What is a CBDC? A Guide to Central Bank Digital Currencies

Global superpowers and small nations alike are exploring the prospects of operating a digital version of the national currency. The European Union researches digital euro, and the United States is concerned with the digital yuan releasing soon. Meanwhile, they all have already been left behind by the Bahamas. In this guide, the ChangeHero team will explain what is a CBDC and what countries are developing them.

Key Takeaways

- CBDC (stands for “central bank digital currency”) a legal tender digital currency issued and maintained by a central bank or entities authorized by it;

- CBDCs use distributed ledger as an underlying technology but in a centralized way, unlike cryptocurrencies which are decentralized;

- CBDCs have been launched in the Bahamas and Cambodia. Chinese digital yuan is approaching final stages of testing.

What is a CBDC?

So, what is a CBDC? First of all, it stands for “Central bank digital currency”. Like the term implies, it is a digital currency issued by a central bank.

Source: SUERF

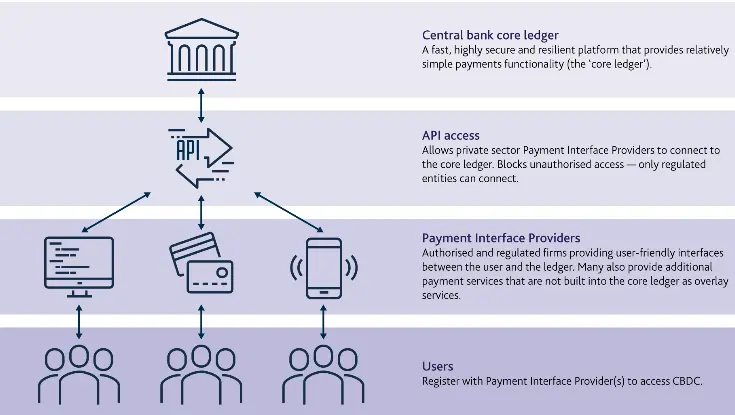

But why is it a new thing if electronic payments are already widespread? Unlike the digital representation of money used now, CBDC is issued and controlled by the central bank or authorized entities. It is legal tender and actual money in digital form, rather than a representation.

CBDCs include the projects targeted at retail users and wholesale or interbank products. Interbank CBDC projects are intended to be used in financial institutions, while retail CBDCs are targeted for the general public.

Retail CBDCs are more challenging to introduce but have more disrupting potential than the wholesale. This is why the news covers retail CBDCs like the Chinese digital yuan more than interbank initiatives which are more mature at the moment.

In this guide, we are going to talk about both of these kinds of CBDCs. But first, let’s evaluate the concept in general.

Why do we need CBDC?

What is a CBDC raison-d’être, anyway? To answer this question, we have to look at the CBDC benefits:

- Decreases the number of middlemen. Digital currency is issued directly by the state and maintained by the issuers;

- More reliable than current payment systems: distributed systems are more resistant to downtimes and don’t have a point of failure;

- Increases national currency’s sovereignty domestically and overseas: inclusion for more residents, broader exposure to international financial markets.

What is a CBDC use case? Ideally, to replace at least the M1 money: notes and coins in circulation, demand deposits, traveler’s checks. This seems to be what most advanced projects like the digital yuan aim for.

CBDCs for interbanking purposes cover more specific uses: interoperability with foreign and domestic banks, cross-border payments and settlements, real-time gross settlement (RTGS).

CBDC vs Cryptocurrency

How are CBDCs different from cryptocurrencies?

- Most cryptocurrencies do not have a centralized issuer. Those that do are issued by private entities with no state affiliation;

- Cryptocurrency blockchains are usually maintained by independent entities. The nodes of CBDCs have to be affiliated with the central bank;

- CBDCs are the extension of the existing monetary systems. By default, CBDCs are legal tender in their own jurisdiction.

Top Central Bank Digital Currencies

Venezuela — Petro

Petro, or Petromoneda (PTR) was the world’s first state-issued cryptocurrency. It was not called a CBDC as the Central Bank was not explicitly stated to be the issuer. Petro’s value is supposed to be pegged to the country’s natural resource (oil, gold, diamonds) reserves. The project started in 2017.

Venezuela is known to be a petrostate (dependent on natural resources, wealth gap and corruption are present) suffering from hyperinflation. To ease this, the residents turned to digital and cryptocurrencies. President Maduro’s government also turned to crypto to solve their own problems.

