Bitcoin Dominance: Complete Guide to Understanding Crypto Market Share

Contents

- 1. What is Bitcoin Dominance?

- 2. Historical Context and Evolution of Bitcoin Dominance

- 3. Why Bitcoin Dominance Matters for Crypto Investors

- 4. How to Read and Interpret Bitcoin Dominance Charts

- 5. Bitcoin Dominance and Market Cycles

- 6. Trading Strategies Using Bitcoin Dominance

- 7. Bitcoin Dominance vs Other Crypto Metrics

- 8. Advanced Bitcoin Dominance Analysis

- 9. Institutional Perspective on Bitcoin Dominance

- 10. Limitations and Concerns with Bitcoin Dominance

- 11. Future of Bitcoin Dominance

- 12. Where to Track Bitcoin Dominance

- 13. Conclusion

Bitcoin dominance is the percentage of the total cryptocurrency market capitalization that Bitcoin represents. In simple terms, it shows Bitcoin's share of the entire crypto market compared to all other cryptocurrencies combined. This metric gives you a quick snapshot of Bitcoin's market position relative to thousands of altcoins (alternative cryptocurrencies like Ethereum, Solana, and others)—and vice versa.

The calculation behind it is simple, but the implications for your investing and trading decisions are surprisingly deep. Let's unpack it step by step.

What is Bitcoin Dominance?

By definition, Bitcoin dominance (BTC.D) is the percentage of total cryptocurrency market capitalization that Bitcoin represents. In simple terms, it shows how much of the entire crypto market's value belongs to Bitcoin compared to all other cryptocurrencies combined.

Think of it like Bitcoin's "market share" in the crypto world. If Bitcoin dominance sits at 50%, that means Bitcoin accounts for half of all the value in the cryptocurrency market, while the remaining 50% is distributed across thousands of altcoins—Ethereum, Solana, stablecoins, and everything else. These days, the metric is rarely off the 50% mark by more than 10%, although it does occasionally happen.

BTC dominance as a metric matters because it acts as a quick snapshot of where investor confidence sits. High dominance suggests traders are focusing on Bitcoin as the safest or most promising asset. Low dominance, in turn, often signals money is flowing into alternative projects, typically during periods when investors feel more adventurous.

How Bitcoin Dominance is Calculated

The calculation itself is straightforward. Bitcoin dominance is calculated by dividing Bitcoin's market capitalization by the total market capitalization of all cryptocurrencies.

The exact formula is: Bitcoin Dominance (%) = (Bitcoin Market Cap ÷ Total Crypto Market Cap) × 100

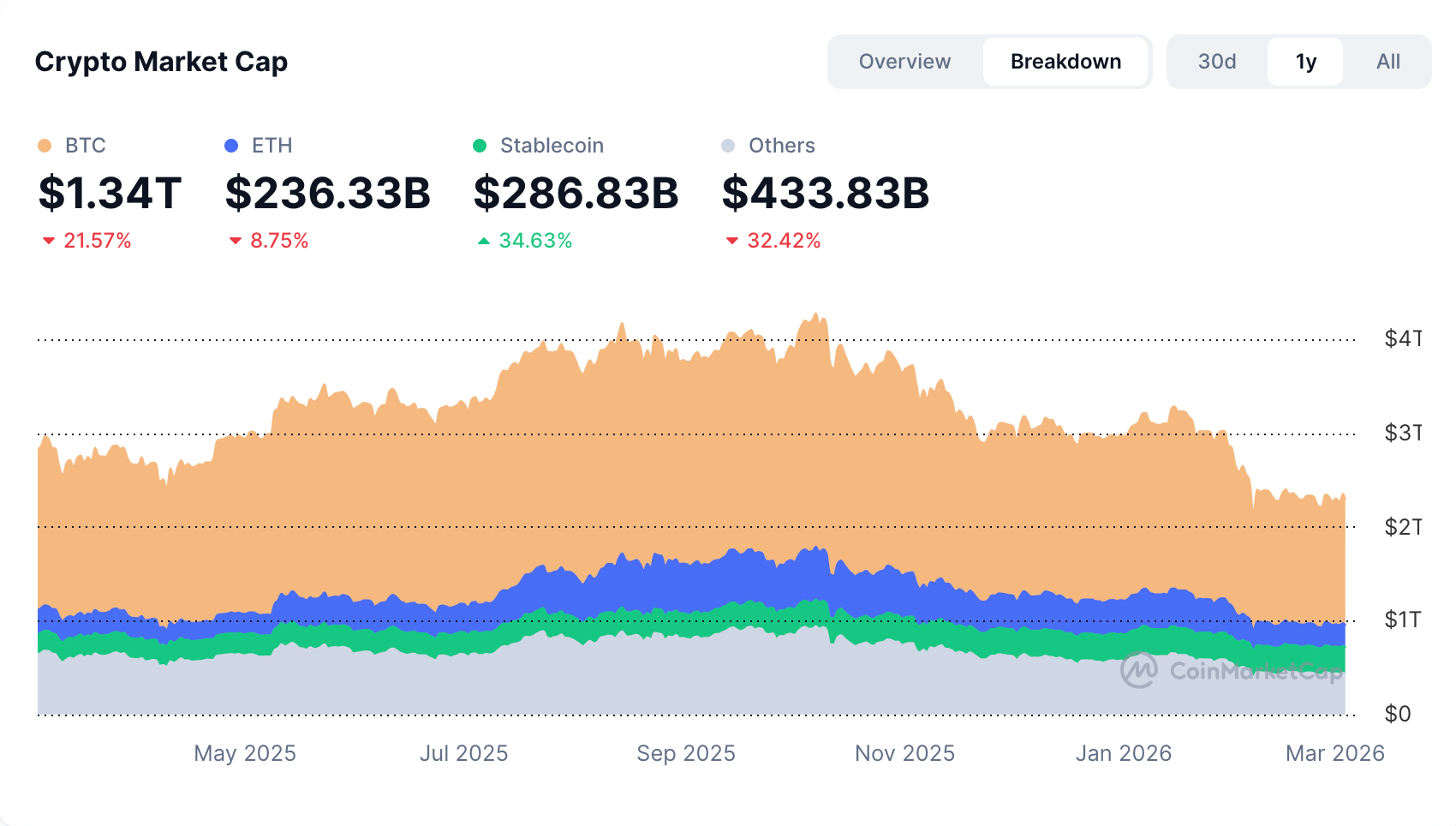

What is it at the time of writing, as an example? Bitcoin's market cap is currently $1.34 trillion and the total crypto market cap is $2.39 trillion, so Bitcoin dominance is 57.45%.

