Welcome to the fresh round-up of crypto news by ChangeHero! In this article, we’ll cover and analyse the latest crypto news and provide a Bitcoin digest. What companies are buying the dip? Have the bears prevailed? Find the answers below.

ChangeHero Updates

Giveaway for Early Newsletter Subscribers Extended!

Due to response to our ongoing giveaway on Twitter, we have extended the deadline and increased the number of winners. The prize pool of $400 in Bitcoin will be shared among eight winners. Make sure you entered and spread the word to claim your reward!

Latest Cryptocurrency News

Bitcoin Digest

- For the first time in a while, BTC changes the trajectory in a 7-day time frame. After briefly touching $58,000 it got rejected quite rough. The flash crash to $47,400 on Monday could have made things worse. The first support level to which the price went was $44,800.

- Just a few hours ago, though, it tested another support at $44,100. This is the first pullback in a while but in other time frames it doesn’t look as dramatic.

- Is now a good time to buy Bitcoin? For a longer term to hold, this might not be a bad idea. TradingView technicals and ‘fear and greed’ index suggest likewise.

- Glassnode Research published the insights that could explain the BTC price trend. They found that in January and February, two groups of large holders showed opposite dynamics. The number of BTC whales (>1,000 BTC) hold was increasing in January and decreasing in February. On the other hand, the holders with 100–1,000 BTC took the initiative from them when February started.

Altcoin News

- Ethereum EIP-1559 (Dynamic Fees) is 99% ready and will be able to be implemented with the next hardfork. The final decision, however, has to be reached in the community. On the consumer side, it will make fees more transparent and less volatile in times of high load. On the miner side, however, it will reduce revenue from fees.

- Meanwhile, competing chains start seeing Ethereum protocols migrate. Most recently, 1Inch team announced that they will expand to Binance Smart Chain. Previously, Harvest Finance and Value DeFi expressed the same intentions.

Business Cryptocurrency News

- Bitcoin purchases by Microstrategy are becoming a staple in our weekly crypto digest. Square also added to their Bitcoin holdings. The former purchased 19,452 BTC ($1.026B) and the latter — 3,318 BTC ($170 million).

- SEC has approved the IPO of Coinbase. It became the first cryptocurrency exchange to have its stock traded. The new status puts Coinbase in 4th place among publicly traded companies with holdings in BTC (the others being MicroStrategy, Tesla and Galaxy Digital).

Cryptocurrency News on Adoption

- Reportedly, Gates Foundation is planning to develop a digital payment system of their own. The mission of the initiative is to provide accessible financial services to the impoverished in developing economies. Crypto news outlets picked on this initiative in light of Bill Gates’ recent speeches on Bitcoin. He told Bloomberg and CNBC about his concern about the speculative nature of the crypto market.

- In collaboration with British artist Damien Hirst, HENI Leviathan offers a collection of artworks for sale for BTC and ETH. The art marketplace describes this offer as the first, and the artist’s testimonial expresses his support for the crypto industry.

Regulation & Politics Cryptocurrency News

- Bitfinex and Tether have finished their legal battle in New York. The Attorney General ruled out that the companies shall no longer be able to operate in the state. In addition, both companies are now obliged to provide quarterly reports and fined for $18.5 million. Tether and Bitfinex consider this a victory: the USA legally is not included in the territories they provide services in.

Twitter Crypto Digest

The SEC investigating dog memes sent by a memer about a memecoin is peak 2021.

All Hail Emperor Musk! pic.twitter.com/qbm1fLGbED — Official* Pope of Muskanity 🖌 (@RationalEtienne) February 25, 2021

One of the rumors that riled up the community was that the SEC might come after Elon Musk. The allegation: manipulating the DOGE price by tweeting. DOGE reacted by dipping, but neither Musk nor community took it seriously. After all, that would not be the first time for him.

Presenting: The most expensive approve https://t.co/WQvgjZWFug

— Andrew Redden 🕯️ (@androolloyd) February 23, 2021

This transaction unearthed by the Groundhog Network CTO had a fee of 500,801 gwei… or $36,509.59. However, high gas fees are not to blame this time. The Uniswap user just meant to set gas price to 500 or 801 gwei. If it’s any consolation, this transaction must have been very fast.

