Stellar is a fitting name for a project that has the ambition to revolutionize the existing finance system as a whole, don’t you think? In this Beginner’s guide, ChangeHero team is going to introduce you to the Stellar network, explain Stellar lumens (XLM), look at its history and provide tips on how to purchase and store Stellar lumens.

What is Stellar?

Stellar is designed as a currency-agnostic system for quick and borderless payment settlement. It is open-source, decentralized and as the developers put it, “cryptocurrency-adjacent”.

The distributed ledger technology behind Stellar is called the Stellar Consensus Protocol, and thanks to the principle of flexible trust, there is no need to have a curated list of approved validators. Instead, the network relies on quorum slices, where the highest-tiered validators are trusted by the majority of network participants.

Stellar connects network participants across the world in a borderless way by issuing a tokenized representation of an asset on-chain. For example, if we were to send 100 dollars to another country through the Stellar network, we would issue 100 dollar tokens on-chain first. Their main property is being redeemable in 1:1 ratio anywhere in the world, so by receiving 100 dollar tokens, our recipient can redeem them for the 100 dollars we meant to send them. This is not just an abstract example but the way AnchorUSD works. The Stellar network can have similar applications for different use cases, too.

How it started

Stellar was envisioned after Ripple faced criticism for its lack of true decentralization: from a list of approved validators to a huge share of the existing supply in the founders’ hands. One of the co-founders of Ripple and founder of the Mt.Gox exchange, Jed McCaleb, left the team behind Ripple in 2013 and the next year launched the new currency with Joyce Kim. Just like that, Stellar began its history in July, 2014.

At the early stages, Stellar received $3 million seed capital from Stripe, another prominent payment tech giant, and was backed by other known personalities like Keith Rabois, co-founder of PayPal, Patrick Collisson (Stripe CEO), Sam Altman, YCombinator president, Naval Ravikant, AngelList co-founder and CEO and Matt Mullenweg, founder of WordPress.

The Stellar network is supported by the Stellar Development Foundation (the SDF for short), established in 2014 as well, which is a non-profit organization. By April 2015, the concept of Stellar Consensus Protocol was described in the whitepaper, and the new codebase was deployed in November 2015.

What are the advantages of Stellar?

Stellar Consensus Protocol

Initially, Stellar was built on the source code of XRP made public by Ripple. The main difference that makes Stellar stand out in comparison to XRP and other cryptocurrencies is the unique consensus protocol, which the nodes use to confirm transactions. Its principle is that a node can decide for itself which validators to trust, so anyone can join the process.

Tokenization

Stellar, with the use of lumens, native token, can track IOUs across the system. This way, lumens can be used instead of any currency within the platform. This is achieved by tokenization, and the network supports not only fiat but also other cryptocurrencies. During the ICO boom of 2017, Stellar was the second-most popular platform for ICOs, after Ethereum.

Path Payments

Tokens on Stellar are highly customizable, for example, if there is any need for strict compliance, access to tokens can include KYC/registration/multi-sig for holders. All tokens issued on Stellar can also be traded on the integrated decentralized exchange. It is thanks to the DEX path payments are possible. Path payments allow the sender to send one tokenized asset while the receiver gets another.

Anchors

The role similar to the gateways in Ripple in the case of Stellar network is delegated to anchors. However, anchors do not only provide fiat on/off-ramping but they also can be the issuers of tokenized assets, and any financial company or service provider can join as long as they meet the criteria publicly listed by the Stellar Development Foundation.

What is Stellar lumens?

As it was previously mentioned, Stellar Lumens (XLM) is a native token in the Stellar network. It was introduced because otherwise there was no friction to prevent spamming attacks. A small amount of lumens is required to own an address in the system. XLM was picked to impose the equal rules to all the users of the Stellar network, regardless of their preferred currency for payments or the country where they are based in.

Transaction fees, as it is very common with such networks, are also paid in lumens. Besides, XLM is useful as an intermediary when trading illiquid assets on the network’s DEX.

How much is Stellar Lumens (XLM) worth?