Source: CoinMarketCap

Market cap for Bitcoin is calculated by multiplying the current BTC price by the circulating supply—the number of bitcoins that have already been mined and are actively available. The same calculation applies to every other cryptocurrency. Add them all together, and you get the total crypto market cap.

Naturally, dominance fluctuates constantly as prices change. A sharp drop in altcoin prices, for instance, can push Bitcoin dominance higher even if Bitcoin's own price stays flat. This makes it an interesting metric to watch: sometimes Bitcoin's dominance rises not because Bitcoin is doing well, but because everything else is doing worse.

Key Components of Bitcoin Dominance Metrics

Several factors determine how dominance is measured and what's included in the calculation. Understanding these components helps you interpret the numbers more accurately.

Market cap components: The calculation uses Bitcoin's circulating supply multiplied by its current price. For total market cap, data providers aggregate price and supply data across thousands of cryptocurrencies.

Exclusions: Some platforms exclude stablecoins (like USDT or USDC) from dominance calculations. Why? Because stablecoins are pegged to fiat and don't reflect speculative crypto investment behavior in the same way. Other platforms may also for various reasons filter out dead projects, tokens with negligible volume, wrapped and bridged assets, etc.

You’d soon learn that this exclusion can shift dominance numbers by several percentage points, so it's worth checking which methodology your data source uses.

Data sources: Platforms like CoinMarketCap, CoinGecko, and TradingView track dominance using live market data from exchanges worldwide. The quality of this data matters—inconsistent reporting, fake volume, or missing liquidity can skew the numbers slightly.

The important detail is worth keeping in mind: dominance isn't a perfect metric. Different platforms may show slightly different percentages based on which coins they include and how they source price data. It’s the overall trend that matters the most for decision-making. A one or two percentage point difference between platforms won't change the bigger picture of what the market is doing.

Historical Context and Evolution of Bitcoin Dominance

Bitcoin Dominance from 2009 to Present

Bitcoin dominance tells the story of how the cryptocurrency market evolved from a single-coin ecosystem to a sprawling digital economy. When Bitcoin launched in 2009, it held 100% dominance simply because it was the only cryptocurrency in existence. This near-total control continued through Bitcoin's early years, with dominance staying above 90% until 2014.

But here's where things get interesting. Bitcoin's dominance has structurally decreased from over 95% before 2017 to a range of roughly 38%-72% since, with major drops during the 2017 ICO boom and 2021 DeFi boom. What does this mean? As more cryptocurrencies emerged with unique use cases—from smart contract platforms to decentralized finance protocols—capital naturally flowed into these alternatives. The market wasn't rejecting Bitcoin but expanding beyond it.

As of 2026, Bitcoin dominance typically hovers between 40% and 60%, depending on market conditions. During uncertain times, investors tend to retreat to Bitcoin as the most established asset, pushing dominance higher. When optimism returns and risk appetite increases, money flows into altcoins, and dominance drops.

