Futures markets can become an opportunity to trade crypto even if you don’t own the asset but to a newcomer, it is just too overwhelming. Why would they even need not one, not two, but three kinds of prices? The ChangeHero team is here to explain every term: mark price, index price, and last price.

Key Takeaways

- Due to the nature of contract trading, these markets utilize additional ways to determine the value of an underlying asset. They include mark price, index price, and last price;

- The mark price is not the actual current price of an asset but rather an estimate of its fair value at any given time. In contrast, index price can be considered an actual representation of the market price, since it is calculated by taking the asset price from several sources and weighing them against their quality (volume, liquidity, etc.);

- The last price is the most immediate way to see how an asset is valued at the moment on a market. However, it is prone to volatility and not immune to price manipulation, and neither is index price. Therefore, to trigger and decide liquidations in futures markets, the mark price is used.

Brief Intro to Futures Trading

There are significant differences between spot trading, which is the most basic form, and futures, which is a form of trading contracts instead of assets. But first, let’s make sure to catch you up on the definitions just in case.

Spot trading is a direct exchange of one asset for another. It gets its name because the transaction occurs “on the spot,” meaning the buyer pays for and receives the asset immediately or shortly after.

Futures contracts trading involves the buying or selling of an asset at a predetermined price, with delivery and settlement occurring at a later date. In the case of crypto, a physical delivery seldom occurs, since the assets are digital. Instead, the futures contracts are settled at the expiration date, and the realized profit or loss is settled in cash.

Futures markets and spot markets are moving under the influence of more or less the same set of factors. However, factors unique to the futures market such as interest rates, storage costs, and market expectations create a discrepancy between these types of markets. To account for it, futures markets use special metrics to determine the current asset price and expected value and regulate liquidations.

What Does Mark Price Mean?

In futures trading, the mark price refers to the current estimated value of an asset or contract. It helps traders gauge the current value of an asset or contract and provides a benchmark for trading and investment decisions.

The mark price is determined by several factors, including the current market conditions, supply and demand dynamics, and the underlying asset’s price movements. It helps traders understand the fair value of a futures contract and allows them to make informed decisions about buying or selling.

It’s important to note that the mark price is not the actual trading price of the futures contract. The trading price may differ from the mark price due to factors like liquidity, trading volume, and market fluctuations.

While this is the definition of the mark price, how it is used is more important and helps to understand the concept better. But before getting to it, let’s define other crucial terms for futures trading.

Mark Price vs. Index Price

The mark price and index price are two different concepts in futures trading. While the mark price represents the estimated value of a futures contract, the index price refers to the actual current value of an underlying asset or index. Let’s unpack the comparison.

