What is Cryptocurrency: A Complete Guide to Digital Currency in 2026

Heads Up: Disclaimers and Risk Warnings

This guide is for educational purposes only and does not constitute financial, investment, legal, or tax advice. Placing capital in cryptocurrency carries substantial risk, including the potential loss of your entire investment.

Key risk factors include:

- Cryptocurrency markets are unstable and risky

- Digital asset values can change very quickly and strongly

- No government backing or deposit insurance protects cryptocurrency holdings

- Loss of private keys results in permanent loss of funds that cannot be undone; there is usually no password reset button

- Laws about cryptocurrencies remain uncertain and can change any time

- Past performance does not guarantee future results

Before putting any money in cryptocurrency, you should:

- Conduct thorough independent research

- Assess your personal financial situation and define the risk you are willing to take

- Understand the technology and specific cryptocurrencies you're considering

- Only invest capital you can afford to lose completely

- Consult qualified financial, legal, and tax experts for guidance about your own situation

The cryptocurrency industry continues changing rapidly as of 2025. Laws vary significantly by jurisdiction, and legal status can change. Always check current legal requirements in your location before buying, trading, or holding digital assets.

Introduction to Cryptocurrency

What is Cryptocurrency?

At its core, cryptocurrency means digital money secured by cryptography, a science that studies transforming data to hide its contents or protect it from wrong use. Think of it as currency that exists purely online, with no physical bills or coins involved. The "crypto" part refers to the complex mathematical codes that protect every transaction and make these digital assets extremely difficult to counterfeit or double-spend.

Unlike traditional digital payments (which are just electronic records of dollars or euros), cryptocurrency represents an entirely different form of money. Each unit exists as data in a base called blockchain: a distributed digital ledger (record book) maintained by a network of computers worldwide. The most important thing is that no single bank or government controls it.

When you own cryptocurrency, what you actually possess is a private key (essentially a secret password) that proves ownership of a specific address on the blockchain. This key lets you send your crypto to someone else, but once you do, there's no customer service line to call if you make a mistake. That's the trade-off for having direct control over your money.

Digital Currency vs Traditional Currency

The key difference between cryptocurrency and traditional currency (what we call fiat money) comes down to who controls it and how it moves.

Fiat currency like US dollars or euros is issued by governments and overseen by central banks. When you transfer money online through your bank, you're not actually moving dollars around the internet. You're asking your bank to update its ledger and tell the other person's bank to do the same. The banks work as go-between in this exchange who check if things are right and keep the records.

Cryptocurrency works differently. Sending coins happens directly between users on a peer-to-peer network, with no middleman needed. Instead of trusting a bank to approve your payment, the blockchain network uses code and cipher. Every transaction gets recorded without the possibility of being removed across thousands of computers at the same time, making the system transparent and extremely difficult to rig.

Another major contrast: supply control. Central banks can print more money when they want to stimulate the economy, which causes inflation. As opposed to that, most cryptocurrencies have fixed supply rules written into their code. Bitcoin, for example, will only ever have 21 million coins and no central authority can change that.

This fundamental difference makes crypto attractive to people looking for financial systems outside traditional banking, especially in countries with less reliable currencies or limited banking access.

How Cryptocurrency Has Value

Source: Investopedia

Cryptocurrency has value for the same reasons anything else does: limited supply, utility, and what people are willing to pay for it.

Firstly, scarcity (limited supply) creates the base of value. Bitcoin's 21 million coin limit means it's scarce similarly to gold. People who worry about inflation making their savings smaller appreciate this built-in rarity.

Secondly, utility drives practical value. Beyond just sending payments, cryptocurrencies make real applications work. Ethereum, for instance, has smart contracts—agreements that execute by themselves when given conditions are met. Stablecoins settle trillions in transaction volume yearly, on par with major payment networks like Visa. That's real-world usage creating real-world value.

Thirdly, network effects add to the worth. The more people use a cryptocurrency, the more valuable it becomes. More users mean more businesses accept it, more developers build applications on it, and better conditions for trading it. Social networks are valuable for the same reason: because everyone's already there.

Lastly, market perception also plays a huge role. Cryptocurrency prices reflect what people who buy it believe the technology will be worth in the future, and because it relies on these opinions, its price is always changing.

By the way, this doesn't mean crypto is automatically a good investment for everyone. We'll dig into that later in the guide.

Expert Perspectives on Cryptocurrency

Why do we need to look into what cryptocurrency is beyond its price? Below are insightful quotes that explain the ways how cryptocurrency works and what is the purpose of cryptocurrency in reshaping money as we know it.

"Blockchain technology represents the most significant innovation in data integrity and trust architecture since the advent of the internet itself," notes Dr. Andreas Antonopoulos, blockchain researcher and educator. "What cryptocurrency really demonstrates is that we can create systems of value exchange that don't require centralized intermediaries—that's a fundamental shift in how humans coordinate economic activity."