I'd literally rather accept Pokemon cards than a distributed ledger.

— The Crypto Monk ⛩️ (@thecryptomonk) February 23, 2021

This week, the US Congress was holding a hearing on domestic terrorism financing. CoinDesk reported that one of the topics they meant to cover is Bitcoin. However, as Crypto Monk put it, this is an old misconception. Bitcoin’s traceability and transparency make it worse than physical cash (or Pokemon cards).

Influencer of the Week

— ParabolicTrav (@parabolictrav) February 23, 2021

Ironically self-described “Slave to Bitcoin”, ParabolicTrav is a popular Bitcoin analyst. The content you can find on his Twitter is mostly technical Bitcoin digest, arguments in its favor and memes. If the mix of thoughtful and light-hearted sounds alright for you, that’s a recommended follow.

Top Crypto Digest

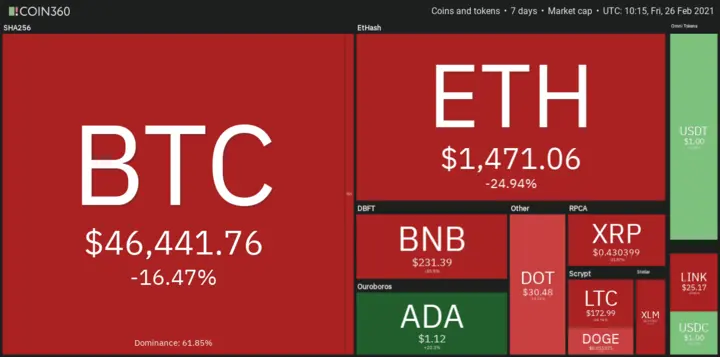

At the moment of writing the crypto digest, the general market stats are:

- Total Market Cap: $1,399,098,009,055 (-13.37%);

- BTC Dominance: 61.85%.

7d Top Capitalization Crypto Digest

At the moment of writing this crypto digest, the 7-day change of the top currencies is as follows:

- Bitcoin (BTC) $46,441.76 (↓16.47%);

- Ethereum (ETH) $1,471.06 (↓24.94%);

- Binance Coin (BNB) $231.39 (↓31.20%);

- Polkadot (DOT) $30.43 (↓13.24%);

- XRP $0.428331 (↓24.24%);

- Litecoin (LTC) $173.19 (↓26.87%);

- Chainlink (LINK) $25.18 (↓27.77%);

- Bitcoin Cash (BCH) $483.20 (↓32.90%);

- Stellar Lumens (XLM) $0.376291 (↓26.90%);

- Dogecoin (DOGE) $0.050968 (↓7.37%).

ChangeHero Gainers of the Week

Which altcoin has the most potential? Here are the top-three proving theirs at the time of writing the crypto digest:

- Holo (HOT) $0.002945 (↑81.99%);

- Pundi X (NPXS) $0.002169 (↑62.69%);

- Polygon (MATIC) $0.1799 (↑44.75%).

Key Takeaways

- The Bitcoin digest can be summed up as a pullback. The support level has moved to $45,000. Bitcoin lost about 17% of its price in the seven days. Moves like this are nothing out of the ordinary for the crypto market. In the long term, the technicals are healthy and bullish;

- The dip was bought by MicroStrategy and Square, among others. Two companies put $1.028 billion and $170 million in BTC respectively. The general trend suggests that whales turn to selling while “sharks” get in BTC when it goes down;

- Tether and the New York Attorney General have concluded the legal battle. The company was fined $18.5 million and banned from operating in New York state. For Bitfinex and Tether, this is a victory, since legally they do not operate in the USA;

- Ethereum is discussing the EIP-1559 (Dynamic Fees) that would help relieve congestion and high fees. Its code is almost completed and tested. Its controversial nature, though, can significantly delay it;

- Most altcoins are trading in red this week, following Bitcoin. There are only a few that decoupled from the trend (like HOT, NXPS, MATIC).

Conclusion

Will this pullback continue or will the rally resume? Tune in to our blog next week for the next weekly crypto digest. In the meantime, follow the news on our Twitter, Facebook, Reddit and Telegram.