Trading on an exchange does not have to be excessively complicated: more often than not it is a simple deal between two parties seeking to buy and sell. How does crypto spot trading work? Find an explanation in a new guide by ChangeHero!

Key Takeaways

- Crypto spot trading works exactly like in financial markets: it involves a deal between a buyer and a seller matched through an order book. Spot traders aim to sell their crypto assets for more than they have bought and buy cryptocurrencies when their fair market price is low.

- This is one of the most basic trading methods available on centralized exchanges, decentralized exchanges, and over-the-counter at brokerages or peer-to-peer trading platforms.

- When it comes to owning the underlying crypto assets, spot trading can be opposed to margin and derivatives trading. The former let margin traders borrow assets and amplify their positions. The latter has the traders deal in contracts that track the price of the underlying crypto asset rather than the real thing.

What does spot trading mean?

In traditional exchange markets, spot trading is a mode of trading in which buyers are matched with sellers to instantaneously exchange assets for the current market price. It gets its name because the deals are settled “on the spot”.

The goal of spot trading is to buy and sell assets to get a profit: in the simplest terms, “buy high, sell low”. To engage in spot trading, traders need to own the assets or transfer the ownership to the buyer.

What is spot trading in crypto?

Crypto markets and trading largely take after the traditional markets, which is evident with centralized exchanges. Simply put, spot trading cryptocurrencies is not any different from spot trading stocks: the only difference is the assets you trade and the place where you do it.

There are three basic components to a spot trade: a buyer, a seller, and an order book. For example, Alice places an order to buy BTC at the current market price. Through the order book of the exchange, she is matched with Bob, who wants to sell BTC for this price. The trade is settled immediately: the BTC is transferred from Bob’s to Alice’s balance.

Useful Terms for Spot Trading in Crypto

- The spot price is the current price of the asset on the given market. If you want an immediate delivery of the asset, you will have to reference the spot price when placing an order.

- A market pair is a pair of assets in which trades are executed on this particular market. In crypto trading, these pairs can be made up of a fiat currency with a cryptocurrency or two crypto assets.

- An order book is a component of the market where you can see all open buy and sell orders.

- A market order is a buy/sell order that references the spot price of the asset. It guarantees the trade’s execution but not the price.

- You can place an order with a specific price that is different from the spot price but it will be executed only when matched with an order of the opposite type. In that case, it is a limit order: it guarantees the price (the specified or better) but not the execution of the trade.

- A bid order is the same as a buy order. An ask order is the same as a sell order.

- Market depth is the ability of the given market to absorb large orders without drastic spot price movements.

- A taker fee is paid when a market order is made on the spot market. A maker fee is taken for placing a limit order and is generally lower than taker fees to incentivize growing the market depth by providing liquidity.

- A stop-loss order is a type of order that will be executed when the price of an asset reaches a certain point. For example, after buying BTC for $37,100, you can create a stop-loss order to sell it if it falls below $36,800 (or a trailing stop if it falls below a set % from the market price). It is a deliberate measure to prevent further losses from falling or rising prices.

