Five years ago, quite a lot of crypto enthusiasts knew about Zerocoin and XZC. Firo today is a completely different cryptocurrency than Zcoin (XZC) in 2018. Nevertheless, it remains a remarkable project that built itself up into a reputable privacy coin. We are going to tell you more about FIRO and this journey in our guide.

Key Takeaways

- Firo (FIRO) is a cryptocurrency with privacy-preserving features. Its protocol can destroy coins on-chain to clear their transaction history and hide values such as addresses and amounts transacted;

- Firo used to be formerly known as Zcoin (XZC), built on the Zerocoin protocol, originally designed for Bitcoin. Since then, it has introduced changes to the privacy protocol, consensus protocol, and mining algorithm, and rebranded;

- Firo’s native asset FIRO can be used as a privacy-protecting digital currency. It can be mined by general-purpose processors or staked in a masternode.

What is Firo? How does it work?

Firo is a privacy-focused cryptocurrency, the likes of which are also sometimes referred to as “privacy coins”. Its main purpose, as is the case with the whole subset, is to provide users with the tools to transact value securely and privately.

Privacy coins differ from each other because of the ways they achieve their goal. Firo was built on the basis of the Zerocoin protocol. This protocol specified a way to turn bitcoins into anonymous assets by mixing through an on-chain escrow. The history of an asset being deposited there would be wiped, so the protocol users would get “clean” coins. However, due to a fault in the protocol’s cryptography, Firo’s community opted to change it.

Lelantus

To circumvent the faults of the Zerocoin protocol, the Firo team developed Sigma. It removed the trusted setup of Zerocoin which was known to be exploitable. However, they kept the zero-knowledge proofs and made them more compact, reducing the proof size seventeenfold.

Zero-knowledge proofs are a cryptographic technology that lets the protocol verify the truth without revealing the question. It is more complicated than proving something with public data, and the computational challenges tend to make these proofs take up more space than simpler standard cryptographic assumptions. That is why Sigma was a step up above Zerocoin. But the Firo team did not stop there.