Major Events That Shaped Dominance Patterns

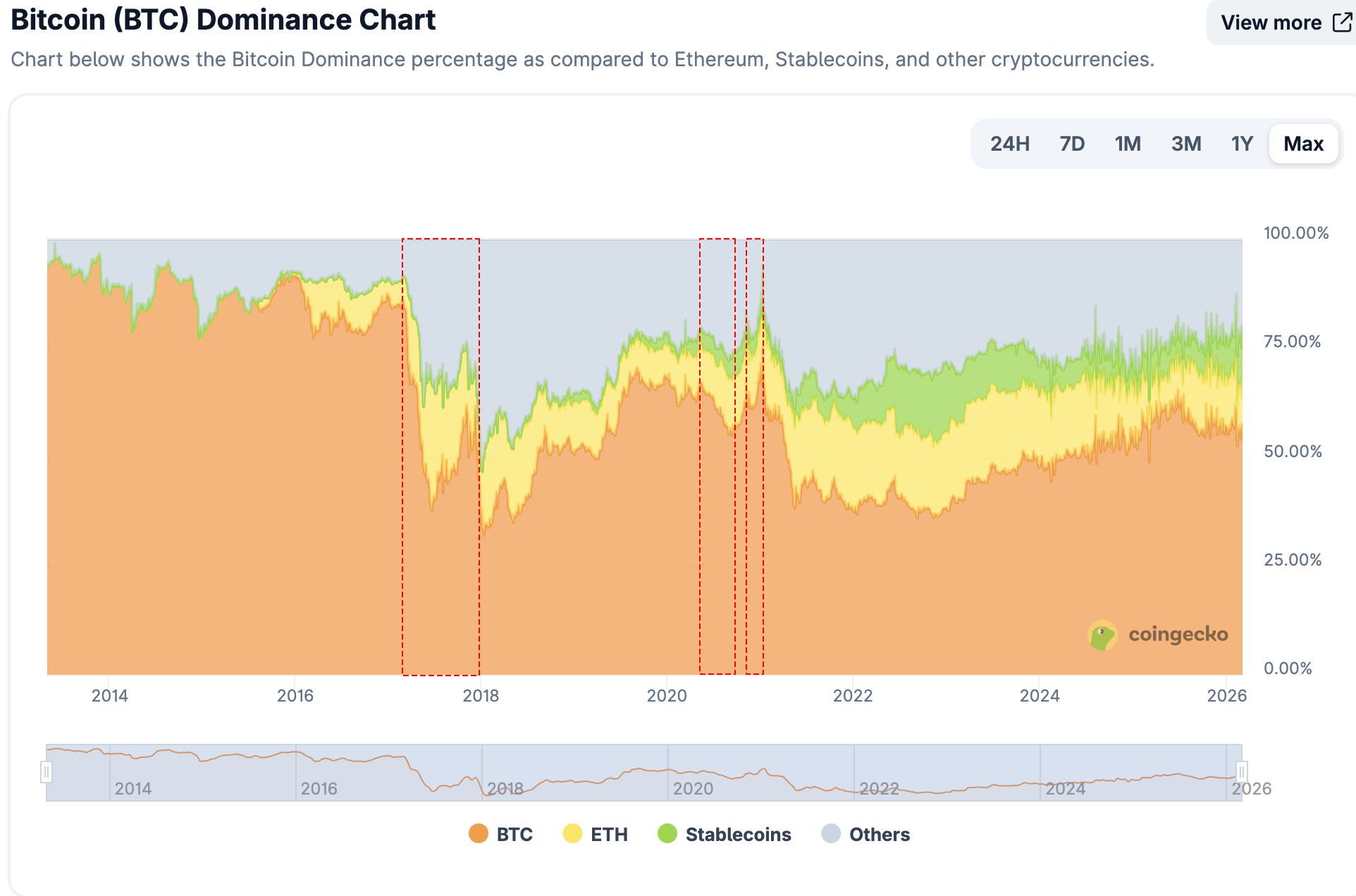

Bitcoin Dominance Chart (all time) with areas of interest highlighted. Source: CoinGecko

Three major waves dramatically reshaped Bitcoin's market share. Understanding them helps you anticipate future patterns.

The 2017 ICO Boom was the first real challenge to Bitcoin's supremacy. Ethereum's smart contract platform enabled anyone to launch a token, and thousands of projects raised billions through initial coin offerings (ICOs). Bitcoin dominance plummeted from around 85% in early 2017 to below 40% by January 2018. Capital flooded into speculative altcoins, creating the first major "altcoin season."

The 2020–2021 DeFi Summer introduced a new narrative: decentralized finance. Platforms like Uniswap, Aave, and Compound offered yield farming and liquidity mining, attracting billions in capital. Bitcoin dominance dropped from roughly 70% in early 2020 to approximately 55% by mid-2021 as DeFi tokens surged. Investors chased returns in these new protocols, temporarily shifting market weight away from Bitcoin.

Institutional adoption in 2020–2021 had the opposite effect. When companies like Tesla and MicroStrategy added Bitcoin to their balance sheets, and investment firms launched Bitcoin-focused products, dominance actually increased back to around 70%. Why? Institutions primarily trusted Bitcoin, not speculative altcoins.

From there on, as the altcoin space and DeFi matured, the share of Bitcoin in the big picture of the crypto market has decreased, and floats around the 40–60% range.

These patterns reveal a fundamental truth: Bitcoin dominance rises when the market seeks safety and credibility. It falls when investors chase innovation and higher returns.

From history, you can already see that dominance is tightly connected to investor behavior. Now let's dig into why that matters for your portfolio.

Why Bitcoin Dominance Matters for Crypto Investors

As we’ve explained, Bitcoin dominance isn't just a number on a chart — it's a powerful lens into what's actually happening in the crypto market right now. Think of it as the market's emotional compass, showing where investor confidence is flowing and what that means for your portfolio decisions.

Market Sentiment and Psychology Indicator

When Bitcoin dominance rises, it tells you something specific: investors are playing it safe. They're moving capital back into the most established cryptocurrency, which typically happens when uncertainty creeps into the market or when altcoins start looking risky. It's like watching money flow back to gold during economic turbulence.

On the flip side, falling dominance signals a growing risk appetite. Investors feel confident enough to explore beyond Bitcoin, chasing higher returns in altcoins. This shift reveals optimism about the broader crypto ecosystem—people believe newer projects can deliver meaningful value.

Impact on Portfolio Allocation Strategies

One smart crypto investing strategy uses dominance as a portfolio balancing tool. When dominance climbs above historical averages (say, above 65%), it often signals that Bitcoin is outperforming altcoins, meaning your portfolio might be overweight in underperforming assets. Conversely, when dominance drops significantly, altcoins typically gain momentum. That's when rebalancing toward them might make sense.

Another smart move is matching your allocation to the current market phase. High dominance periods? Favor Bitcoin-heavy portfolios. Low dominance periods? Look for opportunities to diversify into quality altcoins. The timing does not even have to be perfect—it's more about aligning your risk exposure with where capital is actually flowing.

Relationship with Overall Market Health

Historically, Bitcoin dominance also acts as a maturity indicator for the entire crypto market. A steadily declining dominance over years (like the structural shift from 95% to the current range) shows ecosystem growth. More legitimate projects other than BTC are attracting capital, and the market is evolving beyond a one-asset show.

On the other hand, extreme swings can signal instability. Rapid dominance spikes during market crashes indicate panic selling in altcoins, while sudden drops might reflect unsustainable speculation. What does a healthy market look like? Gradual, sustainable shifts, not violent swings driven by fear or greed.

In simple terms: dominance helps you separate sustainable growth from temporary hype cycles and make smarter decisions about when to hold Bitcoin and when to explore opportunities elsewhere.

How to Read and Interpret Bitcoin Dominance Charts

Understanding is one thing but reading a Bitcoin dominance chart is simpler than you might think. The chart displays Bitcoin's market share as a percentage over time—usually shown as an aggregated line graph with time on the horizontal axis and dominance percentage on the vertical axis. Most platforms like CoinGecko or TradingView let you toggle between daily, weekly, monthly, and even yearly timeframes. This matters because short-term spikes can look dramatic on a 24-hour view but barely register on a yearly chart.