How to Spot Trade Crypto: Exchanges & OTC trading

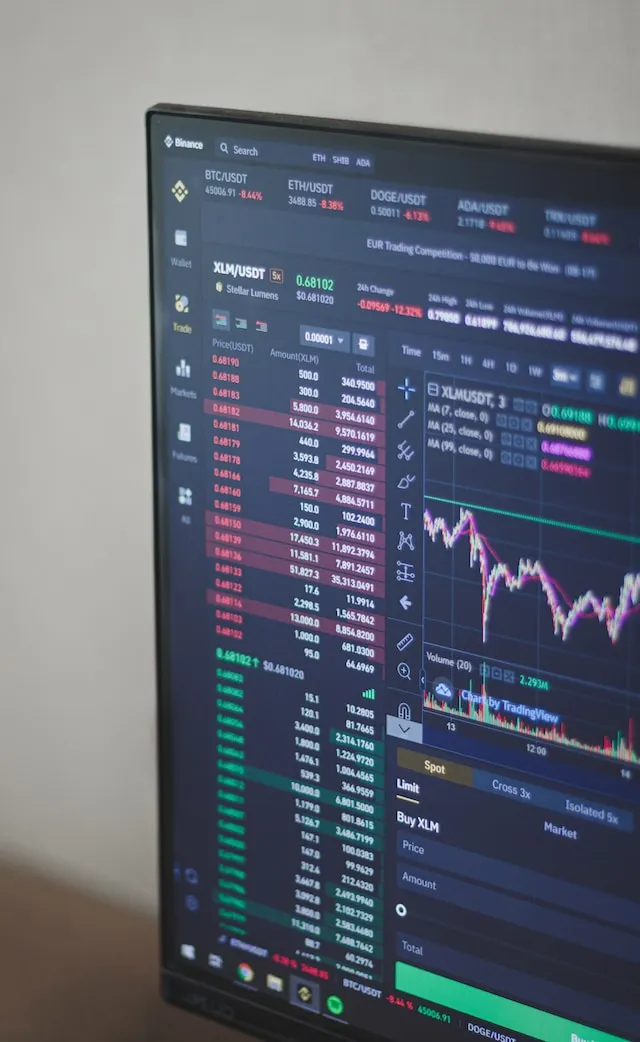

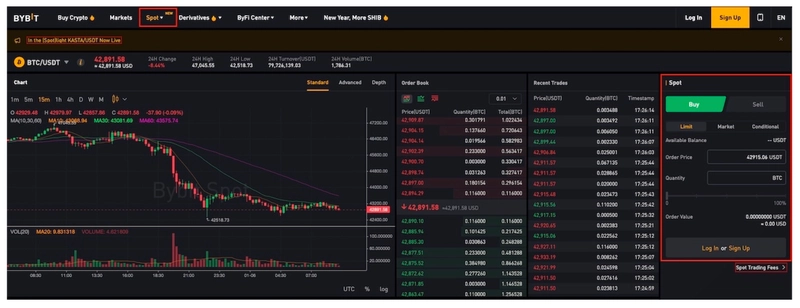

Centralized exchanges (CEX)

The go-to place to spot trade crypto is a centralized exchange. It is essentially a default option for any CEX, with derivatives like futures trading and margin trading being extra. Examples of CEXs include Binance, Coinbase, Kraken, OKX and Bitfinex.

To get started on a CEX, you will need to create an account and verify it. Next, you will have to deposit supported fiat currency or crypto into your account. Only then you will be able to place orders on a spot market of your choice.

When choosing a CEX, you will have to consider quite a few things. Is your local currency supported there? Does it have the cryptocurrency you want to trade? What is the market depth of the spot market you chose to trade in? Does the exchange have a good reputation and sufficient security to keep your private data and assets?

Using a centralized crypto exchange for spot trading is rather simple and straightforward. Moreover, when you get to grips with the process, it will be easier to move to riskier and more rewarding modes of trading: e.g. margin trading. At the same time, you can’t start from the get-go because trading on a CEX will require you to create and verify an account and make a deposit.

Decentralized exchanges (DEX)

A more recent and truly crypto-native mode of trading is decentralized exchanges. DEXs usually do not have an order book but instead use an automated market maker (AMM) powered by smart contracts. The most popular ones are Uniswap, Curve, and PancakeSwap.

The barrier to entry for a DEX is lower: you only need to connect a crypto wallet. Although, you will have to already have some cryptocurrency on balance to start trading. Another hurdle to using a DEX is that here you will be able to trade cryptocurrencies only: trading with fiat currencies is not supported on any of them.

Despite seeming simple at first glance, DEXs are generally not recommended for beginners. Using one efficiently requires careful management of trades to minimize slippage and save on blockchain network fees. Making a stop-loss order is also considerably more complicated for any DEX that does not offer the feature.

Over-the-counter (OTC)

OTC trading in crypto is also the legacy of financial markets. OTC trading is offered by brokers that support crypto trading as well as any major crypto trading platform.

OTC trades are made privately outside of exchanges. Therefore, the deal prices may vary from the current market prices, may not be disclosed to third parties (as they would be in an order book), and are not executed automatically.

Trading OTC is usually associated with transactions involving enormous value. Rather than risk doing it on an exchange, which may not even have the necessary liquidity, and move the prices, OTC is the way to go. However, it can also help you purchase assets without the risk of getting your bank account frozen or closed.

Trading cryptocurrencies peer-to-peer (P2P) is another way of doing it over the counter. Some of the P2P crypto platforms available today are Paxful and Paybis.