Lumens were premined at launch, so when the network went live, an initial supply of 100 billion XLM was created. However, this was not the total supply, as an annual inflation rate of 1% was also coded in. In 2019, a community decided to first, end the inflation mechanism and next, reduce the existing supply of XLM by half with no more to be created.

Out of those 50 billion, only 20,473,733,165 XLM are in the open market. The rest are in Stellar Development Foundation’s custody and will be used to support the ecosystem, thus also entering the circulation.

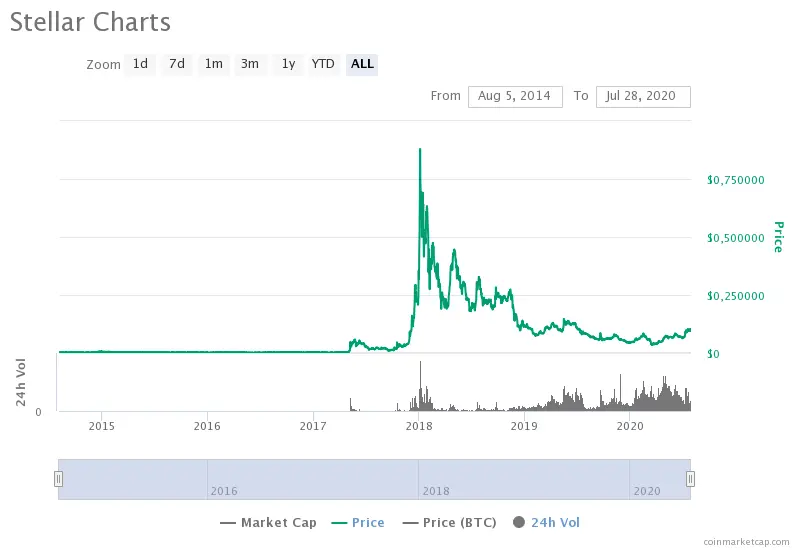

Stellar lumen’s price movement resembles the most currencies that were around for as long as XLM: cheaper prior to 2017, peaking in late 2017– early 2018, descending during the crypto winter of 2018 and 2019. The price range for the first few years of XLM’s history was around $0.001–0.003, then it rose to $0.03–0.05 in the second half of 2017. The historic maximum for Stellar (XLM) price was reached on January 4, 2018 — $0.938144. From then on and until the end of 2019, a downward trend prevailed, though not without some upward spikes in price. Relative to this, Stellar is performing well this year. While it saw greater volatility than some other currencies, having started at $0.044613, XLM has gained more than 100% over the year-to-date and recently hit a new yearly high since February. At the moment of writing, Stellar (XLM) has the market capitalization of $1,958,762,029, ranking 14th according to CoinMarketCap, and a single XLM is worth $0.095672.

Is Stellar involved in any controversies?

Over-zealous compliance

Among some things Stellar got criticized for was overdoing it with the compliance, as co-founder of CoinPrices Matt Odell put it. The token distribution was happening throughout 2018, when the supply was at 100 billion Stellar lumens and 20% of it was supposed to go to Bitcoin and Ripple users. Later in 2019, however, the distribution model was reworked.

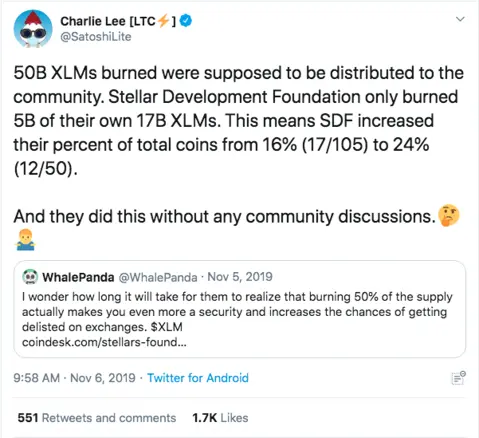

Existing supply slash in 2019

The move to destroy half of the existing supply of lumens is certainly a big deal. The Litecoin creator, Charlie Lee, claimed in his Twitter that the SDF did so without properly informing the community and for their own gain.

