Source: Investopedia

Source: Investopedia

How to Short Bitcoin, Why, and Where to Do It

You may have noticed that even though the price of Bitcoin is supposed to “always go up”, it doesn’t always do. This is normal for a free market: news, changes in the macroeconomic climate, and investor sentiment can drive the price both ways. It is even possible to make a profit from bearish price action, and in this guide, we will tell you all you need to know about how to short sell Bitcoin (BTC).

Key Takeaways

- How do you short Bitcoin or crypto? You will need to engage in crypto derivatives trading. These financial products and contracts let you capitalize on the price of an asset under certain conditions without necessarily holding it;

- What does shorting Bitcoin mean? Short selling involves a contract between traders that opens with a purchase of an underlying asset, in our case, Bitcoin. A short position is closed upon selling the asset, and if the price has declined, the trader takes a profit;

- Where can you short sell Bitcoin or crypto? Shorting BTC is available on most major exchanges and some OTC platforms. It is not universally available across all platforms due to complex regulations and increased risks of this mode of trading.

Why is Shorting Crypto Tricky?

Even if you do not actively engage in trading and financial markets, you might have heard of shorting or short selling stocks. Knowing next to nothing about cryptocurrencies, you would also think that you can do the same to Bitcoin or any other coin. But this would be a misconception: Bitcoin and other cryptocurrencies are not and do not behave the same way as stocks and traditional financial instruments.

Bitcoin

Bitcoin or BTC is the first cryptocurrency which works with the help of a decentralized ledger called blockchain. It is often brought up along its other characteristics such as energy-intensive mining process or its high price volatility.

Because there is no real-world asset that backs the value of Bitcoin (unless we count the energy involved in mining as production costs), its price depends on other factors. One of them is the limited emission: Bitcoin is programmed to never have over 21 million units. Due to this scarcity and the increasing cost to produce new “coins”, BTC is believed to accrue value and grow in price over time.

Ethereum and Altcoins

But Bitcoin is not the only cryptocurrency this niche of digital assets has to offer. By now, there are hundreds of thousands of newer coins and tokens, each changing or improving the original design in many different ways.

One of the exemplary “alternative coins” is Ethereum, which is best described as a decentralized computer. It is a vast and busy network of applications which deal with value without a single central authority. Ethereum’s native currency, Ether’s (ETH) value is derived from its utility plus supply dynamics and its use for gas fees (network commissions).

/>

In this regard, Bitcoin and its counterparts are not too different from commodities. You will find it hard to bring a barrel of crude oil to an exchange and expect to trade it there. However, you can buy and sell assets which are linked to the value of oil, and a lot of crypto trading also deals with instruments rather than the real thing.

Where Does Short-Selling Come From?

Going short is not a straightforward act of selling an asset or a financial instrument. It is a concept that deals with more complex transactions which became possible thanks to the developments in financial markets.

Financial Derivatives

To begin with, we will have to know what are financial derivatives. This is a type of financial instrument that gets its name from the fact that it derives its value from an underlying asset or reference rate. For the purposes of this guide, you also have to be familiar with financial contracts: an agreement between two parties to buy or sell an underlying asset at a specified price and time in the future. The value of such a contract is determined by the price movements of an asset it represents.

Futures Contracts

By definition, in a futures contract, two parties agree to buy or sell a specific asset at a predetermined price and date in the future. Futures contracts have specific details such as the underlying asset (e.g., Bitcoin), contract size, expiration date, and settlement method. Each exchange may have its own set of contract specifications.

To enter such a contract, you need to deposit an initial margin: a percentage of the contract’s notional value. Furthermore, to keep the position open, you need to maintain a maintenance margin. If the account balance falls below the maintenance margin, you may receive a margin call from the broker and even risk having your position liquidated.

Aside from the confidence regarding where the price will go, why else would you want to consider futures? Futures trading can involve leverage, letting traders control a larger position with a smaller amount of capital. For example, if you have 10x leverage, a $1,000 investment would allow you to control a $10,000 position. Leverage amplifies both profits and losses.