Saifedean Ammous, CC BY-SA 4.0; by Nadezhda Hope Boginya

Economists highlight a complex role digital currencies play in modern finance.

"Cryptocurrencies function as both speculative assets and practical payment rails," explains Saifedean Ammous, economist and author. "The distinction matters tremendously for how we evaluate their long-term viability. Bitcoin's fixed supply creates scarcity similar to precious metals, while stablecoins offer payment utility without volatility—each serves a different economic function."

Vitalik Buterin, Ethereum co-founder, mentions the broader implications of this platform:

"Smart contracts and decentralized applications extend cryptocurrency beyond simple value transfer. We're building programmable trust—financial primitives that execute automatically without human intervention. That's how cryptocurrency evolves from digital cash into the foundation for entirely new economic systems."

History and Evolution of Cryptocurrency

From Bitcoin to Modern Cryptocurrencies

Cryptocurrency began in 2009 with Bitcoin, the first successful digital currency designed to work without banks or governments overseeing it. Created by an anonymous person (or group) known as Satoshi Nakamoto, Bitcoin introduced a practical application of blockchain technology to record transactions (exchanges of value) that no single entity could alter or control.

Bitcoin's early years were experimental. By 2013, it reached $1,000 for the first time, catching mainstream attention and sparking a bigger question: could digital currency become a real alternative to traditional money? As Bitcoin grew bigger, developers began creating even more new cryptocurrencies (called altcoins) to solve different problems or improve on Bitcoin's original design.

Ethereum launched in 2015, introducing the smart contract technology. This opened the door for applications beyond simple payments. By the late 2010s, thousands of cryptocurrencies existed as spins on Bitcoin or created on the Ethereum blockchain, each serving different purposes: faster transactions, privacy features, or specialized use cases.

Today's crypto ecosystem includes an even larger range of advanced concepts from stablecoins (designed to maintain steady value) to memecoins (community-driven tokens) and NFTs (unique digital assets). The industry has grown from a niche experiment to a global market.

Key Milestones in Crypto Development

Several major events shaped how cryptocurrency works today.

By Matt Brown, CC BY 2.0

Ethereum's launch in 2015 made blockchain capable of being programmed. Smart contracts meant developers could build decentralized applications (also called dApps) that run without servers in a single place or middlemen—a fundamental shift in how blockchain could be used.

The DeFi boom of 2020–2021 brought Decentralized Finance (what DeFi stands for) into the spotlight, letting people lend, borrow, and trade without banks. Total Value Locked, a metric that measures digital money involved in a protocol or platform, in all DeFi protocols now is as valuable as over $120 billion U.S. dollars.

Stablecoin growth to tens of trillions dollars in volume over year has been another key milestone that proved crypto can handle real-world payment volumes at scale.

Adoption of crypto by giant businesses and governments accelerated by a lot in 2024. The U.S. Securities and Exchange Commission approved spot Bitcoin ETFs in January 2024, giving traditional investors access to crypto with the benefits of state supervision. Europe followed with MiCA, the first comprehensive crypto legal framework.

These developments transformed cryptocurrency from a fringe experiment into legitimate financial infrastructure, complete with specific laws, institutional backing, and real-world utility.

How Cryptocurrency Works

The Technology Behind Cryptocurrency

Cryptocurrency works because of core technologies: blockchain and cryptography. Think of blockchain as a shared digital notebook that everyone can read but no one can erase, and cryptography as a virtual lock-and-key system that keeps your funds secure.

When you send cryptocurrency, you're creating a transaction that gets checked by a network of computers called nodes and if correct, recorded on the blockchain forever. Cryptography is supposed to ensure only you can allow transactions from your wallet with your private key, a unique digital signature that proves ownership without telling who you are.

The genius of this system is that it removes the need for banks or other middlemen. Instead of trusting a single institution to keep accurate records, cryptocurrency relies on thousands of independent computers maintaining exactly the same copies of the transaction history. If someone tries to cheat the system by altering their copy, the network rejects it because it doesn't match everyone else's version.

This combination of transparency and security is what makes digital currency work. Every transaction is visible to the network, but your personal information stays private thanks to cryptographic protection.

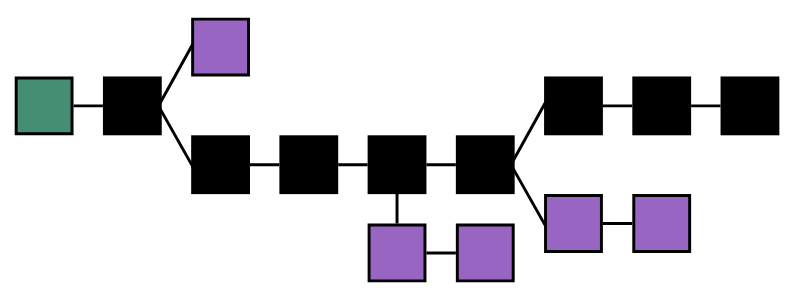

What is Blockchain Technology

Blockchain schematic.

