Contents

Ethereum started the second generation of blockchains, expanding on the capabilities of the technology greatly and introducing tons of new concepts into the industry. Today it’s hard to imagine the market without Ethereum and other currencies that exist because of it. In this article, ChangeHero team is going to answer all your questions about the most popular altcoin.

What is Ethereum?

In simple terms, Ethereum is a blockchain which has the functionality of smart contracts. They are compiled in Ethereum Virtual Machine (EVM) and executed on the blockchain. As for their function, smart contracts are the scripts or programs that run only if all the conditions stated in its code are met. Smart contracts let a robust variety of features such as tokens, dApps and prediction markets exist on the Ethereum platform.

The nodes that perform the computations are rewarded with a block reward of 2 ETH and the gas fees. Unlike transaction fees in Bitcoin, you pay gas for everything recorded in the blockchain, including contract calls.

How was Ethereum created?

The idea of Ethereum was first presented in January 2014 in the whitepaper by Vitalik Buterin. Before that, he was looking into the solutions for creating applications on the Bitcoin blockchain. Ultimately, he came to the conclusion that it’s fundamentally limited, having nothing like backwards scanning or complicated scripts. A new platform would need to be built with a scripting language from the ground up.

Although Vitalik Buterin is often considered to be the face and voice of the project, he is not the only founder. Ethereum wouldn’t happen without Gavin Wood, Charles Hoskinson, Anthony Di Iorio and Joseph Lubin. In early 2014 they finished figuring out the basics laid out by Buterin, and decided to crowdsale the launch. The Ethereum Foundation, responsible for the ongoing development, would be established with 31 thousand Bitcoin raised.

What has Ethereum made possible?

Stablecoins

Stablecoins are the tokens that are pegged to the value of another asset, for example, commodity or a fiat currency. Some stablecoins are more centralized and have treasuries, others rely on algorithms.

Technically, stablecoin technology and principles do not require them to be built exclusively on Ethereum. Nevertheless, the most popular stablecoins like Tether and DAI chose the Ethereum network for optimal security.

Blockchain Gaming

Gaming on blockchain is decentralized, censorship-resistant and has consistent uptime. The last two are especially important, since with centralized providers, like game publishers and stores, your purchases generally do not belong to you, and the servers need to go down for maintenance.

In addition, blockchain games allow for tokenization of collectibles and trading on in-game marketplaces. Other players like yourself create a unique local economy within the game with the help of these platforms.

Ethereum is one of the most popular platforms to build on, purely for its security and proven functionality. The games built on Ethereum include Decentraland, Gods Unchained and, of course, CryptoKitties. It is not dominating by a wide margin, since in practice, the transaction throughput is better on Layer-two solutions.

Decentralized Finance

Arguably the most important and potentially impactful application of Ethereum platform and smart contracts is for decentralized finance, or DeFi. In comparison to traditional banking, it is uncensorable, accessible, open and self-sovereign.

DeFi applications include asset management and issuance apps, alternative savings (like Dharma or Linen.app), decentralized exchanges like Uniswap, oracles, prediction markets, DAO, insurance and lending, among other things.

Some of DeFi applications on Ethereum have projects with networks of their own. The oracle network ChainLink verifies and transfers any data on-chain, providing communication between smart contracts and real world. Prediction market Augur puts the future price betting on the blockchain, making it fair by incentivizing honest behavior. Plasma-powered decentralized exchange solution OMG Network’s mission is to provide accessible and fast financial services to anyone with Internet access. These tokens power their own ecosystems but at the same time work thanks to Ethereum.

What dApps on Ethereum are popular?

| App | What it is | Users |

| OpenSea | P2P marketplace for collectibles and NFTs | 25.55k |

| Uniswap | Decentralized exchange (DEX), powered by an automated market maker (AMM | 17.75k |

| Polygon Bridge | Contract for ETH–MATIC–ETH transfers | 1.4k |

| Ethereum Name Service (ENS) | Domain name service for Ethereum addresses (.eth) | 1.05k |

| Mirandus | Fantasy multiplayer game by GalaGames | 156 |

| OwlDAO | Platform for users to build their own casinos and GameFi tokens | 11 |

| CryptoPunks | Digital collectible avatars | 56 |

| Step | Move-to-Earn project, possibly fashioned after STEPN | 4 |

Source: DAppRadar

As we can see, the most popular and used categories are exchanges and DeFi. Games and social apps on the Ethereum blockchain are not as populated as the same apps on other chains and Ethereum Layer-2s.

How are Bitcoin and Ethereum different?

Ethereum is a second-generation blockchain to the first one represented by Bitcoin. Its versatility, in comparison to the first cryptocurrency, is vastly superior. However, how does Ethereum do its job of transacting currency?