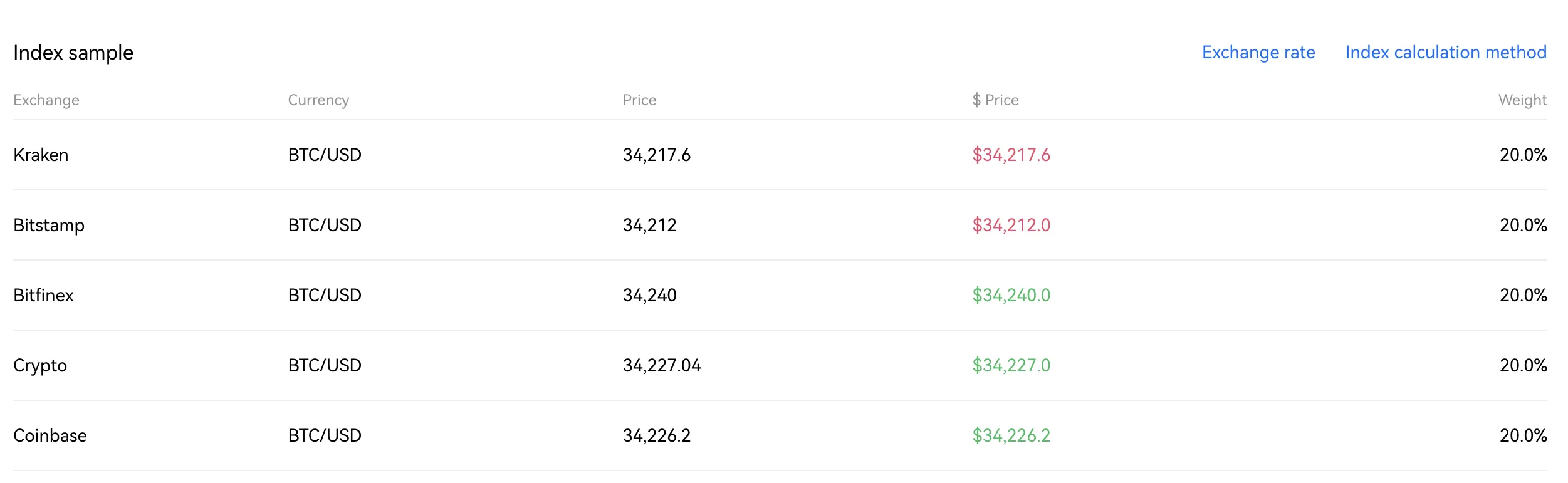

The index price is the actual market price of the asset or index that the futures contract is based on. It is usually determined by taking the weighted average of the underlying assets’ prices or components of the index.

For example, a crypto exchange A can track the price of BTC on exchanges B, C, and the spot market of exchange A. Since all three sources have different liquidity and volumes, instead of calculating a mean or average, the numbers are weighted according to the quality of the source. Each exchange has its own formula to calculate index prices, with its own sources and weights to them.

On the other hand, the mark price is the calculated reference value of the futures contract itself. It is derived from the index price but takes into account additional factors such as interest rates, dividends, carrying costs, and market volatility. Therefore, there are also individual formulas to calculate the mark price on each exchange.

The mark price in derivative markets helps prevent manipulation and ensures fair pricing. It is used to calculate the funding rate in perpetual swap contracts and is often used as a reference for margin requirements and liquidation levels.