Blockchain’s definition is a distributed ledger technology: a digital database that's maintained by thousands of computers worldwide at the same time rather than stored in one location.

Picture a chain of blocks (hence the name) where each block is its own list of transactions. Once this list fills up with approved transactions, it gets a unique digital fingerprint called a hash which is linked to the previous block. This creates an unbreakable chain: if someone tries to alter an old transaction, it changes that block's hash, which breaks the chain and alerts the entire network.

What makes blockchain revolutionary is its distributed nature. Instead of your bank holding the only record of your account balance, thousands of nodes each maintain a full copy of the blockchain. When you send cryptocurrency, all these nodes receive information about your transaction. They independently check you have sufficient funds and the proper digital signature, then add it to a new block.

Banks can freeze accounts or reverse transactions, but blockchain networks use preprogrammed rules that no one can override on their own. This decentralization, moving authority from a single point to a network as a whole, is what gives cryptocurrency its resistance to censorship and single points of failure.

By the way, blockchain isn't only useful for cryptocurrency—it's being explored for supply chain tracking, medical records, and voting systems. But cryptocurrency remains the most developed use case for this technology.

Nodes and Network Architecture

Coming back to nodes, they are the backbone of how cryptocurrency works. These individual computers add to, approve, and keep the blockchain network safe.

In simple terms, a node is any computer running cryptocurrency software that connects to the network. Full nodes download and store the entire blockchain history, independently checking every transaction that's ever occurred. Having thousands of copies might sound like too much, but it's exactly what makes the system trustworthy: instead of asking one authority "Is this transaction valid?" the network asks thousands of independent members.

How broadcasting blockchain transaction works

When you let all nodes know about a transaction, it is shared from peer to peer across the network, reaching thousands of nodes within seconds. Each node checks if your transaction is correct using the same rules, then adds it to their copy of the blockchain. This way of checking transactions means no single node can manipulate the network because transactions that do not pass the check get rejected by the majority.

Mining nodes sometimes called validators depending on the network go one step further by competing with each other to package approved transactions into new blocks. Other node types include light nodes which store only recent data for faster mobile access—like a crypto wallet app—and pruned nodes which verify everything but delete old transaction data to save space.

Anyone can run a node. Open participation prevents any single company or government from controlling cryptocurrency.

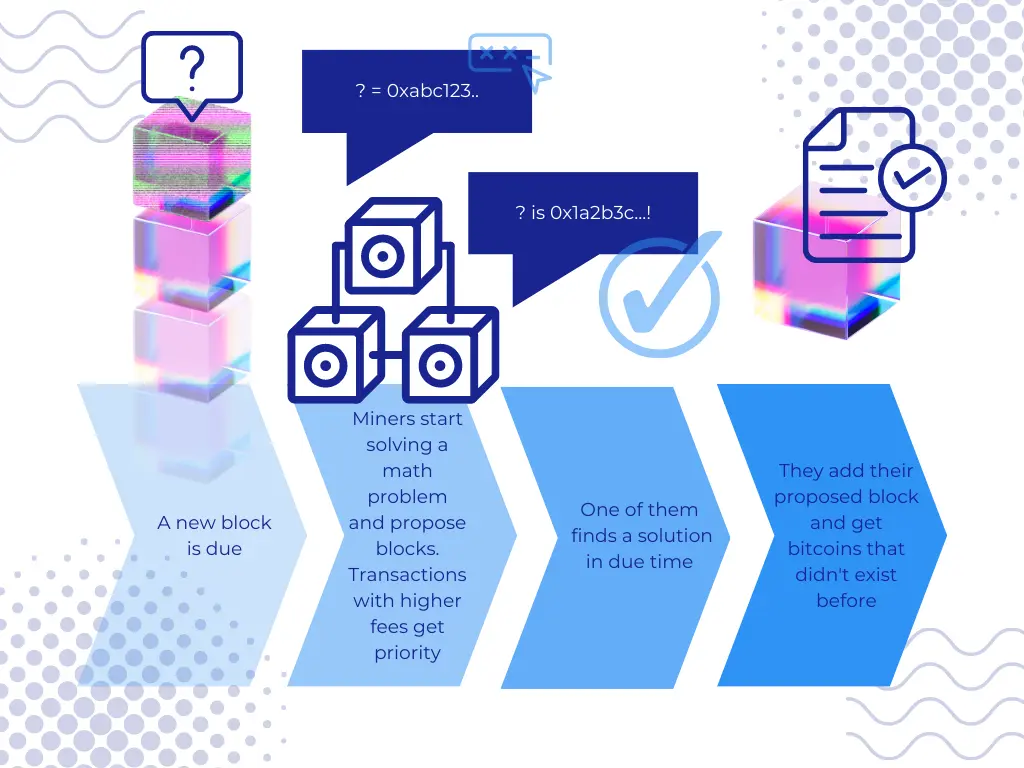

How Cryptocurrency Mining Works

Mining is the name of a process that protects cryptocurrency networks from unwanted changes and in some cases creates new coins.