In Bitcoin, each new block takes 10 minutes (target block time), so a transaction needs around the same time for acknowledgment. There is an artificial limit at 7 transactions per second to decrease the chances of double-spending. Bitcoin is slow but once the record is on the chain, there is no changing it.

Ethereum is much faster in comparison, with a block target time of only 15 seconds. This increases the throughput of the network to 15 transactions per second, which also accounts for smart contract execution in addition to money transfers.

Bitcoin’s blocks have a 1 MB memory cap, and Ethereum’s have a block gas cap. Since gas depends on how many lines of code a node has to execute, a maximum limit of processing for one block is 10 million Gwei.

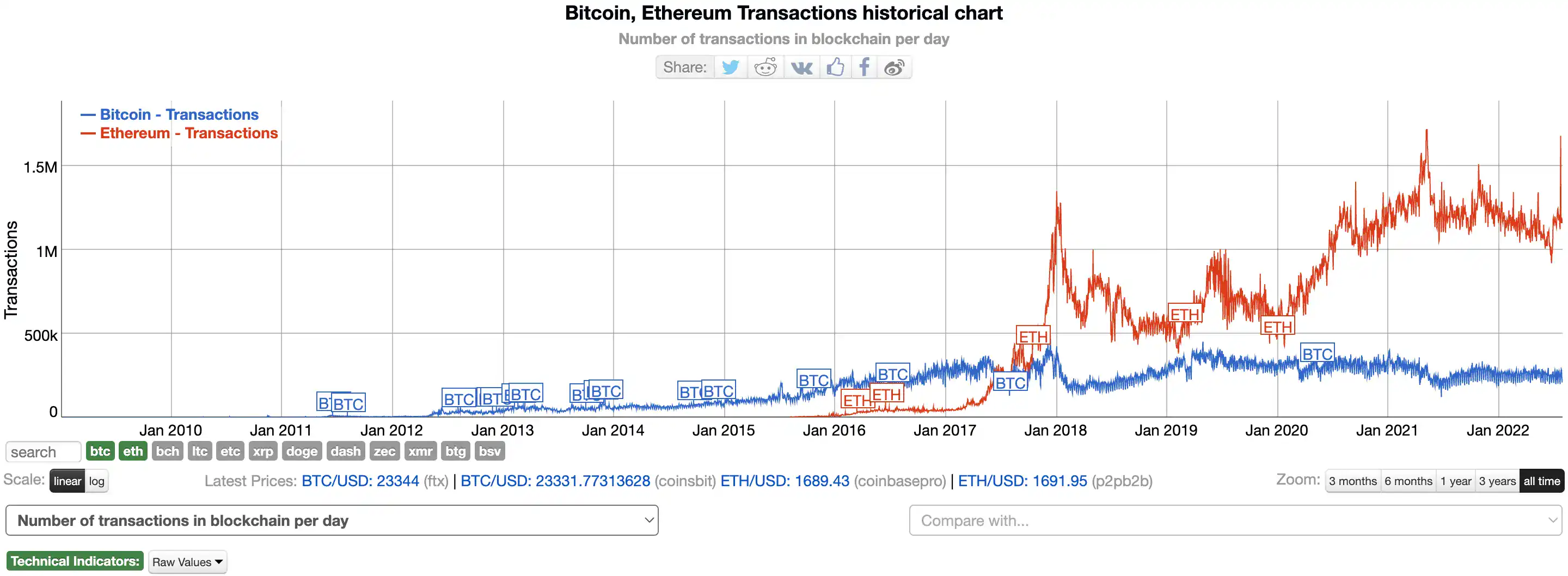

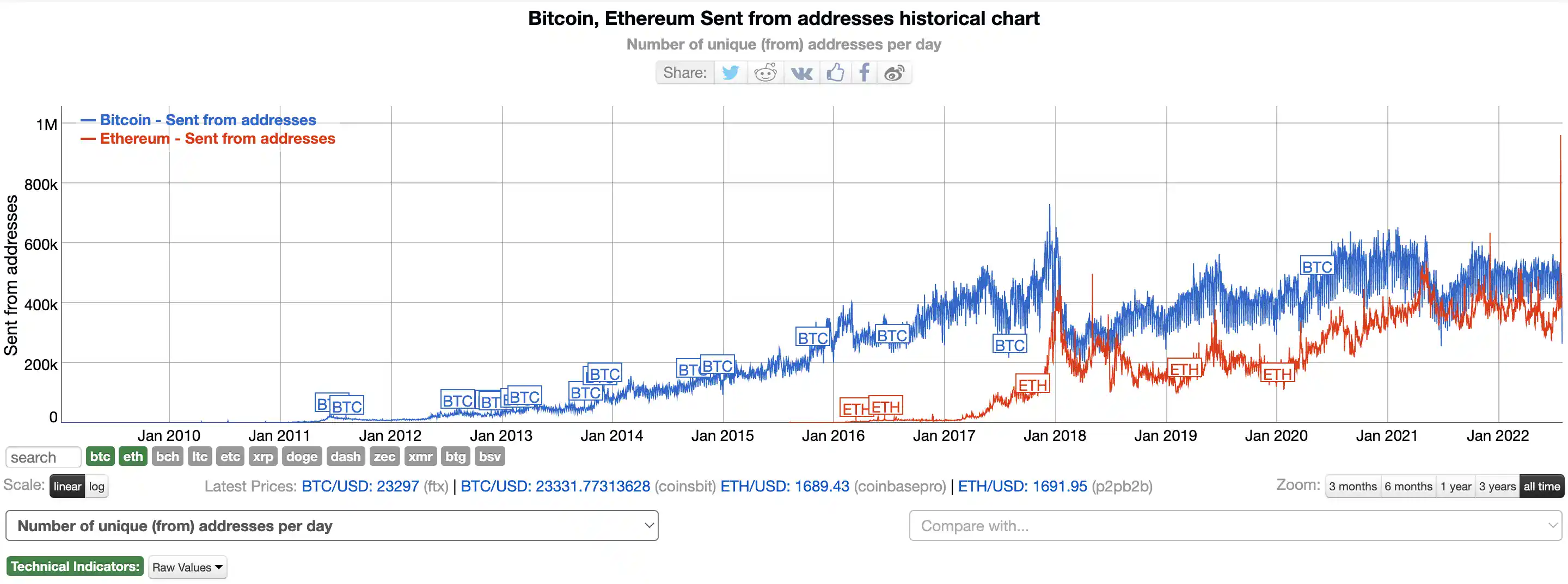

Since a “transaction” in Ethereum is only value transfer, on average there are more transactions than in Bitcoin. Ethereum transactions are hitting almost 1 million a day, while in Bitcoin this figure is closer to 300 thousand.

Nevertheless, the number of unique addresses, another important metric for chain activity analysis, shows better results for Bitcoin than Ethereum. ETH addresses overtake BTC only occasionally.

How much is ETH worth?

Ether (ETH) is the native currency in the Ethereum network , though it is most often referred to as Ethereum, like the platform. At the time, Ether is issued through mining and its value comes from enabling transactions and smart contract execution.

Gas is very similar to transaction fees in other currencies, but all computations performed by nodes charge it. It is fully customizable, but usually there is no need to set it for more than needed. Gas is the reason ETH was so popular in 2017 and 2018, when the ICOs were all the rage, and it certainly contributes to the popularity of Ethereum today, since the most used stablecoins are ERC-20 tokens.

