This is the second part of our guide to crypto terms. We explained blockchain, cryptocurrencies and digital currencies in the first part. In this guide, we look at Bitcoin and its siblings. Learn what altcoins are and what Ether is. We also will tell you about stablecoins.

What does bitcoin mean?

Bitcoin’s definition: it is one of the cryptocurrencies. Crypto is a digital form of money that uses blockchain and is not controlled by one authority. Bitcoin is the first successful crypto. It uses the ticker symbol BTC for short. Bitcoins’ meaning includes both a cryptocurrency and its protocol.

What are bitcoins for?

How to work with bitcoins? We have an answer. Its original purpose is to use instead of cash. Shops online and even offline accept it.

Bitcoin will have a total supply of 21 million. Because of this, people use it to save up money. Fiat, or state money, is prone to inflation. Because the state can print more money, it loses value. There is a limit to bitcoins, and people expect their value to grow.

What does mining crypto mean?

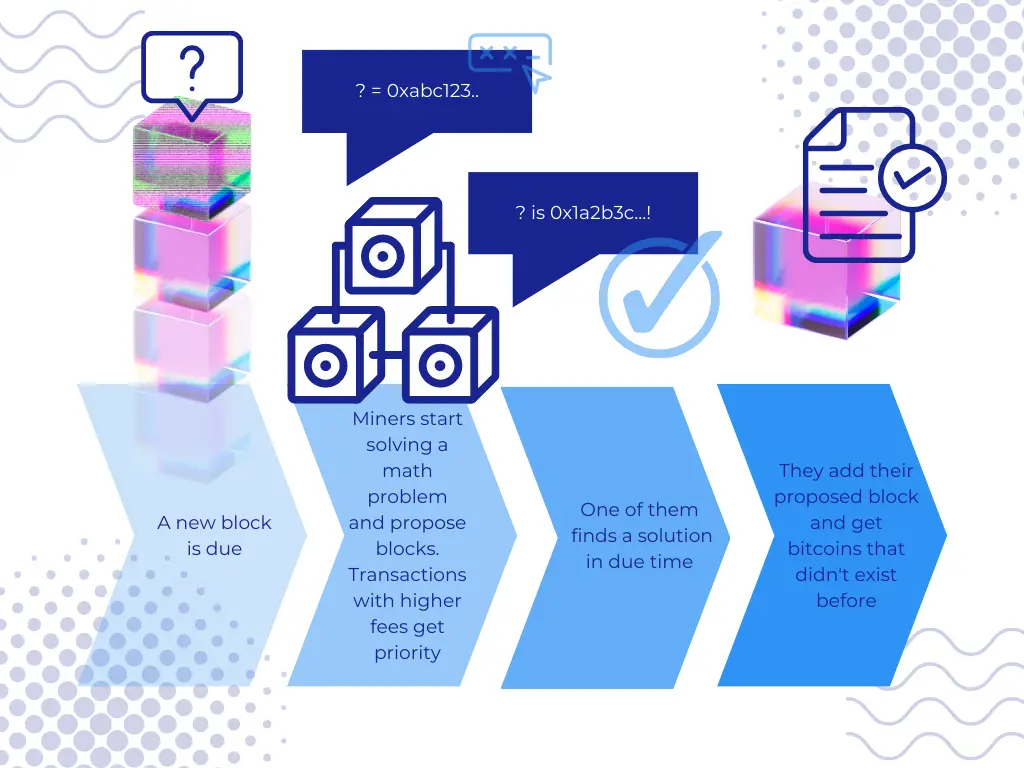

We wrote in the past guide that mining keeps blockchain going. What is crypto mining in simple terms? It is a complex process of solving ciphers and adding information to the database. It is called mining because it is similar to the real-life industry. Mining gold gets harder over time. The more gold is mined, the less new gold you can find. “Mining” bitcoin gets harder, too, and it yields less and less.