As reports confirm, petro is not easily accessible to the general public. It is traded mostly on state-authorized exchanges and the large average size of transfers suggests that it is mostly the elites who use it. Gradual adoption with the ordinary people seems to be taking place, but other cryptocurrencies are way more popular.

Bahamas — Sand Dollar

The digital version of the Bahamian Dollar, called Sand Dollar, is the first CBDC to be launched worldwide. The pilot testing was conducted in December 2019, and officially rolled out in October 2020. Sand Dollar can be acquired through authorized financial institutions and used with a mobile wallet or a payments card.

Transfer to the national digital currency made payments with Bahamian dollar more efficient and accessible. Records of daily transactions and income can be used for micro-loans but also make financial regulation easier for the state.

Fun fact: Sand dollar is called after an animal of the same name which looks like a five-part symmetrical shell. It even uses the image of this animal in the logo.

Cambodia — Bakong

The National Bank of Cambodia (NBC) started their research of digital currencies back in 2018. Project Bakong is an interbank system first, launched in October 2020 and connecting domestic and international banks. Since 2020, the project has been expanded to give retail users access to easy and affordable cross-border transactions.

In rural Cambodia, bank account usage is way less common than the usage of mobile phones. With this project, NBC hopes to make the banking sector more accessible to the population. The distributed ledger-based payment system supports Khmer Riel and US Dollar, with the latter being used more frequently.

China — DC/EP

Mainland China CBDC is called “Digital Currency/Electronic Payment” or DCEP for short. DCEP is primarily targeted at retail users, and its development started as early as in 2014. In 2021, it is in the final stages of testing, which is understandable, given the population of China.

DCEP is one of the more advanced CBDC projects, aiming to replace M1 money (liquid money supply, does not include bank deposits). For that purpose, it has to work both online and offline, and the trials are showing that it is successful. Trials have been conducted for both retail and wholesale.

DCEP is also arguably the most talked about central bank digital currency. This is because the People’s Bank of China hopes it will help improve the yuan sovereignty. The launch date is not yet certain but China plans to make it accessible by the Winter Olympics in Beijing in 2022.

Hong Kong — LionRock

The LionRock project is a joint interbank initiative for the use of Distributed Ledger Technology (DLT). The strategic partner for this project is Bank of Thailand, and the two parties intend to use it for real-time gross settlement systems. RTGS can change the remittances market as we know it today, making settlements instant, borderless and virtually costless.

The project has just transferred to Phase 2 this year, and the next steps would ensue multinational connections. Particular interest is paid to adapting LionRock to work with the DCEP and transform it into a global hub for businesses using offshore Renminbi.

Singapore — Ubin

Project Ubin completed the final research phase in mid-2020. Moving forward, the Monetary Authority of Singapore is looking for opportunities to expand their blockchain-based wholesale network into foreign markets. For instance, they have announced that they will collaborate with People’s Bank of China.

A particularly interesting feature of Ubin network is the ability to connect with other existing blockchain networks. Interoperability allows the payments system to cover more use cases, provided for by private enterprises: conditional payments, trading escrow etc.

Ukraine — E-hryvnia

In September to December 2018, Ukraine conducted a pilot test of CBDC — e-hrivnya. The test was supposed to prove the feasibility of introducing a CBDC and test the potential impact on hryvnia. Participants included banks and retail users alike.

The pilot test was successful but since 2019 the project has been concentrating on research and development. One of the prominent crypto industry representatives backing the project is Tezos Foundation.

In 2020, Ukraine scored the highest rank in cryptocurrency adoption according to Chainalysis. Regulating the emerging sector is one of the priorities of domestic monetary policy for the National Bank of Ukraine.

Canada — Jasper

Bank of Canada (BoC) initiated the blockchain research Project Jasper in 2017. The Jasper-Ubin project ran from during 2019 and focused on researching high-value interbank payments, clearing and processing. While Jasper was concentrating on research, the joint project was supposed to test the findings in practice.

What is a CBDC status in Canada? Bank of Canada has decided to carry out further research on the possible applications of decentralized systems for interbanking services. Other partners in the initiative include the Bank of England and HSBC, one of the oldest and largest European banks.

Conclusion

In the coming years, more and more states will introduce their own national digital currencies. Knowing what is a CBDC and how to use it can help stay in the loop once this future arrives. Do you look forward to them or are you sceptical about state control? Let us know in the comments!

For analytical guides and industry news, check out ChangeHero blog. Feel free to subscribe to our Twitter, Facebook, and Telegram for updates and quick content in social media!

FAQs

<em>What does CBDC stand for?</em>

CBDC stands for “Central bank digital currency”.

