This is the third part of our guide to crypto terms. We explained Bitcoin, altcoins and Ethereum in the previous part. In this guide, we look at complex crypto use cases. Read to learn about crypto wallets. We also tell you about smart contracts and staking. They made popular trends like NFTs, DeFi, and Web 3.0 possible.

Crypto wallets explained

What is a cryptocurrency wallet? How does a crypto wallet work? These are the first things newcomers to crypto should learn.

A crypto wallet is an app that helps you see your cryptocurrency. It does not necessarily store it. Your crypto is kept on the blockchain address. Because of this, you will be able to see it in different wallet apps and on different devices.

What’s important is to safely keep your private keys and a mnemonic phrase. Your private key is a very long string of letters and numbers. It is very likely you won’t even know it. A mnemonic phrase can be called a seed or recovery phrase. It is a set of 12 or 24 words. If you lose it, you lose access to a crypto address forever. Someone else can steal your crypto if they have this phrase.

Crypto wallets these days are more than simply interfaces. They offer software features such as card purchases and coin swaps. Choosing a wallet that fits you best can be difficult. Luckily, you can try out many options. Blockchain is a ledger accessible in many ways. Just keep in mind that you must keep private keys and a seed phrase secret. Don’t import them to websites or apps you don’t trust.

Further reading: ChangeHero’s Top Cryptocurrency Wallet List

Now let’s see what cool things you can do in your crypto wallet!

Smart contract explained

The smart contract definition is a computer program that acts only under special conditions. It is useful for transactions. You can program a smart contract to check for any conditions. Some of its use cases are automatic payments or social services.

To understand the smart contract explanation, think of a vending machine. It gives you goods only if you pay for them. A vending machine’s programming tells it what to do and when.

What are smart contracts in crypto? This invention is mostly found in blockchains. In the real world, you borrow money from a bank. The bank has to have a government license. But there is no one to give licenses for a blockchain. Because no authority controls them, smart contracts replace the law. They make sure you get money and pay it back. They act automatically, so this protects the agreement.

Ethereum is the first smart contract blockchain. It uses a special language called Solidity. You can write any program that runs on an ordinary computer in Solidity. Remember how we called Ethereum the “world computer”? Smart contracts are programs for it. They are executed by miners or validators who add such transactions into a block.

What is the meaning of “proof of stake”?

In blockchain, “proof-of-stake” refers to how security works. Nodes (miners or validators) have to agree with each other to approve updates to the blockchain. They compare their records, and a version wins if most nodes have it.

There are different ways of building blocks and rewarding it. In Bitcoin, miners solve maths problems. This is called “proof of work” (PoW). An issue with PoW is a lot of wasted electricity. Other blockchains use proof of stake (PoS). To take part, a node has to “stake” a lot of coins. “Stake” comes from gambling: it is something you give to win more or lose. If a node works well, its balance increases as it approves new blocks. If a node fails, it loses the stake. PoS crypto does not use a lot of energy.

The proof-of-stake definition is a consensus (agreement) mechanism described above. Not every network has voting rounds. They use different methods instead. People use proof-of-stake networks for passive income. It does not require costly equipment and much energy like PoW. All you do is stake coins and their number grows little by little.

Is staking crypto worth it?

Sounds great, right? But is crypto staking worth it? It works only if a blockchain has good network activity. Even then, the yearly profit is a few percent. If a blockchain promises more, it probably has a high inflation rate. Tokens lose value because there are more of them. Staking has other risks. You can lose the deposit if the node fails. Smart contracts oversee staking. People write smart contracts, so human error can happen.

Further reading: Staking in Crypto: Perks and Pitfalls

What is the meaning of DeFi?

What is DeFi? It is short for “decentralized finance”. This new industry aims to bring decentralization to finance. How? It gives an alternative to real-world finance such as banking.

What is DeFi in crypto? It is many apps for financial services. They work thanks to smart contracts. How does DeFi work? A DeFi app is a set of smart contracts that work with each other. As we said above, they act only under special conditions. By fulfilling them, you use a DeFi smart contract.

With DeFi people trade, borrow or lend cryptocurrencies. Let’s take a decentralized exchange (DEX). People trade crypto tokens there. They trade tokens on centralized exchanges (CEX), too. A CEX keeps a list of trades that people want to make. It gets a share of their trades, too. It also needs to have some crypto of its own. So, CEX is a middleman for buyers and sellers. How does DEX replace it? It makes other people share liquidity and make trades easier. In return, they get trading fees. Now, instead of a CEX, trades are regulated by many other people. It is a much less centralized way.

There is another meaning to “decentralized” in DeFi. Traditional finance is almost always not public. DeFi makes it the opposite. Anyone can see the smart contract code. All transactions and balances are visible on most blockchains. This brings audits and transparency to a new level.

It is important to know that DeFi apps can involve a lot of smart contracts. If these protocols use complicated smart contracts, processing fees (that go to miners or validators) add up. DeFi fits users with cash to spare and knowledge of finance.

Further reading: What is DeFi & How to make money with DeFi tokens?

What Does NFT Mean?

A lot of people talked about blockchains and NFTs in 2021. How come? It was a hot topic because NFTs sold for a lot.