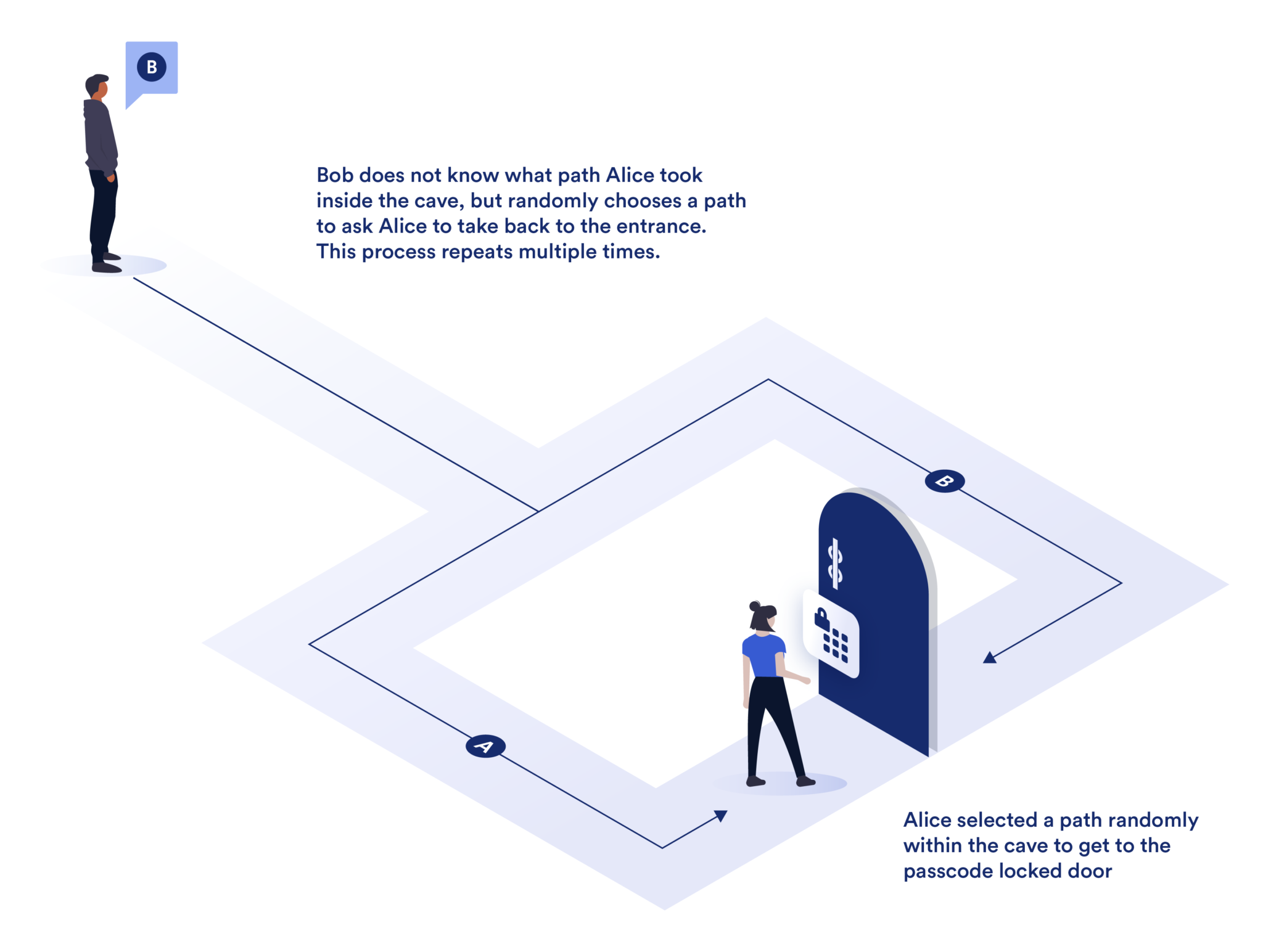

Sigma then became the basis for the Lelantus protocol, authored by the cryptography advisor of Firo, Aram Jivanyan. This privacy protocol can obscure the transaction’s values and source: users can burn their coins, relegating them to an anonymity set. To receive an anonymous transaction, another user redeems the coins from this pool with the transaction history wiped clean.

A protected transaction in Firo is made in three phases. The first one is mint: the asset is “burned” and “minted” in a new block with no history. The next is spend: assets are redeemed from a set of all previously minted coins, revealing a serial number that prevents double-spend. Finally, the transaction is verified by the rest of the network, using zk-proofs.

By now, the Firo team designed Lelantus Spark, the most advanced version of this privacy protocol. Spark is a decentralized anonymous payment (DAP) system that enhanced Lelantus with optional transparency, one-time recipient addresses, and multi-signature accounts. Lelantus Spark is yet to be implemented on the mainnet, along with the Elysium update which will enable asset creation on the Firo blockchain.

IP Obfuscation

In addition to optionally clearing the transaction history of inputs, Firo can also obfuscate the originating IP of the user. The Dandelion++ protocol helps to do it by relaying the transaction through randomized paths.

Dandelion++ is a popular solution because it is a lightweight protocol that removes the need to use external services such as The Onion Router (TOR) or a virtual private network (VPN). It is compatible with Bitcoin and used in Monero.

Hybrid PoW/PoS Algorithm

Firo operates on two layers for maximum security from consensus (also known as “51%”) attacks. The execution layer is supported by the Proof-of-Work consensus, and the verification layer uses masternodes. These nodes stake a minimum of 1,000 FIRO and ensure all nodes agree on the state of the network.

As a result, a consensus attack is unfeasible and almost impossible. In addition to securing 51% of hashing power or more, which can be rented, an attacker has to compromise the majority of masternodes, too. You can learn more about the hybrid consensus algorithm of Firo from Reuben Yap, co-founder and the Chief Operating Officer:

History of Development and Team

The Zerocoin protocol, which became the foundation of Zcoin, was invented in 2013. The design paper is credited to Matthew D. Green, a John Hopkins University professor of computer science, and his students Ian Miers and Christina Garman. Interestingly enough, later this year Green would go on to introduce the Zerocash protocol, which then was used as a basis for Zcash (ZEC).