Source: Traders Union

Source: Traders Union

Therefore, if you trade Bitcoin in the futures market, you are dealing with a financial instrument that tracks the changes in BTC’s price. Since it is the same as trading a derivative, it does not entail either buying Bitcoin or selling BTC, unlike in spot trading where the contract is resolved “on the spot” and you sell bitcoins instantly. As a result, traders can manage risks better and gain exposure to Bitcoin without worrying too much about custody or ownership.

What is Shorting?

Is there a way to short Bitcoin? We are getting closer to the point: in futures trading, you can take either a long or short position.

A long position means you agree to buy the asset at a later date, while a short position means you agree to sell the asset. Traders take these positions based on their market outlook.

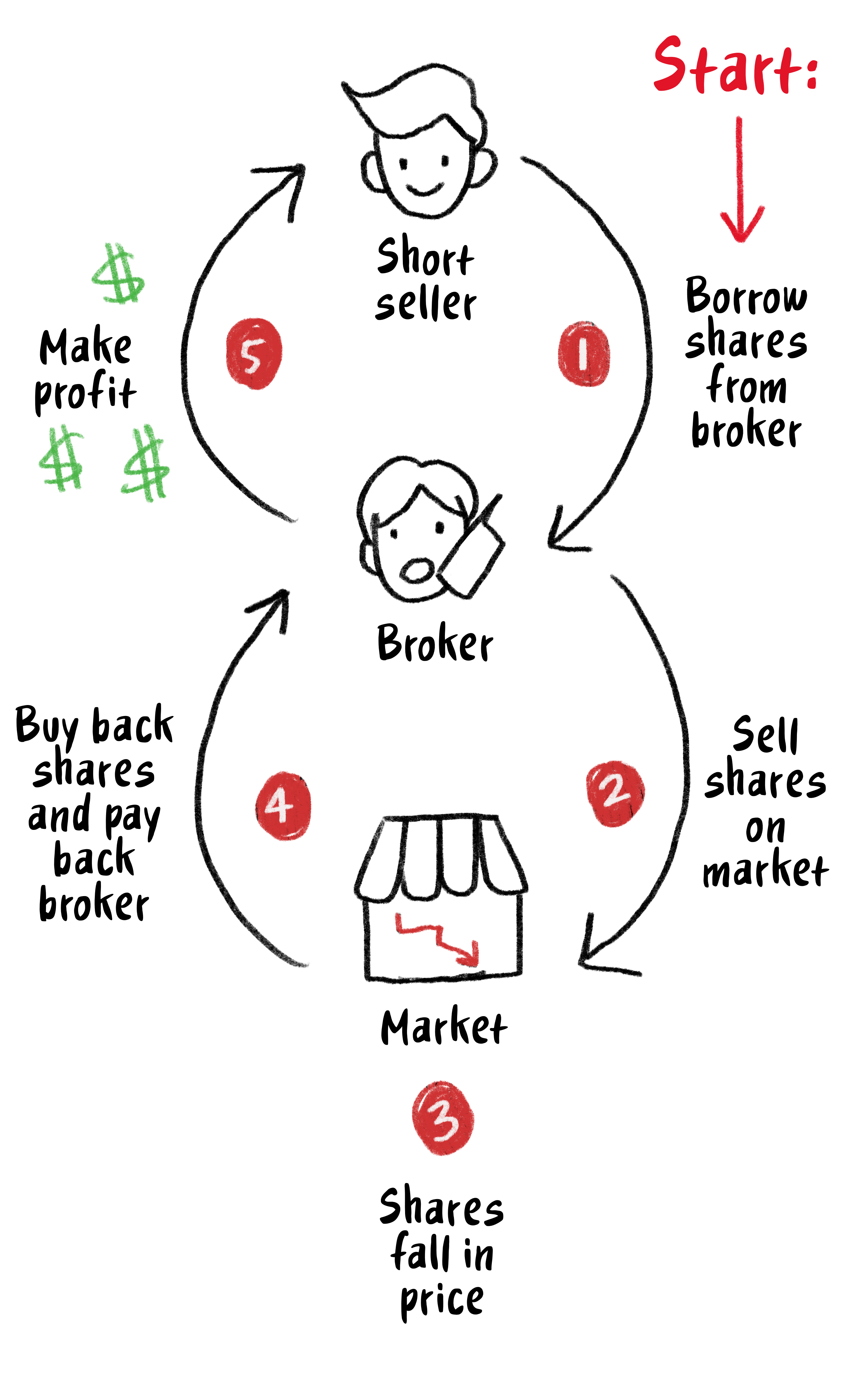

Short selling is a trading strategy of borrowing and selling an asset with the expectation that its price will decline. The idea behind short selling is to profit from a falling market or to hedge against potential losses.