Naturally, a lot of people started wondering. What is NFT in crypto? Let us explain.

NFT stands for Non-Fungible Token. The “N” and “T” parts should be clear by now. What does “fungible” mean? It is a quality of money. It means one unit can be replaced by another. It doesn’t matter which of the $10 bills you pay at the shop. Cash is fungible.

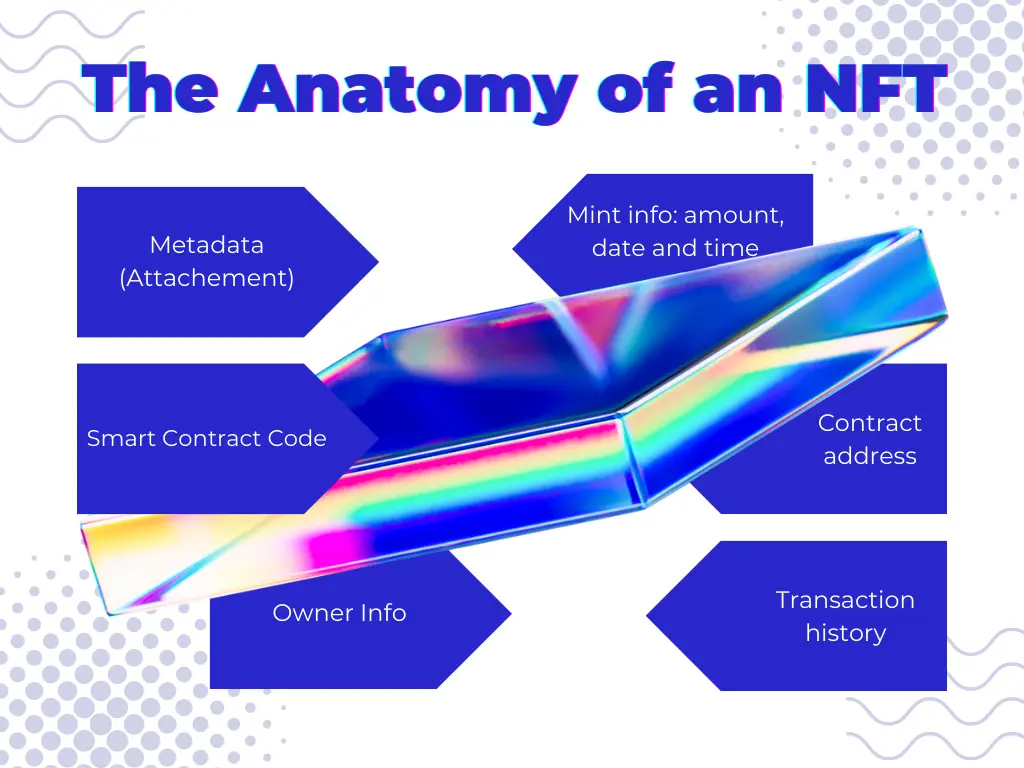

NFTs cannot be replaced by one another. Because of this quality, people use them as tags or checks. They can be proof you own something. For example, an artist can mint (make) an NFT that will point to the artwork. It does not equal copyright unless the artist says so. Digital artist Beeple did it with his 3D renders. An NFT of a collage of 5,000 Beeple’s artworks was sold for $69 million in an auction.

The NFT meaning in finance is a unique asset. It cannot be interchanged for another NFT. Its value depends on what is attached to it. NFT buyers should check what they are buying. Here are only a few things to watch out for. Scammers sell copycat NFTs and tokens with stolen art. Link rot (old links stop working because the website is down) affects NFTs, too. Attackers can send anyone a token with malware. Traders used to fake the trading history of an NFT to sell it for more.

The most commonly used NFT blockchain is Ethereum. However, NFTs can be issued on other blockchains. Some examples are Solana, BNB Chain, and Cardano.

Further reading: What are NFTs? A Beginner’s Guide

What is Web3?

NFTs peaked in 2021. 2022 became the year of Web 3.0. Wait, what is the meaning of Web3 or Web 3.0?

The term comes from a theory. It claims that a new generation of the world wide web is coming. Blockchain and crypto will help create it. Web 1.0 was the time when people had servers and websites of their own. Then corporations like Facebook and Google created their platforms. People started to use their services instead of personal sites. This is Web 2.0, the current Internet.

What is the Web3 definition and vision? Why crypto and blockchain? Web3 believers want the users to be empowered. They generally like how decentralized Web 1.0 was. At the same time, Web 2.0 is more advanced. They want to combine the best of the two eras. DeFi and smart contracts can make it real, or so they believe.

For example, today creators get only a share of revenue for their content. The rest is pocketed by platforms. On a blockchain-based platform, traffic is peer-to-peer. The content maker can get the full cut for the value they created. Also, the blockchain runs with the help of hundreds and thousands of nodes. If one goes down, the network is still running. It is not very rare when Amazon Web Services or Cloudflare go down. A lot of websites of Web 2.0 rely on them and go down, too.

This is the final part of our basic-level guides. Now you know the most useful crypto terms. Continue learning with guides from the ChangeHero blog! Take a look at our Medium once you are ready for the high-level stuff. Let us know what else you want to learn! We are on Telegram, Twitter, Facebook, and Reddit.