How mining adds blocks to the chain.

Its core mechanics are: Miners compete with each other who solves a complex mathematical puzzle using specialized computers first. The first miner to solve this puzzle gets to be the one to add the next block of transactions, with a list of approved transactions they compiled in the meantime. Why do that? Some networks, most notably Bitcoin, give them a reward in the form of new coins; sometimes, the rewards come from transaction fees paid by those whose transactions were added to this new block. This process is called Proof of Work, and as Bitcoin grew, it became more and more difficult, requiring a lot of computing power.

Why make it so expensive as to demand many computers to solve this? Because security comes from cost. If someone wanted to rewrite past transactions, they'd need to create once more all blocks in the chain from where they need to, but faster than the rest of the network combined. As it is now for Bitcoin, it is almost impossible when thousands of miners are competing fairly.

Other cryptocurrencies use different consensus mechanisms, or processes to keep the network safe from unwanted changes. Ethereum switched to Proof of Stake, where validator nodes (instead of miners) lock up cryptocurrency as their stake in the safety of the network, hence the name. If they approve fraudulent transactions, they lose their stake. This mechanism creates security with financial incentive rather than work of machines.

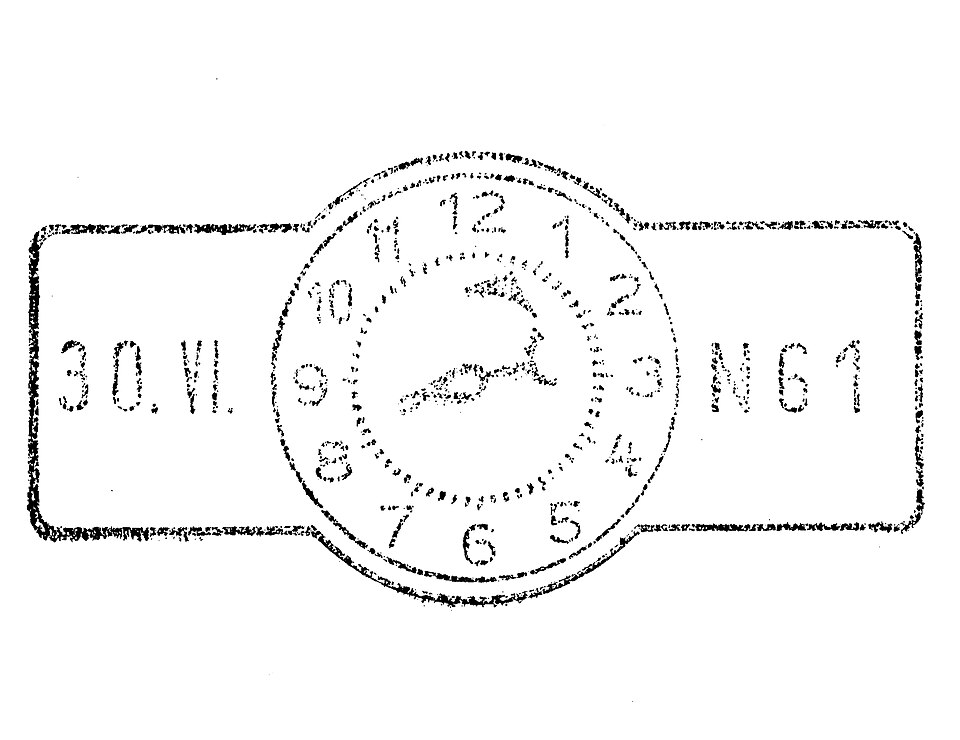

Timestamping and Transaction Validation

Assigning time and date to every action recorded in the block chain is also an important part of how it works. Every cryptocurrency transaction gets timestamped forever at the moment it's added to the blockchain, creating an unchanging record of when funds moved and in what sequence.

Timestamping matters because it prevents double-spending. Without accurate timestamps, someone could theoretically try to spend the same cryptocurrency more than once by sending it to multiple addresses at the same time. The blockchain's record of timestamps makes sure the network can find which transaction came first and reject the duplicates.

1960-era Time-stamp impress. By Oxfordian Kissuth, CC BY-SA 3.0

The validation (approval) process works in stages. When you start a transaction, nodes first check your digital signature (which confirms you own the private key without showing it). Then they review your transaction history on the blockchain and check if you have the funds to spend. Once these checks pass, your transaction enters a waiting area for unconfirmed transactions called the mempool.

Miners then choose transactions from the mempool, verify them again by themselves, and package them into a new block. Each block contains a timestamp showing exactly when it was created, and every transaction within inherits that timestamp.

This creates a chain of ownership that can be reviewed and checked from the outside. Anyone can trace a specific coin (or token) from its creation through every transaction to its current owner. This transparency is what makes blockchain-based currency work: no need to trust any single party when anyone can see the entire history for themselves.