Source: NPR.org

Source: NPR.org

How do you short Bitcoin or crypto, then? The process of shorting BTC would look like follows: to open a short position, a trader borrows BTC from another party (broker or another investor) and sells it at the current market price. Later, after a price has declined, they buy it back and return the loan by the contract expiry date. The difference between the price at which BTC was first sold and the price at which it was bought back makes up the profit from a short trade. In other words, shorting in crypto means the same as what it is in financial markets.

Even without leverage, it is evident that trading Bitcoin like this carries larger risks. In the event of a price increase, a trader may be forced to close the position at a loss. Not to mention, shorting involves counterparties and requires trust in them. Nevertheless, it is a powerful tool for traders and investors to profit from downward price movements, albeit one that requires careful analysis and risk management.

Can you short Bitcoin and crypto?

Like most financial assets, cryptocurrencies are also represented in derivatives markets. There are many crypto exchanges that offer derivatives trading in addition to spot markets.

So can you short crypto or Bitcoin in particular? Yes, it is absolutely possible. It involves borrowing BTC from a lender, usually a broker or an exchange, and then selling it in the market with the expectation that its price will decline. If the price does indeed drop, the investor can buy back Bitcoin at a lower price and return it to the lender, pocketing the difference as profit.

How can I short Bitcoin, you ask? The most common way to short Bitcoin is in the futures market, as we mentioned before. However, there are also other means of trading that offer this opportunity.

Margin trading is another mode of trading assets, including cryptocurrencies, that nowadays many exchanges offer. The gist of it is using funds borrowed from an exchange or broker instead of trading with own assets. The margin account balance can exceed the collateral placed as the initial margin, so by margin trading, you can gain exposure to assets you don’t own. Just remember that this mode of trading implies that you repay the debt before making profits.

Another type of derivative that lets you take short positions in Bitcoin is Contracts for Difference (CFDs). How do I short Bitcoin in this market, you wonder? If you bet that the price of BTC will decline, you open a selling position and close it with a purchase. The difference between the prices is settled in cash, without the delivery of an asset. Another difference between CFDs and futures contracts is the lack of expiry date and time. CFDs inherently have leverage, so it is an advanced trading mode as well, implying higher risks.

Alternatives to Short Selling BTC

How else to bet against Bitcoin without engaging in shorting? There are a couple more ways to benefit from the decline in BTC’s price in addition to Bitcoin shorts. If you believe Bitcoin is getting cheaper soon, you can also turn to binary option trading or prediction markets.

Binary Options

Source: 99bitcoins

Source: 99bitcoins

Binary options are a type of financial derivative that allows traders to speculate on the price movement of an underlying asset, such as BTC, within a specified time frame. In binary options trading, traders make predictions about whether the price of BTC will go up or down by a certain expiration time. If their prediction is correct, they receive a fixed payout. If their prediction is wrong, they lose their initial investment.

Binary options trading can provide an alternative way to trade BTC, especially for those who prefer a simple and fixed-risk approach.

Unfortunately, fixed-risk does not mean risk-free. The outcome of each trade is binary, meaning traders can either win a fixed payout or lose their investment entirely. Additionally, the binary options market is rife with scams and unregulated brokers, so choose a reputable and regulated platform if you decide to engage in binary options trading for BTC.