Bitcoin undoubtedly dominates the crypto market, but Ethereum also takes up a considerable chunk of it. Today, Ethereum holds about 19% of the whole market cap of crypto.

In 2017, the Ethereum price skyrocketed from $10 to $380 over a couple of months when the first smart contracts for enterprise were ready. Decentralized exchanges, blockchain games and stablecoins all contributed to that. On January 13, 2018, Ether price hit a cycle high of $1,432.88. In the years that followed, ETH went to a low around $90 to fly to the current ATH: $4,891.70 on November 16, 2021.

At the moment of writing, a single ETH is worth $1,684.26 according to CoinMarketCap. For more detailed price history, you can check out our Ethereum Price Prediction.

How to put ETH to use?

Buy Ethereum

Since it is second only to Bitcoin, almost every crypto and hybrid exchange has ETH pairs. To buy ETH on an exchange, a user would have to make an account and have it approved first, then make a purchase, then withdraw. To circumvent this somewhat complicated process, on ChangeHero, you can buy Ether after a quick verification, and the whole process will not take more than 15 minutes. Have we mentioned it works both ways, so you can sell it as well? And if you already own other cryptocurrencies, you can use them to purchase ETH even faster and with no registration at all with instant swaps provided by ChangeHero.

Ethereum Wallets

Unique to Ethereum are smart contract wallets. In these apps you can do things that are not normally possible on other blockchains: recover funds, set fraud alerts and limit withdrawals. Wallets like this include Gnosis Safe, Argent and Authereum. The obvious drawback is that these wallets work with Ethereum only, so you can only store ETH and ERC-standard tokens there.

Most multi-currency wallets support Ethereum. For hot storage we recommend Exodus and for cold storage, you can pick Trezor or CoolWallet S, because in these you can exchange cryptocurrencies with ChangeHero as easily as on the website but without leaving the app.