Once a transaction receives one or more timestamps from several blocks that follow, cancelling it becomes practically impossible. We say ‘practically’, since very unlikely scenarios such as controlling the majority of the network's mining or validating power, exist. However, do not count on it and treat all blockchain transactions as impossible to turn back.

Major Types and Core Concepts of Cryptocurrency

By now, the crypto landscape has grown far beyond Bitcoin. Today, digital currencies serve different purposes: some act as money, others power applications, and some exist purely for community fun. Let's break down the main categories you'll encounter.

Bitcoin

Bitcoin is the first cryptocurrency, launched in 2009 by the pseudonymous Satoshi Nakamoto. It is often called digital gold: a store of value created to exist outside traditional banking systems.

Bitcoin operates on a decentralized (with no central authority) network where transactions are written in a public blockchain and validated through mining. Its supply is capped at 21 million units, creating scarcity similar to precious metals because they get increasingly hard to produce.

Bitcoin remains the most recognized digital currency, with institutional investors now able to access it through spot Bitcoin ETFs approved by the U.S. SEC in January 2024. In other words, almost 15 years later, Bitcoin proved cryptocurrency could work and that legitimacy opened doors for everything that followed.

Ethereum

Ethereum is a cryptocurrency that goes beyond simple transactions. Launched in 2015, it's a blockchain that can run programs, which lets developers build applications and execute smart contracts—self-executing agreements written in code.

A smart contract automatically enforces terms without intermediaries. For example, a smart contract could release payment when a delivery is confirmed, with no middleman needed. The code is supposed to handle everything: from conditions to execution of an agreement.

By now, the Ethereum ecosystem has the most DeFi products and protocols. Ethereum also hosts the majority of NFT marketplaces and supports major stablecoins like USDC and USDT.

By the way, Ethereum transitioned from energy-intensive mining to a more efficient proof-of-stake system in 2022, reducing its real-world power consumption by over 99%.

Altcoins

"Altcoin" simply means "alternative coin"—any cryptocurrency that isn't Bitcoin. This category includes thousands of projects, most with unique features. Some succeed by solving specific problems but many don't survive past their initial hype.

Some of the popular altcoins are best known for solving specific purposes:

- Solana is fast and has very low-cost transactions for payments and apps

- Cardano is a research-driven blockchain focusing on sustainability

- Litecoin is a long-standing, somewhat faster Bitcoin alternative for everyday transactions

- XRP by Ripple was designed as a tool for instant cross-border payments between banks or for remittances

No two altcoins are the same: they often experiment with different consensus mechanisms, governance models, or use cases. The key is understanding what problem each altcoin aims to solve—because that's what determines whether it has lasting value.

Stablecoins

Source: DrawKit Illustrations on Unsplash

Stablecoins are a category of digital assets that solve a major crypto problem: volatility. These digital currencies maintain a stable value, most often pegged 1:1 to the U.S. dollar but there are also stablecoins tracking the value of precious metals or even other cryptocurrencies.

Most stablecoins are backed by reserves (cash, bonds, or other assets) held in circumstances similar to traditional bank accounts. When you buy 1 USDT or USDC, the issuing company holds $1 in reserve—at least, that's how it's supposed to work.

Stablecoins have many practical uses:

- Moving money between exchanges without converting to fiat

- Cross-border remittances with significantly lower fees

- Earning interest through DeFi lending protocols

- Protecting value during crypto market downturns

Common types include centralized stablecoins (USDT, USDC) backed by companies, and algorithmic stablecoins that use code to maintain their peg. The algorithmic ones are less common because they are riskier; code doesn't guarantee stability if the mechanism breaks.

Memecoins

Memecoins or meme coins, are community-driven cryptocurrencies that often start as jokes but gain real economic value through social factors. Dogecoin, originally created as a parody of other cryptocurrencies in 2013, is the most famous example. It's now worth billions.

Unlike Bitcoin or Ethereum, memecoins rarely have serious technological innovation or long-term utility. Their value comes entirely from community enthusiasm, social media buzz, and sometimes celebrity endorsements. The appeal is that memecoins represent the playful, rebellious side of crypto culture. They're high-risk, high-reward bets where fortunes can be made or lost just as quickly.

It is true that some people have profited from memecoins but these digital currencies are still extremely unstable and speculative. The majority of meme coins drop to near-zero value once the initial hype fades, if it even gets off the ground. If you're exploring memecoins, keep in mind that they have more in common with gambling than investing.

Non-Fungible Tokens (NFTs)

NFTs, which were huge in 2021 but now are a single niche on a crypto market, aren't even cryptocurrency. They're unique digital assets recorded on a blockchain. One BTC equals any other BTC but each NFT is one-of-a-kind. That's the "non-fungible" part.

NFTs are best described as digital certificates of ownership. They can represent:

- Digital art and collectibles

- In-game items and characters

- Music, videos, and creative content

- Real-world assets like property deeds or tickets

A practical connection to cryptocurrency is that NFTs work with the same blockchain network as base, for instance Ethereum. The blockchain shows who owns which NFT and tracks every transfer, creating digital scarcity that can be confirmed by anyone.