What is the difference between Stellar Lumens and XRP?

Though Stellar seems like Ripple’s competitor, not only it diverged in code from the latter significantly, but also the philosophies and the purposes of these two networks are different.

Ripple is more focused on institutional partnerships and its main use case is international remittances. Stellar network is more about the individual participants of the financial system. This is why they can boast such features as inclusive network participation and clear participation guidelines for anchors.

There is also the difference between the consensus protocols in Ripple and Stellar networks. In terms of speed of settlement and throughput both networks are on a par with each other. However, even though both networks charge a 0.00001 fee on each transaction, in dollar terms the XLM transactions are cheaper than in XRP.

Who are the partners of Stellar?

As is expected with a mission like Stellar’s, their success relies on the partnerships they secure. Among the largest corporations that use Stellar’s platform are IBM and Deloitte. Their money transfer solutions are used by such providers as Tempo in France, Remitr in the Americas, SatoshiPay in Europe, SureRemit in Africa, among others.

The most recent partners on board with the SDF are Abra, Elliptic and Samsung via the Keystore integration. The variety of the markets they cover and products they use should be a step in the direction of a much broader degree of adoption.

XLM on social media

A SDF developer, Kolten, can be found on Twitter under the handle @koltenb_. He’s regularly posting the updates to the development process of Stellar network. This week they introduced the anchor building process and a proposal to increase the minimum fee. The community will have to vote on whether to accept it or decline.

An overwhelming amount of messages on Twitter are about the price movements of Stellar lumens. Trader @KiaCrypto gives their long-term prediction for Stellar’s price based on the recent breakout. Looking at the weekly chart, one might see that XLM’s value indeed broke out of a months-long slump.

And in other XLM news, Revolut has just announced the integration of lumens on their platform. For Stellar, this is a valuable partnership, as Revolut is a popular app that can be a fiat on/off-ramp for Stellar users everywhere in the world.

How to purchase Stellar lumens?

Stellar (XLM) pairs are traded every day on the most popular exchanges like Binance, Coinbase and OKEx against fiat and cryptocurrencies. However, to buy it on an exchange, even with crypto, you need an account, which has to be verified and make a deposit to it. With ChangeHero, you can get XLM without the need to deposit your assets or register an account. We will process the exchange easily — leave all the order matching to us! — and securely, without having custody over your assets.

How to store Stellar lumens?

The official website recommends the following wallets, from most to least secure but more accessible:

- For cold storage, Ledger and Trezor hardware wallets provide the top-class asset security;

- The downloadable wallets recommended are Lobstr and Solar, the prior being developed by SDF themselves;

- For Web storage, they recommend Coinbase wallet. The wallet is different from the exchange account as the private keys are stored in the browser’s cache. Obviously, while being the most lightweight solution, it is also the least secure.

In addition to Trezor, ChangeHero team can recommend Exodus wallet for desktop or mobile storage and access to blockchains or CoolWallet S for hardware storage with mobile access. With these wallets, you can not just store Stellar lumens but exchange them as easily as you would do on our website with the help of ChangeHero’s API integration.

How can I use Stellar Lumens(XLM)?

As a utility token, lumens are best used within the Stellar network to facilitate trades between tokenized currencies. That being said, XLM is also popular with traders for speculation.

Quick settlements and transfers make Stellar (XLM) attractive to payment processors and gateways, so you can expect the currency to be supported anywhere where CoinGate or Bidali is used to accept crypto payments.

Summary

Stellar is one of the potential disruptors of the contemporary financial system that aims for everything Ripple aimed for and a bit more. Such ambition is risky but the work SDF are putting into the network seems to be in sync with the development tempo. It’s hard to say yet, will Stellar be the tech to revolutionize finance, but it will definitely be interesting to watch unfold.

If you also would like to know more about the developments in the crypto industry, stay tuned to ChangeHero Blog and follow us on our social networks: Twitter, Facebook, Reddit and Telegram.