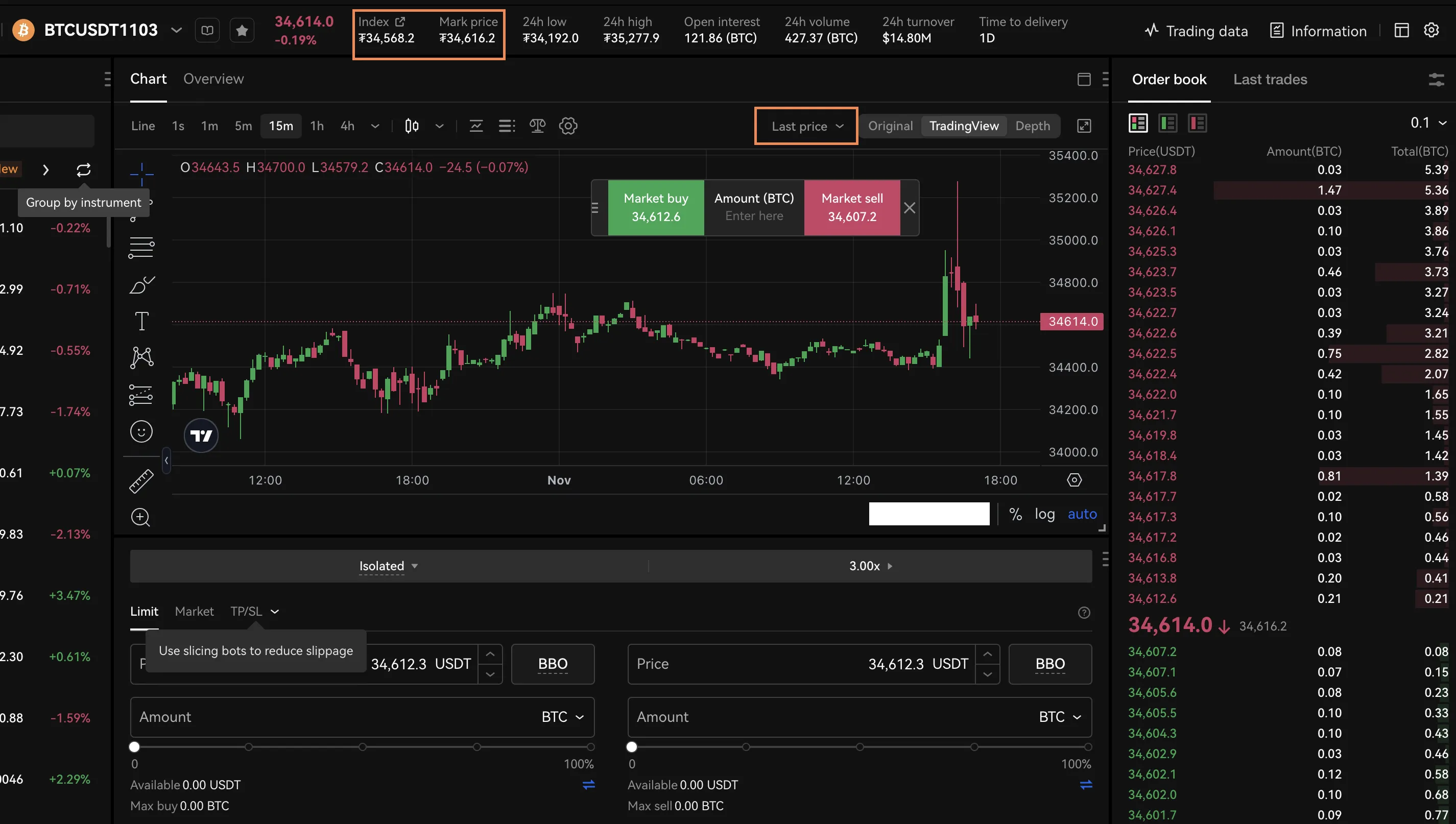

Mark Price vs. Last Price

In addition to the mark price and index price, there is also the last price. While the mark price represents the estimated value of a futures contract, the last price refers to the most recent transaction price at which a trade occurred.

As we have learned, the mark price is calculated with a formula and accounts for things like volatility, interest rates, dividends, and so on. On the other hand, the last price is simply the price at which the most recent trade took place. It represents the actual transaction price between a buyer and a seller.

The last price is widely used to track the current market price and can be seen as a snapshot of the market at a specific moment. While the last traded price reflects the actual price at which trades are executed, it may not always be a reliable indicator of the contract’s true value.

This is especially true in situations where there is low liquidity or high volatility, which can result in large spreads between the bid and ask prices. Since these situations are not rare at all, to safeguard traders against sudden margin calls and liquidations in a volatile market, the last price is not used as an indicator.

Instead, the mark price is referenced to trigger and decide liquidations. Instead of using the index price directly, the mark price is bound by the index price, among other things like moving averages. If the trigger price for liquidations were decided based on an index price, it would still be too vulnerable to price manipulation or volatility spikes.

Conclusion

Futures trading can take a while to wrap your head around but every quirk and feature there has a purpose. You can use the mark price to gauge the fair value of a contract, the index price to see how it is doing on the market, and the last price to stage your entry.

And you can always get your hands on 200+ crypto assets for a fair market value on ChangeHero. No need to register an account, go through KYC, or navigate a complicated interface.

Read more about crypto trading and the variety of digital assets in our blog — our team always has insights to share. Keep up to date by following ChangeHero on Telegram, X (Twitter), Reddit, and Facebook.

Frequently Asked Questions

What does mark price mean in crypto?

In the context of crypto, the mark price refers to the estimated value of a cryptocurrency or digital asset. It is typically calculated by taking into account factors such as the current market price, trading volume, and other relevant market data. The mark price serves as a reference point for various trading activities, including margin requirements and liquidation levels in crypto derivatives trading.

What is the mark price and last price?

The mark price is an estimated value of a cryptocurrency or digital asset that takes into account various market factors. It is used in derivatives trading to determine margin requirements and liquidation levels. In contrast, the last price refers to the trade price, the most recent transaction price at which a cryptocurrency or digital asset was bought or sold on an exchange.

How is the mark price calculated?

The mark price is typically calculated using a combination of factors such as the spot or index price of the underlying asset, moving averages, funding and interest rates, volatility, and other market conditions. It is designed to provide a fair and accurate representation of the market value of the asset to ensure proper risk management in derivatives trading.