Key Chart Elements and Timeframes

When you first open a dominance chart, focus on three elements: the current percentage (typically displayed prominently at the top or elsewhere), the historical trend line, and the timeframe selector.

The yearly view will help you understand long-term patterns and give you context. Monthly or weekly views are handy to spot more recent momentum shifts. Together, they give you the full picture: where Bitcoin stands now, where it's been, and how quickly things are changing.

Rising Dominance: Market Implications

When Bitcoin dominance climbs, it typically signals that investors are consolidating back into Bitcoin—either out of fear during market uncertainty or because Bitcoin is outperforming altcoins. Think of it as a "flight to safety" within crypto.

Rising dominance often coincides with bearish altcoin price action, as capital flows out of smaller cryptocurrencies and into Bitcoin. This pattern suggests risk-off sentiment: traders want the relative stability of the largest, most liquid crypto asset rather than speculative smaller tokens.

Falling Dominance: Altcoin Season Indicators

On the other hand, falling dominance is often the clearest sign of an "altcoin season"—periods when alternative cryptocurrencies outperform Bitcoin. As dominance drops, it means altcoins collectively are gaining market share faster than Bitcoin.

The best historic examples of this would be the 2020 DeFi summer and 2017 ICO boom. If you're watching dominance decline steadily over weeks, it suggests growing risk appetite and speculative momentum across the broader crypto market. Translation? Investors are feeling adventurous and exploring opportunities beyond Bitcoin.

Critical Dominance Levels

While there's no magic number, certain levels tend to trigger behavioral shifts. Around 70% dominance has historically marked peak Bitcoin strength, while levels near 40% often signaled peak altcoin euphoria. When dominance hovers around 50%, the market is relatively balanced—neither Bitcoin nor altcoins have clear momentum.

As it stands, strategies are worth a reevaluating look once BTC dominance crosses either a 65% or 40% thresholds. Experienced traders watch these levels as rough guidelines, not hard rules. Why? Because market context always matters more than a single percentage. Dominance becomes even more insightful when you map it onto full bull and bear cycles.

Bitcoin Dominance and Market Cycles

Dominance Patterns in Bull Markets

Bitcoin dominance tells a fascinating story during bull markets—but not always the one you'd expect. When crypto rallies begin, Bitcoin typically leads the charge. Dominance rises first as investors seek the most established, liquid asset before branching into riskier territory. Think of it as confidence building.

Here's where it gets interesting: as the bull market matures, dominance usually drops. Once Bitcoin establishes strong gains, traders start rotating profits into altcoins, hunting for higher percentage returns. In other words, what is the key pattern? Early bull market = rising dominance; late bull market = falling dominance as speculation spreads across the broader crypto market.

Dominance Behavior During Bear Markets

Bear markets flip the script entirely. When crypto prices fall, BTC dominance typically rises—sometimes dramatically. Why? You can probably already tell: investors retreat to safety.

During downturns, newer projects and altcoins often crash harder than Bitcoin. Many lose 80–90% of their value while Bitcoin might drop 50–70%. This mathematical reality pushes its dominance higher even though Bitcoin itself is declining in price. It's a "least worst option" effect rather than actual strength.

You'll also see dominance rise because speculative capital exits the market entirely. The traders chasing 10x returns on obscure tokens simply leave, while long-term holders keep their Bitcoin positions. The result? Bitcoin's market share grows relative to the shrinking altcoin space.

One crucial detail: high dominance during bear markets doesn't mean Bitcoin is safe—it means everything else is performing even worse.

Cyclical Nature and Recurring Patterns

Bitcoin dominance follows surprisingly predictable long-term cycles tied to market psychology. The pattern looks roughly like this:

Cycle Stage 1: Bitcoin leads recovery (dominance rises gradually over the long time frames)

Cycle Stage 2: Market confidence grows, altcoins gain attention (dominance is more stable)

Cycle Stage 3: Peak speculation, money floods into altcoins (dominance falls sharply)

Cycle Stage 4: Market correction, flight to quality (dominance rises again)

These cycles typically span 3–4 years, aligning with Bitcoin's halving events (a scheduled reduction in mining rewards) and broader adoption waves. Understanding this cyclical behavior helps you anticipate market phases. And armed with that cycle knowledge, you can start using dominance not just to observe the market, but to shape your strategy.

Trading Strategies Using Bitcoin Dominance

We have already briefly mentioned how BTC dominance can inform portfolio rebalancing and allocation. But the beauty of this simple metric is that it can be applied to even more investment decisions. See for yourself.

Timing Bitcoin Investments with Dominance

Since it serves as a general indicator of a market cycle or sentiment, BTC dominance can be useful to make entries or exits to the market. Rising dominance typically signals a "flight to safety" moment in crypto. When Bitcoin's market share climbs above 60–65%, investors are often pulling capital out of altcoins and back into Bitcoin due to uncertainty or risk aversion. This consolidation phase can actually present strong Bitcoin buying opportunities—especially if you're looking for stability during turbulent market conditions.

On the flip side, when dominance drops toward the lower end of its historical range (around 40%), it suggests Bitcoin might be losing momentum relative to the broader market. This doesn't necessarily mean Bitcoin is a bad investment even at the moment but it does indicate that capital is flowing elsewhere, potentially into altcoins showing stronger short-term performance.

Altcoin Investment Timing Strategies

If you’re not trading Bitcoin, its falling dominance is often the green light for altcoin season. When it begins declining steadily—particularly during bull markets—it signals that investors are gaining confidence and exploring higher-risk, higher-reward opportunities beyond Bitcoin.

The key levels are similarly around 50% or 45% but context matters and separates bullish conditions from bearish ones. In bull markets, these thresholds have historically marked periods when altcoins outperform Bitcoin significantly. However, don't chase every drop—confirm the trend with other indicators like total crypto market cap growth and increased trading volume in altcoins.