Prediction Markets

Source: news.Bitcoin.com

Source: news.Bitcoin.com

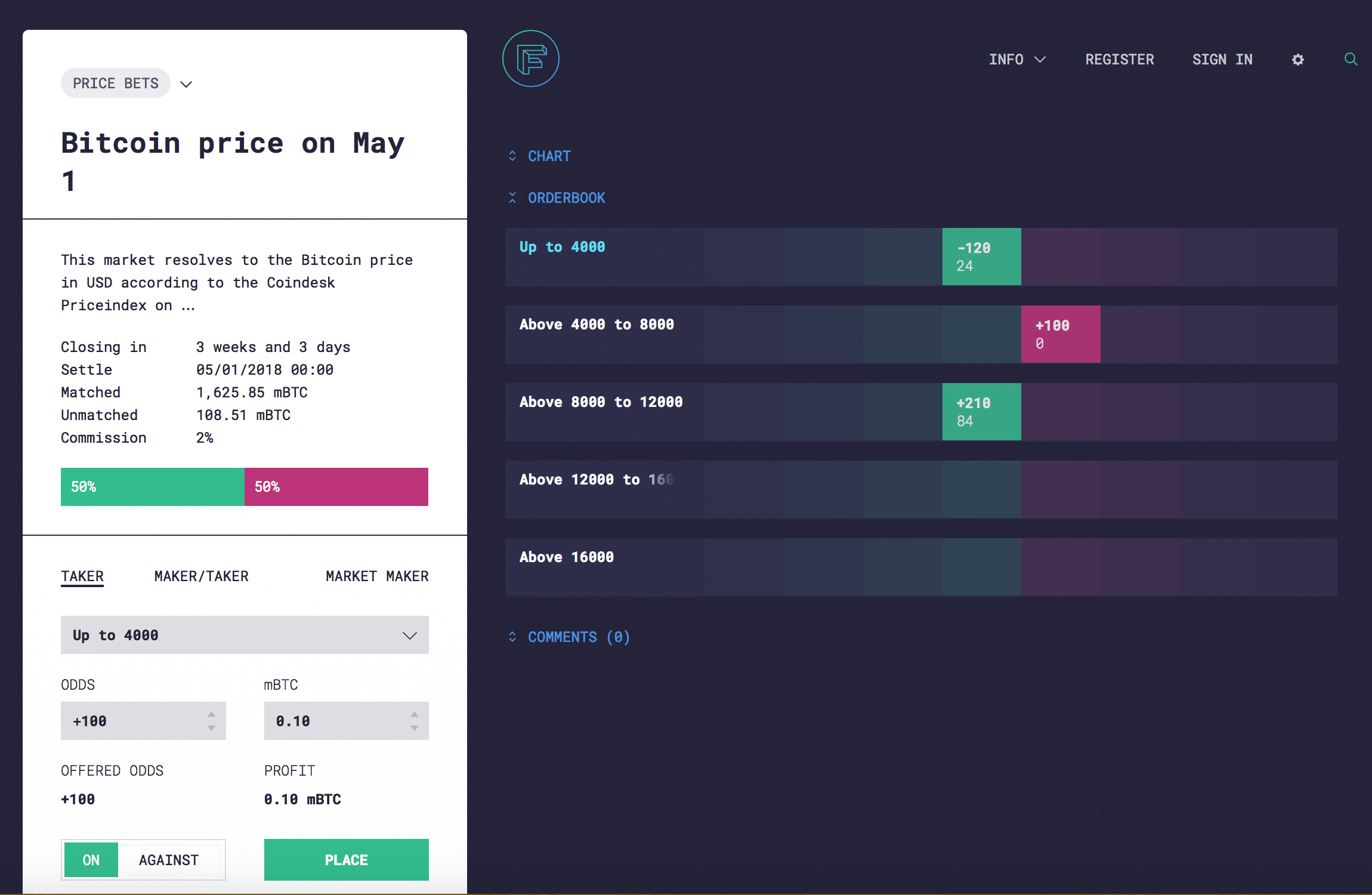

In prediction markets, participants buy and sell shares based on the outcome of an event, such as the price of BTC at a certain point in time. In crypto prediction markets, instead of shares, there are tokens.

One example of a platform where you can engage in prediction markets instead of short selling Bitcoin is Augur. Augur is a decentralized prediction market platform on the Ethereum blockchain. It allows users to create and trade special tokens on a wide range of events, including cryptocurrency prices.