These platforms act as bulletin boards for purchase and selling offers. Users choose an order that satisfies their requirements (i.e. exchange rate, payment method, amount available for purchase), and buyer and seller transact directly. P2P marketplaces usually do not interfere in the process, although if a dispute arises, they can step in and penalize the counterparty at fault.

Spot trading vs. Margin trading

Of course, as we have mentioned, spot trading is not the only mode of trading. If you do not own the assets but are willing to borrow them to eventually sell and repay, margin trading can open up a lot of opportunities for you, as well as risks.

For instance, margin trading allows you to apply leverage to your trades. It will amplify your gains but losses as well. By borrowing assets to sell and return them later, you can capitalize on the price movements to the downside, or short sell in other terms.

Unlike with spot markets, you will have to pay attention to margin levels and consider liquidation risks. Suffice it to say that it is more complicated than crypto spot trading and is recommended to more advanced traders.

Spot trading vs. Derivatives trading

Another dimension to split the modes of trading financial assets is whether the traders own the underlying asset or a contract that tracks the price movements of this asset. Derivatives are financial products that do the latter.

One example of trading derivatives would be futures trading: an arrangement between a buyer and seller to purchase a certain asset at a set date for a predetermined price. The futures contracts are settled on the expiration date unless it is a perpetual futures contract.

If you would like to learn more about the specifics of futures trading, we suggest you read our guide. The ChangeHero team has also written about other types of crypto derivatives: CFDs and ETFs.

More Alternatives to Spot Trading Crypto

So far, it is clear that for anyone looking for more complexity and a higher risk vs. reward ratio, there are plenty of alternatives to spot trading in crypto. But what about those looking for even less involved strategies?

The most hands-off approach to amassing a crypto bag is long-term holding (or HODLing, as an anonymous Bitcointalk user once famously wrote). It does not get any easier: purchase crypto at your own pace, and when you feel the time comes — for example, in a bull run — sell. This method only requires you to take care of storing the coins but it is an extremely important step: a mistake can cost you a literal fortune.

Dollar-cost averaging (DCA) is also a rather effective way to amass crypto or any other asset. It implies deciding on a certain dollar amount to make regular purchases of crypto (weekly, monthly, etc.). A strong point of this investing strategy is that it works to your advantage even in bear markets: a consistent dollar amount will get you more of an asset when its market price is lower.

Spot trading in crypto is generally a great way to trade cryptocurrencies for one another. However, what do you do if you don’t want to make deposits, or would like to tap a different spot market with a better depth? In such cases, an instant exchange platform such as ChangeHero is your best choice.

Firstly, it is readily available as you will not even need an account to start an exchange. Secondly, you can swap 200+ cryptocurrencies in any combination without checking if this market pair is available. Thirdly, when using ChangeHero to exchange crypto, you tap into not one source of liquidity but ten, which we use to find the best current exchange rate on the market.

Conclusion

All in all, what is spot trading in crypto? Like in financial markets, crypto spot trading is a straightforward exchange of assets for a price that is determined by buying and selling. Mastering spot trading is a useful skill in making a profit from cryptocurrency trading but it is certainly not a requirement.

Subscribe to not miss out on any news on our Telegram, X (Twitter), Reddit, and Facebook. For more content to explore the crypto world, read the insightful content on our blog.

Frequently Asked Questions

Can I make money on spot trading?

Yes, spot trading can be used to make a profit. The usual mode of operating when engaging in it is to sell higher than purchased and buy at lower prices.

Why spot trading is better?

Spot trading can be considered better than margin trading or futures trading because there are fewer risks involved. A losing margin trade can cause losses even larger than the initial investment, and losses can compound. Moreover, crypto spot trading implies a transfer of ownership, resulting in a purchase of actual cryptocurrency.

What is the difference between spot trading and perpetual trading?

Perpetuals can refer to perpetual futures contracts or perpetual swaps: a type of futures contract without an expiry date. In a futures market, you trade contracts that track the price movements of an underlying asset but the ownership of an actual asset is not transferred in a transaction.

Disclaimer

This article is not a piece of financial or investment advice. No price prediction is guaranteed to provide exact information on the future price.

When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration and analysis of your own research and at your own risk.