous, special traits of crypto that were supposed to reduce the involvement of middlemen are indeed finding adoption for crypto escrow needs.

Crypto Escrow vs. Traditional Escrow Account

So what exactly are the traits that enable crypto escrow and make it stand apart from the traditional type of this service? Do they make using cryptocurrency escrow more justified than the usual one? Let’s try to understand.

The existence of specialized cryptocurrency escrow services is necessitated to a degree of separation between the traditional financial systems and DeFi. Crypto escrow specifically caters to transactions involving digital currencies like Bitcoin. Traditional escrow services, quite obviously, primarily deal with fiat currencies.

Most crypto escrow platforms are built on blockchain technology, which offers decentralization and immutability. This means that the escrow transactions are recorded on a public ledger, ensuring transparency and reducing the risk of fraud. Similarly, rather than being a convenience feature and a choice, it is simply a necessity.

Where it gets more interesting is when these services start utilizing the strengths of blockchain technology. Some crypto escrow providers utilize smart contracts: self-executing agreements with predefined conditions. These contracts automatically release funds to the appropriate party once the conditions are met, eliminating the need for a third-party intermediary.

Another perk of digital asset escrow is that it can be accessed by anyone with an internet connection, allowing for global transactions without geographical limitations. Traditional escrow services may have specific regional restrictions or require physical presence.

While arguable, crypto escrow has the potential to provide better speed and efficiency. By using, for example, smart contracts, some steps in the process previously performed by an agent, can be automated. Traditional escrow services may involve more paperwork and longer processing times.

Another arguable advantage is advanced encryption and security measures to protect users’ funds and personal information. Traditional escrow services also prioritize security but may face different risks and employ different security measures. This is debatable because traditional escrow services have a long-established track record and are widely recognized in various industries.

Where to Find the Best Bitcoin Escrow Service in 2023

If you came to this article looking for an escrow service, the ChangeHero team can suggest a few places to start looking. We strongly encourage you to do further research yourself, since the escrow arrangement is inherently trust-based.

P2P Escrows — Paxful Escrow Service

With LocalBitcoins no longer active as of 2023, Paxful stands as the most popular peer-to-peer crypto exchange. As a peer-to-peer exchange, they are in a great position to spin up an escrow service to ensure that buyers and sellers on their platform get a fair end of their deal.

Paxful accepts not only crypto but also bank transfers and even gift cards, and that covers escrow, too. The main use case for their service is the purchase of Bitcoin. The process is entirely off-chain, and the disputes are handled by Paxful’s moderators.

| Pros | Cons |

| Reputable provider | Limited application |

| Long track record | Not trustless |

| KYC/AML protections |

MultiSig Wallet Providers — Bitrated

Another option for a crypto-native escrow service is Bitrated. Unlike the previous entry, they claim to make more use of on-chain features. As a whole, the system is described as a marketplace of trust.

The key principle used in Bitrated is one that is also common in cryptography and digital identity: a so-called web of trust. They believe that by connecting users by both direct and indirect trust, they are able to create a more robust system of reputation. This also allows them to keep users’ anonymity.

Bitrated is not exactly an escrow service but rather a multi-sig wallet provider. In some cases, you may not even need interference from an agent at all: the multi-sig wallet requires two out of three signatures. So, if you and a recipient both are satisfied with the conditions, you can authorize the transaction without the agent’s participation.

| Pros | Cons |

| As trustless as it gets | Confusing flow not safe from mistakes |

| Long track record | Users report troubles with customer service |

| Crypto-first solution |

Extra Service from the Pros — IBC Group Escrow Service

Internet Blockchain Consulting Group is a consulting firm offering a great number of services, including escrow. For all intents and purposes, it works the same as a traditional escrow with a trusted agent, even though they claim to utilize smart contracts.

The focus of IBC’s service is on ICO support but the description supports the idea that it is more flexible than that. In any case, you would need to reach out to them first to have IBC arrange the escrow. In addition to Bitcoin escrow services, they are ready to provide the same service for Ethereum and altcoins.

| Pros | Cons |

| Higher limits | Long and trusted setup |

| Flexible service | Barely different from traditional escrow |

| AML/KYC protections |

Community Escrow Agents

Some members of the Bitcoin community took it to themselves to act as escrow agents and compile a rating for trust and transparency. One of the most prominent resources for this is Bitcointalk. The downside to searching for an agent there is the need to monitor topics and reviews. Much of this work is already done by the forum netizens but this still does not fully guarantee the safety of the Bitcoin escrow service.

| Pros | Cons |

| Checked by the community | Dispute resolution may be tricky |

| Flexible arrangement | May run into inactive or dishonest providers |

| May let you stay anonymous |

Dedicated Platforms

The final type of crypto escrow that we are going to review is the one that comes up first when you look it up in a search engine. However, this is exactly the reason you should tread carefully. Let us explain.

A lot of platforms that work as crypto escrows barely use any on-chain features. Instead, they rely on their own accounts, which are not as easily verified as a blockchain record. Moreover, the attempts to look up user reviews for a platform either end up linking to paid articles or dubious sites boosted by SEO. Even though this alone is not conclusive proof of the lack of legitimacy, it certainly raises some red flags.

In any case, we believe that some of the platforms in this category should be mentioned. These include CryptoExchange and Coinsavr. The platforms seem to be active as of 2023, and there are a handful of reviews about both of them. Nevertheless, we encourage you to evaluate them yourself before using them because some of the older guides recommending these platforms also endorse inactive or fraudulent escrow services.

| Pros | Cons |

| Dedicated platform | Trusted setup |

| KYC/AML protections | Third-party reviews are scarce |

| Straightforward |

Conclusion

Finding crypto escrow for your needs is not as easy as one thinks: one wrong step and your assets end up in a scammer’s wallet. Nevertheless, there seem to be some legitimate crypto escrow services and agents out there who will do what you need for a small fee.

For even more useful guides like this one, browse the ChangeHero blog to get to know the crypto world better. Subscribe to us on social media to stay tuned to the updates: we’re on Twitter, Facebook, and Telegram.

Frequently Asked Questions

What is Bitcoin escrow?

Bitcoin escrow is a financial arrangement where a trusted third party holds and verifies funds in a transaction until the agreed-upon conditions are met, ensuring security and trust between the buyer and seller. It provides protection against fraud and helps facilitate safe and transparent transactions in the Bitcoin ecosystem.

Is there an escrow for Bitcoin?

Yes, there are several Bitcoin escrow services available that provide a secure platform for senders and recipients to conduct transactions with added protection and confidence. These services act as intermediaries, holding the Bitcoin in escrow until the terms of the transaction are met, ensuring a safe and fair exchange.

How do I put Bitcoins in escrow?

To put Bitcoins in escrow, you would need to initiate a transaction through a reputable Bitcoin escrow service. This involves following their specific instructions, including providing the necessary information and confirming the terms of the transaction, after which the Bitcoins will be held in escrow until the transaction is completed.