Risk Management and Position Sizing

Bitcoin dominance helps you balance your portfolio's risk profile; how does that exactly work? During periods of rising dominance, consider increasing your Bitcoin allocation—it acts as the "defensive play" in crypto. When dominance is falling and altcoin season looks imminent, you might allocate more capital to selected altcoins while maintaining a Bitcoin core position.

An example framework: 60–70% Bitcoin allocation when dominance is rising, 40–50% Bitcoin when dominance falls and altcoins show strength. This approach aims to help you capture altcoin gains while maintaining stability through Bitcoin exposure.

Common Trading Pitfalls to Avoid

First mistake: treating dominance as a standalone signal. Dominance works best when combined with other metrics like total market cap, trading volume, and on-chain activity. Don't buy altcoins just because dominance dropped 2%—look for sustained trends over weeks, not days.

Second mistake: ignoring market context. Dominance behaves differently in bull versus bear markets. A dominance increase during a bear market might signal capitulation, not opportunity. Always consider the broader market environment before acting on dominance signals alone.

Speaking of context, let’s see exactly how other metrics complement it and what else you should keep in the picture.

Bitcoin Dominance vs Other Crypto Metrics

Bitcoin's market share is just one piece of a much bigger puzzle. To get a complete picture of what's happening in crypto, you need to understand how dominance interacts with other key metrics, from total market cap to traditional financial indicators.

Dominance vs Total Crypto Market Cap

Bitcoin dominance and total crypto market cap measure different things, though people often confuse them. Dominance shows Bitcoin's percentage of the overall crypto pie, while total market cap shows the size of that entire pie.

Here's why this matters: Total market cap can grow while Bitcoin dominance falls. During the 2021 DeFi boom, total crypto market cap surged, but Bitcoin's dominance dropped. Money was flooding into crypto—just not into Bitcoin specifically.

On the flip side, rising dominance doesn't always mean Bitcoin's price is climbing. If altcoins crash harder than Bitcoin during a bear market, dominance increases even as Bitcoin loses value. Not exactly a victory lap.

Think of it this way: Total market cap tells you about overall investor interest in crypto. Dominance tells you where that interest is focused. When both rise together, Bitcoin is leading a healthy market expansion. When total cap rises but dominance falls? Altcoins are having their moment.

Dominance vs DeFi TVL Correlation

Curiously, Bitcoin dominance often moves inversely to DeFi Total Value Locked (TVL). It’s more clear once you know why: when investors pile into DeFi protocols, they typically use Ethereum and other smart contract platforms, not Bitcoin.

This makes sense because DeFi requires programmable blockchains, and Bitcoin isn't designed for complex financial applications. Ethereum and other smart contract platforms, which all belong to the other slice of the pie, gain ground during DeFi booms and skew the dominance metrics.

For practical purposes, consider both metrics together. When DeFi TVL surges alongside falling dominance, it signals capital rotation into higher-risk, higher-reward DeFi plays.

Dominance vs Network Activity Metrics

On-chain metrics like transaction volume, active addresses, and hash rate provide crucial context for dominance movements. High Bitcoin dominance paired with strong network activity (lots of transactions, growing active addresses) suggests genuine confidence. High dominance with declining network activity? That might indicate altcoins are simply bleeding worse, not that Bitcoin is thriving.

The relationship between dominance and Bitcoin's hash rate (total mining power securing the network) is particularly telling. Rising hash rate shows miners are investing in long-term security, which typically correlates with sustained dominance. When dominance climbs but hash rate stagnates, be cautious—the strength might be temporary.

In simple terms, network activity is one of the key indicators that help you separate real Bitcoin strength from altcoin weakness. Both can push dominance higher, but only one signals lasting momentum.

Dominance vs Traditional Market Indicators

Incidentally, Bitcoin dominance doesn't exist in isolation from traditional finance, either. During periods of macroeconomic uncertainty, be they rising interest rates or stock market volatility, investors often rotate from altcoins back to Bitcoin as the "safest" crypto asset. Consequently, this pushes dominance higher.

Bitcoin's correlation with gold has historically hovered around a weak to moderate level, but during risk-off events, Bitcoin dominance tends to rise as crypto investors treat it like digital gold. Similarly, when stock markets rally and risk appetite increases, money flows into higher-beta altcoins, moving dominance to the other direction.

S&P 500 price chart with BTC.D chart. Areas of interest are highlighted. Source: TradingView

The S&P 500's performance often moves inversely to Bitcoin dominance during crypto bull runs. When stocks soar and investors feel confident, they chase altcoin gains. When stocks tumble and fear rises, Bitcoin dominance climbs as capital seeks relative safety.

Bottom line: Bitcoin dominance is most useful when analyzed alongside these complementary metrics. No single indicator tells the whole story, but together, they give you a much clearer picture of market conditions.

Advanced Bitcoin Dominance Analysis

If one metric is not enough for informed analysis, and a couple may suffice somewhat, isn’t the logical conclusion that the more you factor in, the more comprehensive your findings are? As long as you don’t overdo it, check out how powerful this simple metric can be.

Statistical Analysis and Backtesting Methods

In simple terms, statistical analysis of Bitcoin dominance means testing historical patterns to see if they actually predict future market behavior. Professional traders often backtest dominance signals, meaning they run historical data through trading rules to see how well those rules would have performed.

Here's an example. A trader might test this rule: "Buy altcoins when Bitcoin dominance drops below 45%." By backtesting this across years of data, they can calculate the win rate, average return, and drawdown risk. Tools like Python libraries (pandas, matplotlib) or platforms like TradingView allow you to run these tests on historical dominance data from sources such as CoinGecko.

The key here is correlation analysis. You're looking for statistically significant relationships between dominance levels and market outcomes. Does a 5% drop in dominance actually correlate with altcoin gains? How often? That's what quantitative analysis confirms or disproves.

Dominance as Leading vs Lagging Indicator

The previous tip is based on this: Bitcoin dominance can act as both a leading indicator (predicting future moves) and a lagging indicator (confirming past moves), depending on the context.