While NFT art grabbed headlines during the 2021 boom, the technology has practical applications in proving ownership, managing digital identities, and tokenizing real-world assets. The market has matured significantly, focusing more on utility than speculation.

The Purpose and Uses of Cryptocurrency

For as many kinds of these digital assets exist, what is the actual purpose of cryptocurrency? In simple terms, cryptocurrency serves three main roles: as a digital payment system, as an investment vehicle, and as the foundation for new financial applications. Each use case highlights what digital currency can do that traditional money can't or can do but not as efficiently.

The original vision of cryptocurrencies is a borderless, censorship-resistant form of money. As the technology matured, other applications emerged. Cryptocurrency became a speculative investment, a financial asset that can be bought with the expectation of future growth in value, like stocks. The same technology also powers DeFi platforms, where users lend, borrow, and trade without traditional intermediaries or other hoops to jump through for access.

Beyond finance, crypto supports things like NFTs (digital ownership records), non-financial applications, and cross-border remittances. The key idea is that cryptocurrency and blockchain provide programmable, flexible value that adapts to different needs.

Using Crypto as a Currency

Photo by Jason Leung on Unsplash

It’s in the name: You can use cryptocurrency to buy things, though adoption varies a lot by region and business.

Stablecoins, in particular, have become practical payment tools. They often act as stand-ins for the USD but with much easier access and more options to send it anywhere worldwide.

Some retailers, service providers, and online platforms accept Bitcoin, Ethereum, or stablecoins directly. Payment processors and crypto-friendly apps have made this easier. You can pay for travel, buy gift cards, or even tip content creators using crypto.

The catch is in volatility or changes in value. Bitcoin's price swinging 5–10% in a day under extreme but not impossible conditions makes it less than a perfect fit for everyday purchases. Stablecoins solve this problem, which is why they're becoming the go-to option for actual payments. By the way, transaction speed and fees matter too; some blockchains are faster and cheaper than others, which directly affects usability.

Using Crypto to Invest or Store Value

Other people don't use cryptocurrency as currency at all; they keep it as an investment or store of value, similar to gold. People buy Bitcoin not just as ‘digital gold’ but hoping its price will rise as adoption grows.

Other cryptocurrencies offer different investment characteristics. Ethereum, for example, supports smart contracts and DeFi applications, so its value is tied to platform and network usage. Altcoins can offer high-risk, high-reward opportunities, though volatility is a constant factor.

One key difference from traditional investments is that crypto markets never close. They operate 24/7, across borders, with no central authority controlling supply or circulation. This makes cryptocurrency both flexible and unpredictable.

Real-World Cryptocurrency Applications

Cross-Border Payments and Remittances

One of the most practical uses of cryptocurrency is moving money across borders quickly and affordably. Traditional international transfers often involve multiple banks, currency conversion fees, and waiting periods of several days. Crypto already operates on a global network that doesn't require intermediaries, meaning funds move directly from sender to receiver, often within minutes, and at a much lower cost.

Cryptocurrency in Developing Economies

Photo by Krisztian Tabori on Unsplash

Crypto adoption is said to be the strongest at the grassroots level in lower-middle-income countries, particularly in Central and Southern Asia and Oceania. The reasons are clear: access to traditional banking is more limited than internet access, inflation can erode savings rapidly, and cross-border controls restrict financial freedom.

Cryptocurrency opens finance to everyone: anyone with a smartphone can create a wallet, send value, and participate in the global economy without a bank account. In countries with unstable currencies, crypto can act as an alternative store of value and a way to preserve purchasing power. It's not a perfect solution, but it's empowering people who've been left behind by formal financial systems.

Decentralized Finance and New Applications

Imagine: Instead of borrowing from a bank, you can access lending protocols that connect borrowers and lenders directly through smart contracts. Instead of earning interest through a savings account, you can provide liquidity to automated market makers (AMMs) and earn yield.

As said before, real capital is already being used for lending, borrowing, trading, and earning passive income in DeFi, all without traditional financial intermediaries.

The key benefits are transparency, accessibility, and 24/7 operation. Anyone, anywhere, can participate as long as they hold crypto and understand the risks involved.

Payments and Real-World Purchases

Cryptocurrency is still not very common as a payment method, but real-world acceptance is growing. The appeal is lower transaction fees compared to some credit cards, faster settlement times, and access to a global customer base. For buyers, it means more choice of payment options and, in some cases, additional privacy.

Once again, price volatility remains a challenge for everyday purchases—which is why stablecoins, a middle ground between cryptocurrencies and traditional money, are gaining traction as a more practical payment option.

Regulation and Legality of Cryptocurrency

Is Cryptocurrency Legal?

Photo by Sasun Bughdaryan on Unsplash

Is it even legal to have money outside of the government's control? Especially if it’s a means of payment that has no borders? There is no universal answer to that.

