Contents

The Aave project that stood at the forefront of decentralized finance (DeFi) is trending once again. What is the reason and how would it affect the price of AAVE tokens? Discover the possibilities in the updated AAVE price prediction for 2025 and beyond.

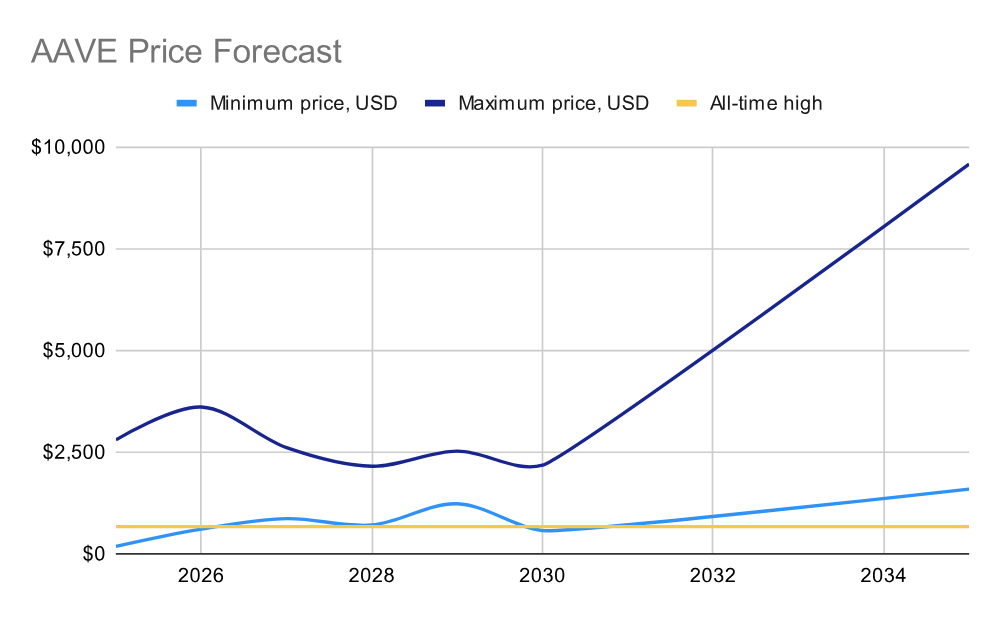

AAVE Price Forecast 2025–2035

- The main psychological level that people watch in AAVE right now is $1,000. With the current sentiment in the cryptocurrency market and the market volatility, it seems feasible soon.

- Bullish AAVE price predictions claim it is achievable next year within the current market cycle. Moreover, some extremely bullish claims propose a price target short of $10K in ten years;

- The majority of opinions on the AAVE price forecast are bullish, even moderate ones. However, there are also bearish opinions that its price is going below the live price of AAVE.

What is Aave?

Aave was originally an Ethereum-based decentralized non-custodial liquidity protocol that expanded to thirteen blockchains and L2s today. Participants join as suppliers or borrowers: the former lend crypto assets as liquidity to the market. The latter can tap into the Aave liquidity pools with collateral. Since Aave is powered by smart contracts, it is less centralized than a bank and accessible to anyone.

In addition to these upsides, Aave offers suppliers an opportunity to earn a yield on crypto locked as liquidity. Borrowers in turn can take a crypto loan and leave collateral to ensure it is returned. The two parties are not connected on a peer-to-peer basis but through a liquidity pool that adjusts rates based on the demand from each side.

If you feel the need for a more detailed introduction to Aave, we recommend reading our Beginner’s Guide before this article.

AAVE Price History

AAVE Price in 2020–2022

In 2017, ETHLend, the predecessor of Aave was presented to the crypto community by Stani Kulechov. At the time, DeFi was not even a thing and decentralized lending was something new. The Initial Coin Offering (ICO) of ETHLend was a success, and tokens went for $1~1.8.

By 2018, the branding was changed to Aave, and a while later the token was migrated to a new contract to change the ticker from LEND to AAVE. In its current iteration, the Aave coin has been around since late 2020. In comparison to the ICO price, AAVE had a strong start near $50. While it was not bad from the start, it would go on to even higher levels. By the end of 2020, AAVE was worth $80.