When dominance starts rising before a market downturn, it's leading—investors are rotating into Bitcoin for safety ahead of trouble. When dominance rises during a crash, it's lagging—it's confirming what's already happening.

The predictive value depends on volume and momentum. A slow, steady dominance increase with low volatility often signals early caution. A sudden spike with high volume usually confirms an ongoing flight to safety.

Multi-Timeframe Dominance Analysis

Analyzing dominance across different time horizons, something already mentioned in the guide but only briefly, helps you separate noise from real trends. A daily chart might show volatility that looks significant but is actually just short-term fluctuation. A weekly or monthly chart reveals the bigger structural trend.

Now is the time to break it down in a bit more detail. Here's how timeframes work:

- Daily charts: Capture short-term sentiment shifts. Useful for active traders.

- Weekly charts: Show medium-term trends and market cycle phases.

- Monthly/yearly charts: Reveal long-term structural changes.

Professional analysis involves comparing these timeframes. If dominance is rising on the daily but falling on the monthly, the short-term move might just be noise within a larger downtrend.

Institutional Perspective on Bitcoin Dominance

As a metric, BTC.D is so helpful that beginner traders and professionals alike can use it to their advantage. Professional traders and hedge funds treat Bitcoin dominance as a critical macro indicator that shapes their entire crypto strategy. They monitor dominance fluctuations to identify market regime changes, essentially determining whether to overweight Bitcoin or rotate into altcoins.

The institutional approach breaks down into three core strategies. First, many funds use dominance as a risk-on/risk-off gauge. Second, quantitative hedge funds incorporate dominance into multi-factor models alongside traditional market indicators. They backtest dominance correlations with volatility, trading volume, and on-chain metrics to generate algorithmic trading signals.

Third, institutional portfolios use dominance shifts for dynamic rebalancing. Rather than fixed allocations, these strategies adjust Bitcoin-to-altcoin ratios based on dominance trends.

Regulatory Implications of Dominance Shifts

Bitcoin dominance carries significant weight in regulatory discussions, though this connection often flies under the radar for everyday investors. For one, regulators view high current Bitcoin dominance as a sign of market concentration and relative stability. Since it is the most established cryptocurrency with the clearest regulatory treatment in many jurisdictions, increased dominance makes the overall crypto market appear less speculative and easier to oversee. As a result, periods of high dominance often correspond with more favorable regulatory sentiment toward crypto as a whole.

Market concentration also affects how authorities classify cryptocurrencies. Bitcoin's dominance supports arguments that it should receive commodity-like treatment, while a fragmented market with low dominance strengthens the case for securities-style regulation across the broader crypto ecosystem.

Impact of Institutional Adoption on Dominance

Institutional adoption has fundamentally altered Bitcoin's long-term dominance trajectory, creating a structural floor that didn't exist before 2020.

Corporate treasury adoption and institutional investment vehicles have locked significant capital into Bitcoin specifically. These players rarely rotate between cryptocurrencies the way retail traders do. Instead, they maintain strategic Bitcoin allocations regardless of short-term altcoin opportunities.

The data supports this shift. Bitcoin's dominance has structurally decreased but despite massive altcoin innovation in DeFi, NFTs, and layer-1 blockchains, dominance has stabilized rather than continuing its downward trend.

Looking forward, continued institutional adoption through spot ETFs and regulated custody solutions will likely establish a higher dominance baseline even in altcoin seasons. This creates a new normal where Bitcoin maintains stronger relative market share even during periods of intense innovation in the broader crypto ecosystem. In simple terms, institutional money has changed the game permanently.

Limitations and Concerns with Bitcoin Dominance

Dominance is powerful but we cannot fail to mention it is far from perfect. Let's talk about where it breaks down. In practice, the metric comes with serious limitations that can mislead even experienced traders.

Data Quality and Methodology Issues

The biggest challenge and the elephant in the room is that different platforms calculate dominance differently. One site might show 52% dominance while another displays 54% for the same moment. In other words, each platform decides which cryptocurrencies to include in "total market cap": some exclude stablecoins entirely, others remove wrapped tokens or certain blockchain-specific assets, and sometimes volume and value filters are applied on top of everything else. A few platforms still count defunct coins that haven't traded in years, artificially inflating the denominator and deflating Bitcoin's dominance.

Data sources matter too. Platforms aggregate price and volume data from multiple exchanges, but not all exchanges report accurately. Smaller exchanges, if counted, might inflate volumes or fail to update market cap calculations promptly. These distortions ripple through dominance metrics, creating readings that don't fully reflect reality.

Market Manipulation and Artificial Inflation

Wash trading, in which traders artificially inflate volume by trading with themselves, directly impacts dominance accuracy. When exchanges report fake volume for altcoins, their market caps appear larger than reality. Result? Bitcoin's dominance looks artificially lower. And it’s not like markets in the first crypto are immune to this either.

Projects with low liquidity but high token counts pose another problem. A cryptocurrency with 10 billion tokens trading at $0.10 shows a $1 billion market cap—even if only a tiny amount actually trades daily. These inflated valuations distort the total market cap calculation, making dominance readings less reliable during periods when low-quality projects proliferate.

Common Misconceptions About Dominance

It’s easy to assume low BTC dominance always signals "altcoin season." Not quite.

During bear markets, Bitcoin dominance can stay low simply because both Bitcoin and altcoins are declining—the ratio remains stable even as absolute values crash. The percentage tells you nothing about whether money is flowing into crypto or rushing for the exits.

Another myth: "Bitcoin dominance above 70% means altcoins are dead." Historical data shows altcoins often consolidate during high-dominance periods, preparing for their next surge. High dominance reflects capital rotating into Bitcoin for safety, not necessarily permanent altcoin failure.

By the way, dominance also doesn't measure network activity, developer engagement, or real-world adoption. A coin could have low market cap but high transaction volume and genuine utility—factors dominance cannot highlight at all.