Cryptocurrency operates in a landscape where legality varies dramatically by country. Crypto isn't universally illegal but it's also not universally recognized. Most major economies these days have chosen to regulate rather than ban digital currency, recognizing its growing presence in the financial system.

Countries generally take one of three approaches: full acceptance with clear regulations, partial acceptance with restrictions, or outright bans. The United States, United Kingdom, Canada, and most of Europe have established legal frameworks that allow cryptocurrency use while implementing consumer protections and anti-money laundering rules. On the other hand, countries like China, Egypt, and Algeria have imposed strict bans on crypto transactions (though enforcement varies).

Legality often depends on how you use cryptocurrency. Trading, holding, and transferring crypto might be legal in your country, while using it for certain purchases or as legal tender (instead of money) might not be.

Legal Status in the United States

The U.S. treats cryptocurrency as property for tax purposes and regulates it through multiple federal agencies. The SEC (Securities and Exchange Commission) oversees crypto assets that qualify as securities, the CFTC (Commodity Futures Trading Commission) regulates crypto commodities like Bitcoin; the Treasury Department enforces AML and KYC (Know Your Customer) compliance through FinCEN.

Spot Bitcoin ETFs approval gave professionals a regulated investment vehicle, signaling increasing regulatory clarity but comprehensive federal legislation is still pending as of 2025.

Cryptocurrency exchanges operating in the U.S. must register as Money Service Businesses and comply with state-level money transmitter licenses. States also maintain their own crypto regulations. New York's BitLicense, for example, imposes strict requirements on crypto businesses.

Legal Status in Europe

Photo by Frederic Köberl on Unsplash

Europe has established the world's first comprehensive legal framework for crypto-assets through the Markets in Crypto-Assets (MiCA) regulation. MiCA creates standardized rules across all EU member states, covering issuers of crypto-assets, trading platforms, and service providers.

The framework requires crypto exchanges to seek approval, put consumer protection measures in place, and maintain transparency of operations. Stablecoin issuers face particularly detailed requirements regarding reserves and redemption rights.

Legal Status in Asia and Other Regions

In comparison, Asia presents the widest regulatory spectrum. Japan recognizes Bitcoin as legal property and maintains a licensing system for crypto exchanges. Singapore has developed a progressive regulatory framework through the Payment Services Act, attracting numerous crypto businesses.

China maintains a full ban on crypto trading and mining, though Hong Kong is developing a licensed crypto exchange system. India has a 30% tax on crypto gains and a 1% TDS (Tax Deducted at Source) on transactions, effectively discouraging trading without banning it outright.

Future of Cryptocurrency and Blockchain

Trends and Predictions

The cryptocurrency industry is moving fast, and several key trends are changing what digital currency means for everyday users.

One major development is stablecoins becoming more common and safe. These digital currencies settled over $10 trillion in on-chain transaction volume in 2023, coming close to volumes handled by major payments networks like Visa. This shows crypto growing from speculation into practical financial instrument.

Decentralized Finance (DeFi) keeps gaining ground, with approximately $120 billion in DeFi protocols as of early 2026. These platforms continue fundamentally changing how people interact with financial services. Grassroots adoption is still the strongest in lower-middle-income countries, particularly in Central & Southern Asia and Oceania, where crypto provides access to financial tools that traditional banking can't always deliver.

Banks and Institutional Adoption

Traditional finance no longer sees cryptocurrency as a fringe experiment. The U.S. SEC's approval of spot Bitcoin ETFs created a regulated and accessible investment vehicle for a broader range of investors, from retirement accounts to institutional portfolios. For everyday people, this means you can now gain crypto exposure through familiar investment channels without having to worry about private keys or navigating crypto exchanges directly.

Banks are integrating blockchain technology for cross-border payments, custody services, and settlement systems. Major financial institutions are launching crypto trading desks and custody solutions, recognizing that digital assets are becoming a permanent part of the financial landscape. When banks adopt blockchain for settlements and payments, it validates the underlying technology and accelerates wider acceptance.

2026: The Year Crypto Regulation Gets Real

If 2024 was about MiCA and Bitcoin ETFs, 2026 is about governments actually implementing comprehensive crypto oversight. Two major developments are reshaping the regulatory landscape right now.

The EU started 2026 with putting into action DAC8: a new directive that requires crypto exchanges and platforms to start collecting detailed user information. Essentially, it brings crypto under the same tax reporting umbrella as traditional bank accounts.

Starting January 1, 2026, any crypto platform serving EU residents must collect your tax identification number, track your transactions, and report everything to tax authorities. The data collection happens throughout 2026, with the first reports due in July 2027. By September 2027, EU countries will be sharing this information with each other automatically.