To profit from the decline in BTC’s price using Augur, you would need to find a prediction market related to BTC’s price and get or trade its tokens based on your prediction. For example, if you believe that BTC’s price will decline by a certain date, you can buy the tokens that represent this outcome. If Bitcoin’s price declines as you predicted, the value of the shares will increase, allowing you to sell them at a profit.

It’s important to note that prediction markets are volatile and speculative, and the outcome of an event is not always guaranteed. Augur is a decentralized platform, so it’s crucial to do your own research and ensure the credibility and reliability of the markets and participants before engaging in any trading activities.

Where Can I Short Crypto and Bitcoin?

By now, we have learned that short-selling is possible on exchanges or platforms where derivatives trading is available. Where can you short crypto? These days, most major cryptocurrency exchanges and a few OTCs and brokers offer these services.

Large centralized exchanges such as Binance, Bybit, and Kraken offer all sorts of leveraged and contract trading, including spot, margin, and futures. BitMEX started out as a crypto derivatives trading platform, so it is best suited for derivatives and leveraged trading and provides adequate regulations for an offshore crypto exchange.

Financial derivatives backed by cryptocurrencies are also supported by brokers and OTCs, such as eToro. There, you will be able to trade Bitcoin CFDs in addition to other derivatives.

FTX was also a popular platform to trade crypto derivatives and short crypto but due to severe mismanagement, it ended up collapsing. Let this be a lesson to you: before engaging with these modes of trading, it’s important to do your own research and consider factors such as fees, security, reputation, and available trading options before choosing where to short Bitcoin and crypto.

There is also another way to read the titular question. Can you short crypto in the US or other countries? The answer is generally yes, although depending on the platform, rules and conditions (such as account balance) apply.

Rules and Considerations

Since financial contracts are complex products that carry considerable risks, they are usually heavily regulated, if available at all. For instance, U.S. citizens cannot trade CFDs anywhere. But how do you regulate a derivative that has cryptocurrency, which is not as well defined legally, as an underlying asset?

Well, the answer is, Bitcoin and crypto derivatives fall under the same regulations standard for all types of financial contracts. The type of an asset does not matter as much here as the terms of the agreement and trading conditions.

Obviously, specific regulations vary depending on the country or jurisdiction in which the trading platform operates. However, on any of the platforms you can expect to find legal regulations pertaining to the following:

- Trading platforms offering cryptocurrency derivatives may be required to obtain licenses or register with regulatory authorities. These licenses ensure that the platform meets certain standards and is operating legally.

- Platforms may be required to implement Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures to prevent money laundering, terrorist financing, and other illegal activities. This typically involves verifying the identity of users and monitoring transactions.

- Some jurisdictions impose specific margin requirements and limits on leverage for cryptocurrency derivatives. This is done to protect traders from excessive risk and ensure the stability of the market.

- Regulatory measures may be in place to protect investors, such as requiring platforms to disclose risks associated with trading cryptocurrency derivatives and ensuring fair and transparent pricing.

How to short sell a cryptocurrency without any legal challenges? In addition to doing your homework on the platform you chose for trading, you should also be aware of the jurisdiction it operates from and its applicable laws and regulations. Knowing the laws of your own country and jurisdiction and ensuring there is a match with the platform is also a must.

Reasons to Go Short on BTC

Can crypto and Bitcoin be shorted? We now know that yes. Should you do this? This is an entirely different question.

Not all crypto enthusiasts like to hear this but line, in fact, does not always go up, and it’s okay. Bitcoin and the crypto market go through some long-term cycles tied to halving but also experience volatility in the shorter time frames. Market conditions and sentiment influence the prices, and there is always a chance they will go down. While some investors prefer long-term holding, others make more money trading, so it’s optimal to use all kinds of opportunities, including taking profits or shorting crypto.

Should I short Bitcoin? Some of the reasons to consider it are speculation on a price decline, hedging, market making, and arbitrage opportunities.

Short trading allows traders to profit from a decline in the price of Bitcoin. If they believe the Bitcoin price will decrease, they can borrow BTC from a broker, sell it at the current market price, and then repurchase it at a lower price in the future. The difference between the selling price and the buying price is their profit.

Short trading can be used as a hedging strategy to mitigate losses in a long position. For example, if an investor holds a significant amount of BTC and wants to protect themselves against potential price declines, they can enter a short trade to offset potential losses in their long position.