When Dominance Signals Fail

Dominance is a metric that is by no means reliable during extreme market volatility. Flash crashes, exchange hacks, or regulatory announcements can cause temporary spikes or drops that don't reflect underlying trends. A sudden 5% dominance jump might just mean one major altcoin got delisted, not a genuine shift in investor sentiment overall.

Stablecoin growth, where accounted for, creates another blind spot. As USDT and USDC market caps expand, total crypto market cap rises—but this doesn't represent new risk capital entering altcoins. It's just dollars sitting on exchanges, waiting. Dominance calculations that include stablecoins become less useful for measuring actual Bitcoin-vs-altcoin capital allocation.

Finally, dominance fails during low-liquidity periods. Weekend trading or holiday sessions often show erratic dominance movements that reverse within hours. These aren't actionable signals—just statistical noise from thin order books.

The takeaway? Use dominance as one tool among many, never as a standalone trading signal.

Future of Bitcoin Dominance

Central Bank Digital Currencies are reshaping how we think about government-backed money—and they could have a meaningful impact on Bitcoin's market share one day.

Impact of Central Bank Digital Currencies (CBDCs)

CBDCs will likely attract users who want digital currency convenience without the volatility or technical learning curve of crypto. Countries like China with its digital yuan and the European Central Bank, testing a digital euro, signal a clear trend toward government-issued digital money.

But here's the thing: CBDCs won't directly compete with Bitcoin's core value proposition. Bitcoin exists as a decentralized, censorship-resistant store of value. CBDCs, on the other hand, are centralized and government-controlled, as the name does well to imply. They're essentially digital versions of traditional fiat currency, not alternatives to Bitcoin's permissionless nature.

That said, widespread CBDC adoption could indirectly affect Bitcoin dominance by legitimizing digital currency concepts and drawing new users into the broader digital asset ecosystem. Some may start with CBDCs, then explore Bitcoin for different reasons—privacy, inflation hedging, or portfolio diversification. As a result, Bitcoin dominance might temporarily dip as CBDCs pull attention or capital from speculative altcoins. But the long-term effects remain less certain.

Emerging Technologies and Blockchain Innovation

New blockchain protocols and cryptocurrencies continue emerging with specialized use cases—smart contract platforms, privacy coins, scalability solutions, and sector-specific tokens. Each innovation wave creates competition for market attention. Ethereum's upgrades, layer-2 scaling solutions, and next-generation chains like Solana or Cosmos could gradually chip away at Bitcoin's market share if they capture significant developer activity and institutional attention.

Major innovations in the crypto space like DeFi and NFTs historically pulled capital into altcoins, dropping Bitcoin dominance during those innovation waves. We saw this pattern repeat multiple times, and each new breakthrough temporarily shifts focus away from Bitcoin.

But Bitcoin maintains distinct advantages: unmatched network security, institutional recognition, and its singular focus on being “digital gold.” Emerging technologies will likely create short-term dominance fluctuations. However, Bitcoin's established position as the anchor asset makes dramatic long-term declines less probable without a fundamental protocol flaw.

Long-term Scenario Analysis

Industry experts generally project Bitcoin dominance stabilizing in the 40%-60% range over the next decade, with cyclical swings during different market phases. Bull markets typically see dominance drop as capital rotates into higher-risk altcoins. Bear markets often push dominance higher as investors flee to Bitcoin's relative safety.

Institutional adoption trends suggest Bitcoin's position as "digital gold" will likely solidify, potentially keeping dominance above historical lows even during altcoin booms. The maturation of crypto markets and clearer regulatory frameworks could reduce extreme volatility in dominance patterns. Think of it as the market finding its equilibrium: Bitcoin as the foundation, altcoins as specialized tools for specific use cases.

Factors That Could Dramatically Change Dominance

Black swan events could dramatically shift Bitcoin's market share overnight. These include quantum computing breakthroughs that threaten cryptographic security, major protocol vulnerabilities discovered in Bitcoin's code, or comprehensive government bans in key markets like the United States or European Union. Any of these scenarios would fundamentally alter the current cryptocurrency landscape, leave alone the dominance ratio.

On the other hand, there are positive catalysts that could boost dominance significantly. Think sovereign nation adoption as legal tender, major central banks adding Bitcoin to reserves, or traditional finance infrastructure fully integrating Bitcoin trading and custody. These developments would cement Bitcoin's position as the primary cryptocurrency.

Regulatory paradigm shifts matter too. If governments classify Bitcoin favorably while restricting altcoins, dominance could spike. Conversely, clear altcoin regulatory frameworks might encourage diversification and reduce Bitcoin's share.

The important detail is, Bitcoin dominance remains one indicator among many. While it reflects market psychology and capital flows, it's not gospel—it's a constantly shifting and sometimes faulty metric shaped by innovation, regulation, adoption, and unpredictable market forces. Use it as context for understanding broader market dynamics, not as a crystal ball.

Where to Track Bitcoin Dominance

The best part is you can track Bitcoin dominance without expensive subscriptions or complicated setups. Whether you check it once a week or monitor it in real-time for trading decisions, several platforms make the data both accessible and actionable.

Real-Time Dominance Data Platforms

CoinMarketCap and CoinGecko are the go-to platforms for free, real-time Bitcoin dominance data. Both aggregate market cap data across thousands of cryptocurrencies and display Bitcoin's percentage share front and center on their global charts pages.

CoinMarketCap tends to update quickly during volatile periods. CoinGecko, on the other hand, offers more transparent methodology documentation (helpful if you want to understand what's actually included in their calculations). Both platforms show dominance as a live percentage, typically updating every few minutes. By the way, they also provide historical dominance charts where you can toggle between daily, weekly, and monthly views.

Professional Trading and Analysis Tools

TradingView stands out for active traders who want to overlay Bitcoin dominance charts with technical indicators, moving averages, or other assets. You can create custom alerts when dominance crosses specific thresholds and integrate dominance analysis directly into your broader market view.