What this means for you: If you're an EU resident trading crypto, your activity is no longer invisible to tax authorities. Platforms will ask for your Tax ID, and they're required to track whether you're buying, selling, trading, or even moving crypto to your own wallet. The goal is to close the gap that let people avoid taxes on crypto gains. By the way, this isn't just an EU thing: 76 countries worldwide have committed to similar reporting frameworks through the OECD's Crypto Asset Reporting Framework.

DAC8 works alongside MiCA, Europe's comprehensive crypto market regulation. While MiCA focuses on licensing and consumer protection, DAC8 targets taxation and information sharing. Together, they create a regulatory environment where crypto operates under clear rules—both for market behavior and tax compliance.

The United States is moving toward its own landmark crypto legislation. The Digital Asset Market Clarity Act (known as the CLARITY Act) passed the House of Representatives in July 2025 with strong support. The Senate Banking Committee scheduled markup sessions for January 15, 2026, meaning the bill is closer than ever to becoming law.

Here's what the CLARITY Act does: It finally answers the question of who regulates what in crypto. For years, the SEC and CFTC have both tried to claim authority over digital assets, creating confusion and uncertainty. The CLARITY Act draws clear lines: the CFTC gets exclusive jurisdiction over digital commodities—assets like Bitcoin and Ethereum that function more like gold than stocks; the SEC keeps oversight of investment contracts and securities-like tokens.

The legislation introduces a three-tier classification system that determines how different cryptocurrencies get regulated. Importantly, it includes a provision that treats certain major cryptocurrencies the same as Bitcoin and Ethereum from day one. If a token is the main asset of an exchange-traded product (like an ETF) listed on a major U.S. exchange as of January 1, 2026, it gets commodity status automatically. That means tokens like XRP, Solana, Litecoin, Hedera, Dogecoin, and Chainlink would receive the same regulatory treatment as Bitcoin and Ethereum.

The catch is timing. Crypto advocates want this passed before the November 2026 midterm elections to avoid losing momentum. The bill works together with the GENIUS Act (passed in 2025), which created a federal framework for stablecoins. Together, these laws represent the U.S. attempting to catch up with Europe's MiCA regulation while maintaining its own approach.

Social, Political, and Economic Impacts

Cryptocurrency's broader implications extend far beyond investment returns. In countries with unstable currencies or limited banking access, crypto offers financial sovereignty and a hedge against inflation. People can store value, send remittances across borders, and participate in global markets without depending on local financial institutions. That's the purpose of cryptocurrency in action—providing tools for economic participation.

Politically, the 2026 regulatory developments signal a fundamental shift. Governments are no longer asking whether to regulate crypto—they're implementing comprehensive frameworks that balance innovation with consumer protection and tax compliance. Europe has established the world's first complete legal framework through MiCA and DAC8. The United States is following with the CLARITY Act. This regulatory clarity helps legitimize the industry while protecting consumers, though it also creates a more monitored environment where transactions aren't as private as they once were.

Economically, cryptocurrency challenges traditional monetary systems and introduces new models for value transfer and financial coordination. The implications are still unfolding, but the direction is clear. Digital currency is reshaping how we think about money, ownership, and financial access.

Environmental Effects and Technological Limitations

Not all progress comes without trade-offs. Energy consumption remains a significant concern, particularly for proof-of-work blockchains like Bitcoin. The industry is responding, though, with green cryptocurrency initiatives and more efficient consensus mechanisms. Ethereum's transition to proof-of-stake reduced its energy consumption by approximately 99%—evidence that sustainability improvements are achievable.

Technological limitations also persist. Blockchain networks face scalability challenges, meaning processing transactions quickly and cheaply remains difficult as networks grow. Transaction speeds on major networks can't yet match traditional payment systems, and high gas fees during network congestion can make small transactions impractical. Solutions like Layer 2 protocols and alternative consensus mechanisms are addressing these issues, but they're still maturing.

Here's the key part: the environmental and technical challenges aren't showstoppers—they're engineering problems being actively worked on. As the technology evolves, expect to see more energy-efficient protocols, faster transaction speeds, and infrastructure that balances decentralization with practical usability.

Bottom Line

After exploring what cryptocurrency is and how digital currency works, it's helpful to step back and look at the big picture.

Cryptocurrency was made to offer genuine benefits. Decentralization means no single authority controls your funds; you’re effectively your own bank, with freedom and responsibility coming together. Cross-border payments with cryptocurrencies can be faster and more affordable than traditional bank transfers. Financial inclusion extends to people without access to banking infrastructure. The underlying technology, blockchain, creates transparent, tamper-resistant records of every transaction.

On the flip side, cryptocurrency comes with real challenges you should know upfront. Price volatility remains significant, even as the market matures. Security depends entirely on you protecting your private key—lose it, and your crypto is gone for good, no customer service can recover it. Regulatory uncertainty varies by country, creating a patchwork of rules, and scams still exist and target beginners specifically. The learning curve is steep, and not all cryptocurrencies serve legitimate purposes.

Continue learning with the ChangeHero blog! If you prefer social media, we are on X (ex-Twitter), Facebook, and Telegram.