Why do you mine bitcoins then? Out of 21 million, 19 million are mined. Miners still can produce almost 2 million new bitcoins. Plus, they get fees from other bitcoin users if a miner adds their transactions to a block. Bitcoins and mining still bring profit.

When Alice sent Bob 1 bitcoin, miners checked the transaction’s signature. However, it was not recorded on the blockchain. It went to the mempool, a queue for blockchain transactions. Transactions with large mining or transaction fees get the highest priority. You can choose how much you pay (if you use a crypto wallet, it is not always possible). It is possible to set the fee to almost zero but it probably will never go through.

What is the purpose of mining bitcoins? Miners compete to mine a block. They do it by guessing hashes and solving math problems. It’s healthy for the blockchain to have a lot of miners. The problem difficulty grows, and it gets too expensive to hack the blockchain.

Further reading: What Is Bitcoin? A Beginner’s Guide

What is “altcoins”?

Now you know about bitcoin. So what is an altcoin? It is any other crypto that is not Bitcoin. Simple, right? They have a common name because bitcoin alone used to have about half of the value of the whole crypto market. These days, BTC has about 40% of the value of it.

What are altcoins? Examples of altcoins are Ether or Ethereum, Dogecoin, Tether USD. All tokens are altcoins as well. Ether is the most popular altcoin. It has about 10% of the value of the whole crypto market.

By the way, tokens and coins are not the same. But first, we need to define Ether coin.

What is Ether cryptocurrency?

Ether is a native cryptocurrency of Ethereum. Ethereum is the second most popular blockchain. Ether also goes by ETH. Its smaller parts (0.000000001) are called gwei.

Ethereum is very popular because it is even more useful than Bitcoin. It uses so-called smart contracts. They act like computer programs. This is why Ethereum is also called “world computer”.

To send Bitcoin, you pay a fee to miners. In Ethereum, there are even more use cases. You can send ETH or you can call a smart contract. Even of you do not send money, miners (or validators) execute the program in a smart contract. It costs them resources such as electricity and bandwidth. As a result, you pay fees on Ethereum for every action. These fees are called “gas” because Ethereum needs validators just like your car needs gas to go. Gas fees are measured in gwei.

Smart contracts can create new cryptocurrencies. They are called tokens and are different from ETH. ETH is a coin, like BTC. Examples of tokens on Ethereum are USDT or the Shiba Inu (SHIB) crypto. When you send or receive a token, you actually make a smart contract call. You ask it to change the balance associated with your ETH account. So if you send a token, you pay gas fees in ETH.

Further reading: What is Ethereum (ETH)? A Beginner’s Guide

What is a stablecoin?

You can guess the stablecoin definition from its name. What are these “stable coins” exactly? They are crypto tokens backed by fiat money or other valuables. The most popular stablecoin Tether is pegged to the US Dollar. Its value is $1, which is stable relative to the crypto market. It’s where the stablecoin meaning comes from.

Let’s get the inner workings of a stablecoin explained next. How is it kept stable? Tether and other popular stablecoins do it in a centralized way. They keep treasuries and issue the tokens. When they get $1 million, they mint $1 million USDT. If they need to redeem USDT for USD, they burn the tokens. The USDT supply is regulated off the chain to keep the $1 balance.

There are also other stablecoin models. Some rely on trading to keep the price stable. Its supply is modified by smart contracts. This design is less centralized but less reliable, too. One such stablecoin UST collapsed in 2022. There are also stablecoins with a peg to fiat money but they are backed by other cryptos. Their treasuries are smart contract vaults on the chain. This is how DAI works.

Some people use stablecoins instead of fiat money. It is often cheaper than remittances. Most commonly, stablecoins find use on crypto exchanges in trading.

Further reading: What Are Stablecoins? Why Do We Need Them?

Our next part focuses on the latest crypto use cases. We explain the basics of crypto wallets, smart contracts, and staking. We attempt to give simple definitions to complicated stuff like DeFi, NFT, and Web 3.0. Dive right in when you are ready!