For institutional investors, Bloomberg Terminal includes Bitcoin dominance as part of its crypto data suite. It offers deeper correlations with traditional market indicators and professional-grade charting. These tools cost significantly more, but they provide the depth serious traders need for multi-timeframe analysis.

Historical Data Sources and Archives

For backtesting strategies or conducting long-term research, you'll need access to historical dominance data. CoinMetrics and Glassnode offer downloadable datasets stretching back years, though access to complete archives typically requires paid subscriptions.

CoinGecko provides free historical charts going back to 2013, which covers Bitcoin's dominance evolution through major market cycles so far. These repositories let you test how dominance patterns correlated with past bull and bear markets—essential if you're building data-driven strategies.

Mobile Apps and Alert Systems

CoinStats and Blockfolio offer convenient mobile tracking with customizable push notifications for dominance changes. You can set alerts for specific percentage levels or percentage-point movements—useful if you can’t or don't want to check charts constantly for any reason.

Most major crypto exchange apps now include dominance metrics in their market overview sections. This makes it easy to glance at dominance alongside your portfolio performance.

The key is matching the tool to your needs: casual observers do fine with CoinGecko, active traders benefit from TradingView's flexibility, and researchers need historical data archives.

Conclusion

To summarize, understanding what Bitcoin dominance is—and what it isn’t—gives you an immediate edge. You're no longer just watching prices; you're reading the flow of confidence, risk, and capital across the entire crypto market.

Keep an eye on the ChangeHero blog to learn more about the latest crypto news, projects, and platforms. And for quicker bite-sized updates, follow us on social media: Twitter, Facebook, and Telegram.

Frequently Asked Questions

What is the Current Bitcoin Dominance Level?

As of 2026, Bitcoin dominance has been fluctuating between 53% and 64% for a year, according to CoinGecko, though the exact percentage shifts daily based on market conditions. Since 2014, Bitcoin's dominance has structurally decreased from over 95% to this more balanced range—a shift that reflects the maturation of the cryptocurrency ecosystem and the emergence of viable alternative blockchain projects.

You can check the current dominance level on platforms like CoinGecko or CoinMarketCap, which update these metrics in real time by dividing Bitcoin's market cap by the total cryptocurrency market cap. Here's the key insight: dominance moves in cycles. Rather than fixating on today's exact number, look at the trend direction over weeks and months.

Is 40% Bitcoin Dominance High or Low?

By historical standards, 40% Bitcoin dominance sits on the lower end of the modern range. Before 2014, Bitcoin commanded over 95% of the crypto market—it was essentially the only game in town. During the 2017 ICO boom, dominance dropped significantly as capital flowed into altcoins.

40% is a level that signals a relatively healthy and busy altcoin market where investors are distributing capital across multiple projects. It suggests a heightened risk appetite and active experimentation with alternative cryptocurrencies. On the flip side, dominance levels above 60% typically indicate a flight to safety, where investors consolidate into Bitcoin during uncertain market conditions.

Context matters more than the raw number. A drop to 40% during a bull market indicates altcoin season—capital is rotating into higher-risk opportunities. The same 40% during a bear market recovery might signal cautious diversification as investors test the waters beyond Bitcoin.

Can Bitcoin Dominance Predict Market Crashes?

Bitcoin dominance isn't a crystal ball, but it can provide early warning signals when combined with other market indicators. Rising dominance during price declines often precedes deeper corrections, as investors flee altcoins and consolidate into Bitcoin's relative safety.

However, dominance alone can't predict crashes reliably. The 2021 market correction, for example, showed mixed signals—dominance fluctuated without providing clear directional guidance. Similarly, rising dominance doesn't always spell trouble. It can simply reflect Bitcoin outperforming during healthy market consolidation.

Bitcoin dominance is one data point in a broader analysis to be combined with on-chain metrics, trading volume, and macroeconomic conditions for a complete picture. It works best for identifying broader market sentiment shifts rather than pinpointing exact crash timing.

How Often Should Bitcoin Dominance Be Monitored?

Your monitoring frequency should match your trading style and investment horizon. Day traders might check dominance several times daily alongside price action, using it to identify short-term rotation between Bitcoin and altcoins. They're looking for immediate opportunities.

Swing traders would typically review dominance weekly, looking for sustained trend changes that signal shifting capital flows. Long-term investors can check monthly or quarterly, focusing on major structural shifts rather than daily noise.

For most people, a weekly check-in provides enough context without creating analysis paralysis. Remember, constantly watching dominance won't improve your returns.

What Happens When Bitcoin Dominance Hits 70%?

Historically, 70% dominance represents a significant consolidation level that often precedes major market shifts. When dominance climbs this high, it typically signals one of two scenarios: either the market is in full risk-off mode during a bear market, or Bitcoin is leading a new bull market while altcoins lag behind waiting their turn.

In bear markets, 70% dominance often marks late-stage capitulation where altcoins have bled significantly and investors cluster in Bitcoin for stability. In bull market beginnings, it can indicate Bitcoin breaking out first—establishing a foundation before altcoins catch up.

Here's the key pattern: extreme dominance levels rarely persist. Markets eventually rebalance as either altcoins recover (dominance falls) or Bitcoin corrects (dominance stabilizes). High dominance creates the setup for the next altcoin season, though timing that rotation remains challenging. It's like a coiled spring—the pressure has to release eventually.

Does Bitcoin Dominance Matter for Long-term Investors?

For long-term holders focused on multi-year horizons, Bitcoin dominance matters less than for active traders, but it's still worth monitoring periodically. If you're holding Bitcoin exclusively, dominance validates your thesis when it rises during market stress—it confirms Bitcoin's role as the crypto market's safe haven.

If you hold a diversified portfolio, dominance helps with rebalancing decisions. When dominance hits extreme highs, it might signal opportunity in oversold altcoins. When it drops to extreme lows, it could suggest taking profits from altcoins and rotating back to Bitcoin.