<em>Is CBDC a Cryptocurrency?</em>

CBDCs are different from cryptocurrencies. Unlike centralized CBDC crypto does not need the control of a central bank to process and verify transactions.

<em>How will digital currency affect banks?</em>

Interbank CBDCs can make cross-border transfers more quick and efficient. DLT-based CBDC can serve as a foundation of a real-time gross settlement system.

<em>Does CBDC use Blockchain?</em>

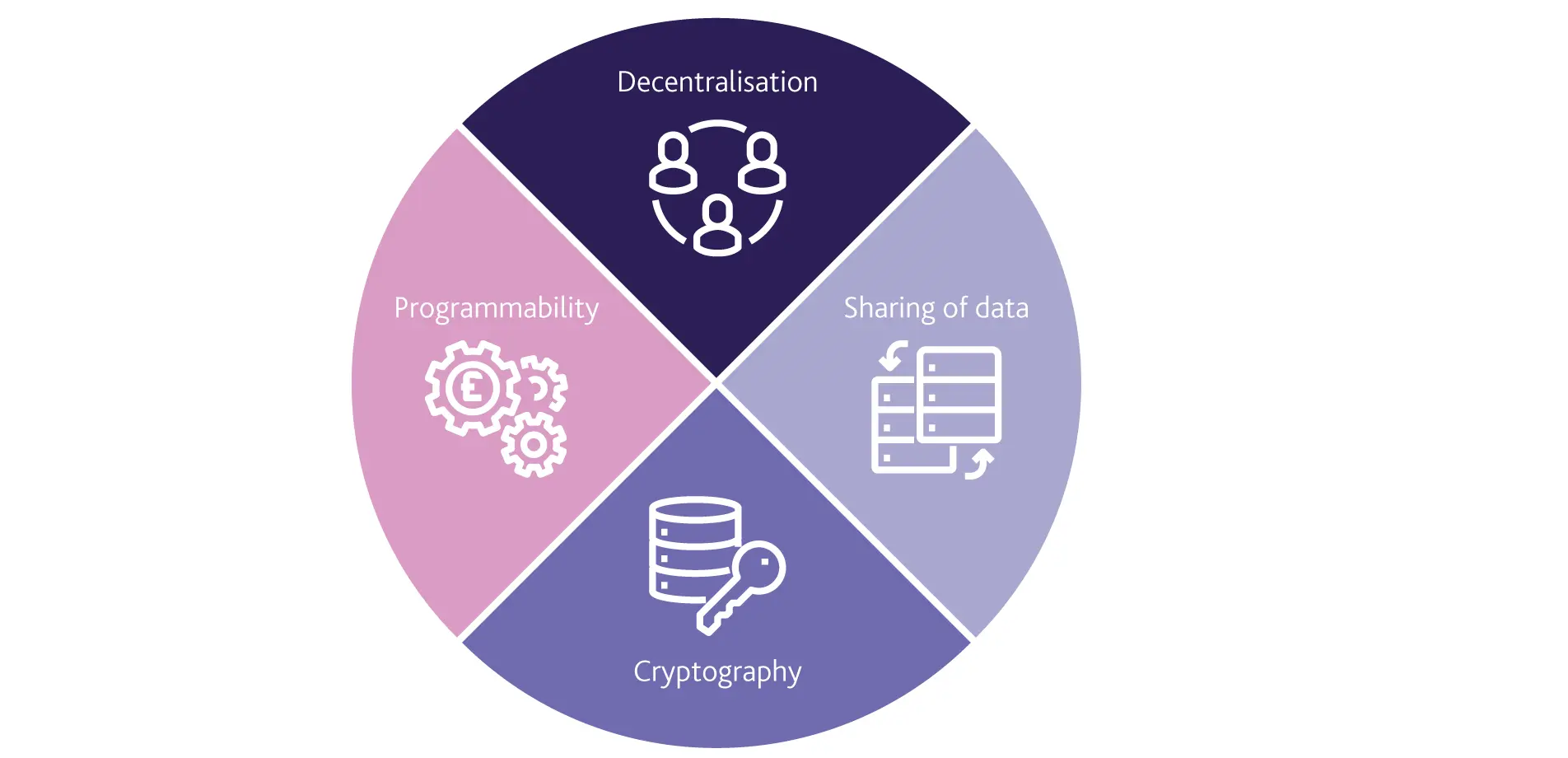

Almost all of CBDCs are blockchain (distributed ledger) based. The technology provides security, transparency and programmability.