Originally intended to be used in Bitcoin, Zerocoin was adopted in Zcoin as a separate blockchain protocol. Its foundation was described by Poramin Insom during his graduate studies of information security at John Hopkins University, who used Green’s research as well.

From 2014 to 2016, Zcoin shifted from research to development. Initial investors included some prominent in the blockchain industry figures, such as Roger Ver and Tim Lee. A few months later, in February 2017, a coding attack on Zerocoin ended up creating 370 thousand tokens which were promptly sold. The developers and community chose not to reverse the incident (unlike Ethereum’s The DAO hack). Another vulnerability in Zerocoin was disclosed in 2018 but it wasn’t until July 2019 that Zcoin upgraded to a new protocol Sigma.

Since October 2020, the cryptocurrency formerly known as Zcoin rebranded to Firo. This coincided with the transition to the Lelantus protocol, and the name was supposed to reflect the burning mechanism.

About FIRO coin

Since Zerocoin was repurposed from a Bitcoin extension to a standalone blockchain, it uses its own unit of account. The Firo’s native token (coin) is referred to as FIRO.

Like in Bitcoin, the intended total supply was supposed to be capped at 21 million. However, due to the minting exploit in 2017, the attackers ended up increasing the cap.

FIRO coins enter the supply like bitcoins, through mining: nodes add blocks to the chain and receive block subsidies with transaction fees from all transactions included in this block. For every set number of blocks, roughly every four years, the block reward gets reduced in half, thus slowing down the rate at which new FIROs enter circulation. The last Firo halving occurred in September 2020, and the next one in September 2024 will slash the reward to 3.125 FIRO per block.

Unlike in Bitcoin, Firo’s block rewards were halved twice in a hard fork. Both in December 2018 and June 2022, the halvings were forced. It was necessary because the block time was also reduced in both upgrades, down to 5 and 2.5 minutes respectively. Had the developers not done that, the emission rate of FIRO would speed up dramatically.

Mining FIRO

Bitcoin’s mining algorithm is also something many Proof-of-Work coins try to improve. The most glaring flaw with mining Bitcoin is the predominance of purpose-built application-specific integrated circuits (ASIC). These devices are more effective than CPUs or GPUs for solving Bitcoin’s mathematical problems but are less affordable. Of course, you can still try to join the network with any hashing power but it will not be economically feasible. Many Proof-of-Work coins sought to replace the mining algorithm to make mining more accessible and as a result, make the network more democratic.

Firo used the improved version of the Merkle Tree Proof (MTP) algorithm to make mining more egalitarian. MTP is memory-intensive, making it more feasible to mine with GPUs and more complicated to build a suitable ASIC. Since 2021, MTP has been replaced by FiroPoW, supposedly, even more ASIC-resistant and less demanding of available space.

Some FIRO stats

| Total supply | 21,400,000 FIRO |

| Emission schedule | Reducing rewards (halving) |

| Block time | 2.5 minutes |

| Throughput | 56 transactions per second |

Firo’s competitors

Firo vs. Verge

At the time of writing, Firo is trending together with other privacy coins, most notably — Verge Currency. Even their price trends have been moving in sync:

So why are these two coins in a similar situation? And what sets them apart?

Privacy coins often achieve the same goals with different methods. Both Verge Currency and Firo have IP obfuscation but instead of Dandelion++, XVG uses Tor and I2P. Both are Proof-of-Work coins but FIRO’s mining algorithm is unique to it.

As the name suggests, Verge Currency intentionally has a high transaction throughput and quicker block times. On the other hand, Firo is more grounded in cryptographic research and offers more solid protection of the users’ privacy.

Firo vs. Zcash

A closer relative of Firo’s is Zcash, both being based on Matthew D. Green’s research. Unlike Zerocoin, Zerocash uses zk-SNARKs — succinct non-interactive zero-knowledge proofs. Zerocash made transactions take up less space but they require more resources to generate and need a trusted setup.