Some professional traders engage in short trading to provide liquidity to the cryptocurrency market. By shorting Bitcoin, they can profit from small price movements and help facilitate trading for other market participants.

Short trading can be used to take advantage of price discrepancies between different cryptocurrency exchanges, or simply put, for arbitrage. Traders can borrow BTC on one exchange, sell it at a higher price on another exchange, and then buy it back at a lower price, making a profit from the price difference.

Risks of Short Selling

By this point in the guide, we have mentioned the increased risks of short selling Bitcion assets in comparison to spot trading multiple times. In any case, it wouldn’t hurt to reiterate them once more in one place.

Some risks to consider when short trading Bitcoin are:

- Market Volatility. Prices can fluctuate unexpectedly, and if the asset’s price rises instead of falling, short traders face losses.

- Margin Calls. Borrowing assets or using leverage can result in margin calls, where additional funds or assets may be demanded as collateral, or the position will be automatically closed.

- Short Squeeze. A rapid increase in the asset’s price due to many short traders covering their positions can lead to significant losses. A BTC short squeeze can also cause a lot of positions to close automatically, affecting the Bitcoin short interest and market sentiment with volatility.

- Timing Risk. Accurate timing is crucial to profit from a decline in an asset’s price, making it challenging to predict market movements.

- Counterparty Risk. Borrowing assets from a counterparty, such as an exchange or broker, introduces the risk of default or insolvency on their part.

Capital Loss

When you enter a long position, you bet on the asset going up, so the unfavorable outcome is limited by zero. When you enter a short position, though, you bet against the upside price movement, and there is theoretically no limit for that.

In other words, short trading has virtually no limit on potential losses if the asset’s price significantly rises. Add leverage to the mix, and you should be able to see how shorting an unpredictable and relatively volatile asset such as Bitcoin can backfire spectacularly.

Regulatory Changes

Due to the complexity and risks of derivatives trading and contracts, the regulations around them are usually tight, if present. Not at all surprising, given how these modes of trading can affect participants and the market at large alike.

Cryptocurrency laws around the world are still taking shape, and although current government regulations choose to treat crypto derivatives like any other, it might change in the future.

What regulations also choose to treat crypto like the existing types of financial assets? Taxation! So don’t forget that shorting Bitcoin and cryptocurrency is most likely a taxable event in your jurisdiction.

/>

The list of risks associated with derivatives trading multiplied by crypto’s volatility is long but if you know what you are doing, the payoff can be worth it. So, take your time to consider if you really want to start short-selling crypto, and best of luck to you!

Conclusion

Shorting BTC is a valid trading strategy to profit off the cryptocurrency market shifts. It is not recommended to newcomers, who may be better off taking the profits or waiting out on a bearish streak. Even experienced traders can miss and lose on these trades but if the stars align, even a loss of value for Bitcoin can turn into a profit for you.

Did you find our guide useful to learn how to short sell crypto? Feel free to share what you think on our Telegram, X (Twitter), and Facebook. While you’re at it, follow us so as not to miss out on any updates and content! For even more guides for exploring the crypto world, take a tour around the ChangeHero blog.

Frequently Asked Questions

What does shorting mean in crypto?

What is shorting cryptocurrency or Bitcoin? Shorting in crypto has the same meaning as in finance: borrowing an asset with the intention to sell it later at a lower price. What does it mean to short Bitcoin? It is a strategy that lets traders take profits from declining prices.

Can you short BTC?

Yes, using derivative financial instruments such as BTC ETFs or in futures or margin trading. How does shorting crypto work? The same as in financial markets: you borrow BTC from the exchange or broker and sell it later at a lower price, pocketing the difference.

Can you short sell Bitcoin ETF?

How to short a Bitcoin or crypto ETF? You cannot do it with any ETF but will have to use an inverse fund. The ProShares Short Bitcoin Strategy ETF (BITI) is one such fund.

Is there a short ETF for Bitcoin?

Yes, The ProShares Short Bitcoin Strategy ETF (BITI) is an inverse exchange-traded fund (ETF) that lets you profit off declining BTC prices.