Spend Ethereum

In addition to utilizing ETH in the Ethereum ecosystem’s apps, you can purchase goods and services in any shop or with any merchant that accepts ETH or has a payment gateway installed. It doesn’t have to be an online shop or platform, since there are lots of real-life shops and hotels that accept such payments. Roughly half of all merchants that accept cryptocurrencies support Ether payments. The full list can be found here.

What is the Merge? What Happened to Ethereum 2.0?

Previously known as Ethereum 2.0, The Merge is a process of transition to the Proof-of-Stake algorithm. While the immediate change will see mining become obsolete, the Merge will also set the ground for updates like sharding on the main chain.

PoS will make the Ethereum network more secure and sustainable. The increased security comes from increased responsibility for running a validator node. To claim one, 32 ETH (~$7,418) need to be locked into the system, and in case a node deviates from expected behavior, the rewards get slashed in part or entirely. However, running a validator node and sustaining it is a dependable source of passive income in the form of validation rewards, so this model will attract even more investors.

The Ethereum Foundation retired the “Ethereum 2.0” term in 2022. The previous wording implied that two networks would coexist, like it has been the case with Beacon Chain. The official sources put The Merge date in Q3/Q4 2022, and unofficially it is expected to happen as soon as on September 19.

Is anything wrong with Ethereum?

Of course, Ethereum is far from being a perfect technology. There are adaptability concerns, already mentioned scalability problems, some critique addresses even security issues.

Decentralization and community governance, as well as rigidness of the blockchain structure makes adaptability a huge issue for Ethereum. In the 2016 DAO hack, when a hacker exploited a smart contract vulnerability to drain millions of ETH from the account that was supposed to become a venture fund for development on Ethereum, the damage could have been prevented by a hotfix. Of course, singlehanded issuance of changes to the network was not possible in this case. In addition, an attempt to write this case out of the history of Ethereum to return the stolen funds caused a schism in the community.

Then there is scalability. The gas limit which has already been increased in September 2019, is being put to test again under the pressure from stablecoins and dApps running on Ethereum. Definitive solutions like sharding are left for the community to solve with layer-two networks.

This guide by the Ethereum Foundation describes the best practices to avoid known attacks, but there is a lot more potential for exploitation with the new kinds of code being developed for Ethereum every day. And, like we already said, there would be no quick way to fix a smart contract due to it being executed on the blockchain.

Ethereum Talk on Twitter

#Ethereum average transaction fees are at the same low level as in 2020!

— DAO Maker (@daomaker) July 31, 2022

In a #bullmarket 2021, many were concerned about the high costs for swapping or interacting with #smartcontracts.

Now other #blockchains cannot use the argument of cheap transactions as a trump card. pic.twitter.com/PWzSxn6jkO

As the DAO Maker team put it, with ETH price action cooling down, gas fees are viable again. Ethereum’s competition will have to offer more than cheap transactions to keep up.

(1/15) Token Standards and Composability

— Haym Salomon (@SalomonCrypto) August 1, 2022

ERC-20, ERC-721, ERC-1155, ERC-4626...

ETC - WTF

Confused what @ethereum token standards are and why they matter? Interested in knowing which tokens are for what purpose? Want to understand the big picture?

This is the thread for you! pic.twitter.com/XuNYGfmDee

Confused about all the token standards of Ethereum? User Haym Solomon is here to help with an infographic.

⌛️7 years ago on 30/07/2015, we launched #ethereum from an office in #Berlin Waldemarstraße 37A.

— Lefteris Karapetsas | Hiring for @rotkiapp (@LefterisJP) July 30, 2022

🦄What was started by this ragtag band of devs from around the world has now grown to a network securing more than $250 billions in value.

🎂Happy birthday ethereum! pic.twitter.com/KpglcKMd9u

Happy belated anniversary to Ethereum! The project was launched seven years ago in Berlin, Germany.

Conclusion

Ethereum sparked a lot of innovation in the sector: ICOs and tokens, stablecoins, DEXs and dApps. Like Bitcoin, it inspired a lot of alternative chains that promise to improve on it, but Ethereum remains a standard for the blockchain-powered platforms.

The development of Ethereum looks very promising, and it is a sound asset even now. So if you would like to get some Ether, you can do it on ChangeHero, both with other cryptos or fiat currencies. Check our service out to see for yourself — it’s easy, hassle-free, safe and lightning fast!

Subscribe to ChangeHero Blog for more of such interesting content. Follow us on Twitter, Facebook, , Telegram and be the first to get notified.

Learn more:

Quick links:

- Exchange Ethereum to Bitcoin

- Exchange Bitcoin to Ethereum

- Exchange Bitcoin to Bitcoin Cash

- Exchange Bitcoin Cash to Bitcoin