2021 will be remembered in the crypto community as the year of a Bitcoin bull run. Following BTC, most of the coins surged, and AAVE was not an exception. On May 18, 2021, it reached its all-time high of $666.86. It had been roughly a month since Coinbase went public, and in May 2021, Aave announced plans for a permissioned pool for institutional investors.

The second half of 2021 was less bullish for the AAVE price but decent nonetheless. After a leg up in November, the market entered a correction phase but nonetheless, AAVE somewhat recovered before the year’s close. Its closing price in 2021 was over $250.

2022, in turn, was the year when the cryptocurrency market prices turned to the downside. What started as a correction from the rapid rise of BTC turned sour after multiple companies and projects such as Terra (LUNA) and then FTX collapsed. During 2022, AAVE went down from $250 to a bit over $50.

AAVE Price in 2023–2024

2023 was more than just a tumble down for Aave’s price for a change. From the current perspective, it certainly looks like a consolidation phase but not without volatility and trend reversals. By November, it managed to step over the psychological threshold of $100.

From there, the price of AAVE dipped below it a few more times but even then, it was gearing for the current parabolic growth. A higher high after high, it climbed from $135 to $172 and then to $180, before launching toward the current price record.

At the time of writing, the current price of AAVE is $366.19 and the token ranks 28th by AAVE market capitalization according to CoinMarketCap.

What Influences the Price of AAVE?

Protocol Updates

Early in 2023, Aave rolled the latest global version of the protocol Aave V3 out to all supported networks. Enabling V3 across the Aave ecosystem helps improve the user experience even further, boosting the market sentiment and confidence in the future of Aave.

The updates are not simply increasing the value of the Aave protocol and consequently, the value of the AAVE tokens. Being a governance token of Aave, AAVE represents voting power and is needed to vote and introduce these improvements in the first place.

AAVE holders have voted on and pushed through proposals such as expansion to Polygon’s zkEVM and BNB Chain. The protocol’s stablecoin GHO is another major contributor to the perceived value of the whole protocol. Behind the current AAVE sentiment and surge are several protocol-related news: integration to zk-rollup L2 Linea and a strategic partnership with Balancer v3.

GHO’s design draws on MakerDAO’s stablecoin Dai: to mint it, you will need to provide collateral multiple times over the amount to mint. This crypto-backed stablecoin model has proved to be more sustainable than algorithmic stablecoins.

Contribution to DeFi

By now, Aave is one of the largest players in DeFi: according to DefiLlama today, it ranks second by TVL with an estimated $22.175B locked in the protocol across all supported chains.

Aave pioneered flash loans, uncollateralized loans that are settled as soon as they are issued (within a block time). This feature is generally used in arbitrage but is also frequently mentioned together with exploits and hacks. In 2023, Aave and Yearn Finance were targeted by a flash loan exploit that managed to drain $10M in various stablecoins from the latter.

Although Aave was without any doubt a pioneer in the DeFi space, it does not mean this position will be unchallenged forever. Even if other lending protocols do not come close in terms of TVL, its native asset has been flipped by both veterans like Uniswap (UNI) and newcomers such as Hyperliquid (HYPE).

Legal Regulation

As a decentralized technology, the Aave protocol and DeFi as a whole have to self-regulate. More often than not, these measures align with the legal framework that is applied to crypto today. For example, as soon as Paxos — the issuer of Binance USD stablecoin — received a Wells notice from the US Securities and Exchange Commission, the Aave community put forward a proposal to disable BUSD on the Aave platform.

Aave also strives to create customer protections that are innately compatible with crypto. They collaborate with entities such as Chaos Labs to have them design risk management tools to prevent hacks and exploits.

Efforts to self-regulate do not mean that Aave is exempt from the encroaching government regulation. The question looming over the crypto market these days, coins and tokens especially, is whether a cryptocurrency they operate can be considered a security.

The examples of tokens that voluntarily sought government registration as security tokens are few and far between. The rest can be charged with operating an unregistered security, which implies consequences that for many crypto projects are nothing less than an existential threat. On May 13, AAVE was dropped by an institutional platform Bakkt, among other 25 cryptocurrencies, due to regulatory compliance.

AAVE Price Analysis and Forecast

TradingView user InvestingScope makes a strong case for the AAVE price extending the rally up to $2,500 in the next year:

AAVE is heavily overbought on its 1D technical outlook (RSI = 82.361, MACD = 36.650, ADX = 44.549) but during Bull Cycles, this accelerates the exponential growth of rallies instead of being a bearish signal for a correction. The current rally has already reached the 0.786 Fibonacci level and based on the Bull Cycle 2020-21, it should not stop here but instead extend above the ATH. Our long term target is the 1.5 Fibonacci extension (TP = 2,500).