Firo vs. Dash

The two-layer architecture of the consensus and execution layers is something common between Dash and Firo. Both networks have a hybrid algorithm, with a Proof-of-Work layer and a masternode layer. Dash is even considered a privacy coin by some but it is arguable. In Firo, privacy protection is a defining feature, while Dash offers it as an option through PrivateSend.

Downsides of Firo and criticism

There are no perfect projects on the crypto market, and considering the downsides is an important part of doing your research. There are a few things to keep in mind about Firo.

Like the majority of privacy coins, Firo relies on resource-intensive cryptography to secure the transaction data and obfuscate it for outsiders. The downside to it is slow transaction times, limited scalability, and subpar user experience. Private data may not be protected as well as a user would hope either due to their misunderstanding of the processes or a limited anonymity set.

There is an external factor hindering the adoption of privacy-preserving coins: regulatory concerns. Centralized services are already refusing to work with these assets due to heightened scrutiny from regulators. After all, with limited or no transparency in the ledger, it is hard to tell whether the assets were involved in criminal activity or not. And typically, these arguments outweigh the appeal to the fungibility of coins.

Firo’s partners and future

Firo is not a project fuelled by the promises of gains or a barrage of hype-generating announcements. At its core, it is a research-driven project that still holds close to the original ethos of cryptocurrencies. It does not mean that the team is reclusive: a look at the Firo news shows that their focus is on raising awareness of their mission. There is still something for every kind of FIRO holder: liquidity mining campaigns, dev updates, beginner-friendly guides, and updates on integrations and vendors accepting FIRO. Recently, the coin became available to Houdini Swap, StealthEX, and Zelcore users.

The official roadmap gives an idea of where the project can be headed in a more distant future. Most of the upcoming upgrades concern Lelantus Spark and digital assets, such as bridges from other chains to the Elysium layer. The research team is also considering the Avalanche protocol to replace masternodes.

Going forward, privacy coins like Firo are more likely to be supported on decentralized services than CEXs. The regulations seem to be going more strict on money laundering and terrorism financing (AML/CTF). At the same time, the concerns about privacy in the digital age only grow stronger, and privacy coin proponents argue the importance of these assets will only increase.

FIRO wallets

Are you ready for this future? If Firo caught your eye, then you should also know which crypto wallet to use to manage it.

For a coin, it can be a bit tricky to find a compatible wallet but Firo has decent support and there is plenty to choose from. To avail of the full variety of features of the Firo blockchain, including privacy protection, you can get a full-node Firo Core Wallet. This is recommended for advanced users but beginners also have a few options: Coinomi and Trust Wallet. Both of these are multi-chain wallets, so you can manage a diverse portfolio of crypto assets in one app. In Edge Wallet, you can swap Firo instantly with the best rates provided by ChangeHero.

It bears repeating that whichever crypto wallet you pick, you should download it from an official source. Always take the necessary precautions to secure your private keys, secret phrases, and passwords.

Where to trade FIRO?

With a limited number of exchanges to choose from, where can you find a market to buy FIRO or sell it?

The answer is simple — ChangeHero. We will find the best rate across ten liquidity providers in real time, and you can start right away with no need to log in.

- Choose the currencies on the home page, amounts, and the type of exchange. Provide your FIRO wallet address in the next step and check the details;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send the cryptocurrency for the swap in a single transaction. In a Fixed Rate transaction, you have 15 minutes before it expires;

- Sit back and relax. Now we are doing all the work: checking the incoming transaction and making the exchange as soon as it arrives;

- As soon as the exchange has been processed, your FIRO is on its way to your wallet. And so, the transaction is finished!

The flow is as easy as it gets but if you struggle with something, don’t worry. Our support team is available 24/7 to help you in the chat or through the email: [email protected].

Conclusion

Firo offers a simple solution that takes the sensibilities of blockchain to improve its privacy and security. It may not be as prominent today as in its heyday, but the team still keeps building the protocol and improving its design.

Learn more about the latest crypto news, projects, and platforms in our blog. For quick daily updates, follow us on social media: Twitter, Facebook, and Telegram.