AAVE Price Prediction 2025

The CryptoNewsZ experts are confident — the AAVE rise will continue. It should be able to go up to $298.63 and trade throughout 2025 at the average price of $240.49. The minimum expected price is $182.35, which is considerably lower than the current AAVE price, so watch out for pullbacks.

Their colleagues at Telegaon provide a more bearish AAVE price forecast: an average price of $226.17 in 2025, and if the conditions allow it, a maximum price of $251.31.

Using historical price data, CryptoSpotter gives a realistic Aave price prediction on YouTube. By comparing the Aave market cap to Ethereum’s, currently and at the previous top, they arrive at the range of $732–$2,800.

AAVE Price Prediction 2026–2029

| Year | Bitnation | PricePrediction.net | LongForecast |

| 2026 | $1,187.28–1,409.89 | $606.81–707.50 | $1,927–3,608 |

| 2027 | $1,558.30–1,780.92 | $864.28–1,065 | $915–2,609 |

| 2028 | $1,929.33–2,151.94 | $1,269–1,482 | $708–1,316 |

| 2029 | $2,300.35–2,522.97 | $1,918–2,229 | $1,230–1,523 |

AAVE Price Prediction 2030, 2035

Reliable long-term crypto price predictions cannot be made with technical analysis simply because there is not enough historical data. The best bet is to look at algorithmic AAVE forecasts to analyze potential price trends.

The one by Traders Union projects AAVE will organically rise to the range of $1,877.94–2,177.84 in 2030 and meteorically burst to $8,262.54–9,582.02 in ten years. However, by then the AAVE supply will grow in comparison to 15 million tokens today. A price target so close to $10 thousand will necessitate a massive growth in the AAVE market cap.

AMB Crypto’s expectations are a lot tamer: an average price of AAVE $712.79 in 2030; and anywhere between $1,591.70 and $2,387.55 in 2035.

Finally, the Coin Price Forecast has the following AAVE price prediction for the long term: up to $1,684 by the end of 2030. Ten years from now, the maximum price AAVE is expected to hit is $2,315 with a 570% potential ROI.

How to Buy AAVE?

You can buy AAVE on ChangeHero’s website in a few steps without obligatory KYC or registration. Just swap any crypto for AAVE on ChangeHero!

- Choose the currencies on the home page, amounts, and the type of exchange. Provide your wallet address in the next step and check the amounts;

- Double-check the provided information, read and accept the Terms of Use and Privacy Policy;

- Send in a single transaction the sum of the cryptocurrency you will be exchanging. Fixed Rate transactions have a 15-minute limit;

- Done? Now we are doing all the work: checking the incoming transaction and doing the exchange as soon as it arrives;

- As soon as the exchange has been processed, your AAVE is on the way to your wallet.

Customer support is here for you 24/7 in the chat on the website or through the email: [email protected].

Conclusion

Aave is one of the most reputable players in DeFi because of its pioneering role. It may not be something that rare gem hunters look for but for someone dabbling in altcoins, this protocol and token are a relatively safe bet to stake in crypto.

How accurate do you think these price predictions are? Let us know on X, Facebook, and Telegram, and subscribe while you are at it! For more insights to help you navigate the crypto world, browse our blog.

Frequently Asked Questions

Does AAVE crypto have a future?

Most forecasts solidify the claim that AAVE is a relatively good investment decision for a moderate risk-to-return ratio. Investors should seek independent professional consultation before purchasing the Aave cryptocurrency.

How high could AAVE go?

The most bullish AAVE price forecast goes as far as to put the target at. Mind that for AAVE to reach $10,000 for one token, its fully diluted market capitalization has to flip Tether USD and come close to Ethereum’s.

What is the Aave price prediction for 2025?

There are differing predictions for AAVE’s 2025 price target, with estimates spanning from $182.35 to $2,800 across multiple sources.

What is the AAVE price prediction for 2030?

AAVE’s expected price in 2030 varies depending on sources, with targets ranging from $1,591.70 to $9,582.02.

Disclaimer

This article is not a piece of financial or investment advice. No price prediction is guaranteed to provide exact information on the future price.

When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration and analysis of your own research and at your own risk.