Investors rarely go all in on a single type of asset and tend to diversify. Volatile assets often find themselves side by side with more stable assets, and gold is one of the oldest forms of store of value. In this guide, the ChangeHero team will review a crypto-native solution to combining the utility of tokens with the soundness of gold. Read our new guide to learn about crypto backed by physical gold, a 2023 edition!

Key Takeaways

- Gold-backed cryptocurrency is represented as of 2023 exclusively by gold-backed stablecoins. This is a type of token with its value directly linked to the price of gold backing these tokens.

- Tokenized gold is convenient because it is a transparent digital representation of gold ownership. Furthermore, it can be divided into units even smaller than an ounce or gram and is more readily accessible.

- Of course, there are downsides to gold-backed stablecoins. There are risks associated with counterparty trust, technological risk, lack of regulation and investor protection, and limited liquidity.

Are There Any Gold-Backed Cryptocurrencies?

Cryptocurrencies are famously volatile because, unlike fiat currencies, their value is determined by purely supply and demand dynamics. Fiat currencies are believed to source their value from the national economy and politics, and stocks depend on things like company performance and share dividends. However, there is a category of crypto tokens that are not characterized by volatility: stablecoins.

Stablecoin, by design, is a stable digital asset that is linked to another asset with a predictable value. These tokens include stablecoins that are linked to the value of fiat currencies or other real-world assets such as precious metals. They can be backed by the underlying asset or other assets: take DAI for example, which is a dollar stablecoin backed by a basket of cryptocurrencies.

In short, yes, there are cryptocurrencies backed by gold. Gold-backed cryptocurrencies are digital tokens that are backed by physical gold reserves. These tokens are designed to provide the benefits of both cryptocurrencies and precious metals, offering a digital representation of gold ownership.

It is important to note that gold-backed cryptocurrency does not mean there are cryptocurrencies maintaining a gold standard or crypto assets that work as a hard currency. The gold standard is a monetary system in which a country’s currency is directly backed by gold, so the value of the currency is tied to a specific amount of gold. Under this system, individuals could exchange their currency for gold at a fixed rate. We are going to discuss this more thoroughly in the sections to follow.

The gold-backed tokens that we are going to review have the following characteristics:

- Each token is typically backed by a specific amount of physical gold held in secure vaults.

- Gold-backed cryptocurrencies use blockchain technology to tokenize gold, creating a digital representation of the underlying asset.

- The value of gold-backed cryptocurrencies is generally more stable compared to other cryptocurrencies, as they are directly linked to the price of gold.

- Gold-backed cryptocurrencies enable individuals to own gold without the need for physical storage or logistics.

- Many gold-backed cryptocurrencies offer the option to redeem the tokens for physical gold. This gives holders the ability to convert their digital assets into physical gold if desired.

- Gold-backed cryptocurrencies often operate within regulatory frameworks, ensuring compliance with relevant laws and regulations.

Benefits of Gold-backed Tokens

Based on the qualities that we have just listed, gold-backed tokens give an array of benefits to the holders:

- Gold-backed stablecoins backed by physical gold provide a level of transparency and reassurance of the token’s intrinsic value.

- The tokenization of these tokens allows for easy transfer, ownership tracking, and divisibility.

- The physical gold reserves provide a layer of security and protection against market volatility.

- They provide a convenient way to invest in gold, especially for those who prefer the digital nature of cryptocurrencies.

- In addition to being redeemable, some platforms provide liquidity to these tokens by allowing trading of these tokens on cryptocurrency exchanges.

- Regulation and transparency can provide investors with confidence in the security and legitimacy of the assets.

Cons of Gold-backed Cryptocurrency

Of course, the blueprint of gold-backed tokens is not a perfect solution. There are multiple drawbacks to consider when reviewing this type of crypto asset:

- Counterparty risk: When purchasing gold-backed crypto tokens, you are relying on the issuer or custodian of the tokens to hold the corresponding physical gold. There is a risk that the issuer may not have sufficient gold reserves or could face financial difficulties, which could affect the value and redemption of the tokens.

- Lack of regulation: The crypto industry is still largely unregulated in many jurisdictions. In reality, this translates to limited legal protections or oversight for investors in gold-backed crypto tokens. It’s important to thoroughly research the issuer and understand the regulatory framework in which they operate before investing.

- Volatility and price stability: While gold is often considered a stable and relatively safe investment, the same may not be true for gold-backed crypto tokens. The value of these tokens can still be subject to significant price fluctuations, influenced by factors such as market demand, liquidity, and the overall performance of the cryptocurrency market.

- Limited liquidity: Gold-backed crypto tokens may have lower liquidity compared to traditional gold investments or other crypto assets. This means that it could be more challenging to buy or sell these tokens at desired prices, especially during times of market stress or low trading activity.

- Technological risks: Investing in gold-backed crypto tokens involves using blockchain technology and digital wallets. There is a risk of technical glitches, hacking, or loss of access to your tokens if you’re not careful with the security measures surrounding your digital assets.

Why aren’t there any hard cryptocurrencies?

The gold-backed cryptocurrencies present today in the market are all gold-backed stablecoins. But why aren’t there any cryptocurrencies that work like a hard currency backed by the gold standard? Why not have Bitcoin or XRP backed by gold?

Such a system would be restrained by too many limitations and challenges:

- Linking the value of an already volatile cryptocurrency to the fluctuating price of gold creates further instability.

- A trusted and reliable mechanism for verifying the gold reserves at the scale of a global currency would require complex and costly measures.

- Converting a limited resource (gold) into a digital, scarcity-free asset could prove challenging in the security department.

- Financial regulations concerning gold and crypto regulations are disparate around the world. They may not be compatible even within one jurisdiction.

Best Gold-Backed Cryptocurrencies in 2023

In contrast to some other categories of cryptocurrencies, there are remarkably few gold-backed stablecoins. We are going to review five of these projects, taking into account their popularity, legitimacy, and market stats at the time of writing.

Tether Gold (XAUT)

As the name implies, Tether Gold is a token issued by Tether, one of the largest stablecoin providers. It trades with the ticker XAUT or alternatively, XAUt. Tether Gold is represented on the Ethereum blockchain as an ERC-20 token.

Each XAUT token represents ownership of one fine troy ounce (t oz) of physical gold held in a Swiss vault. The custodian mentioned on the official site is TG Commodities Limited. As is usual for Tether, they issue and redeem XAUt tokens directly only with authorized customers but allow everyone to trade and hold XAUt.

Tether Gold is traded on various cryptocurrency exchanges, including decentralized exchanges (DEX). Despite having roughly thirty verified markets across all platforms where XAUT is listed, its daily trading volume is around $3 million. It places it near 500th place in the ranking by volume but the difference between trading volume and market capitalization is easily explainable. Assets like gold-backed stablecoins are mostly used for holding and hedging rather than trading.

XAUt can be redeemed for physical gold, with the caveat that they deliver the gold bars to addresses exclusively in Switzerland. The official website claims there are no custodian fees, only a 0.25% fee on purchase and redemption (which retail users, as we have mentioned, needn’t worry about).

Tether Gold in Numbers

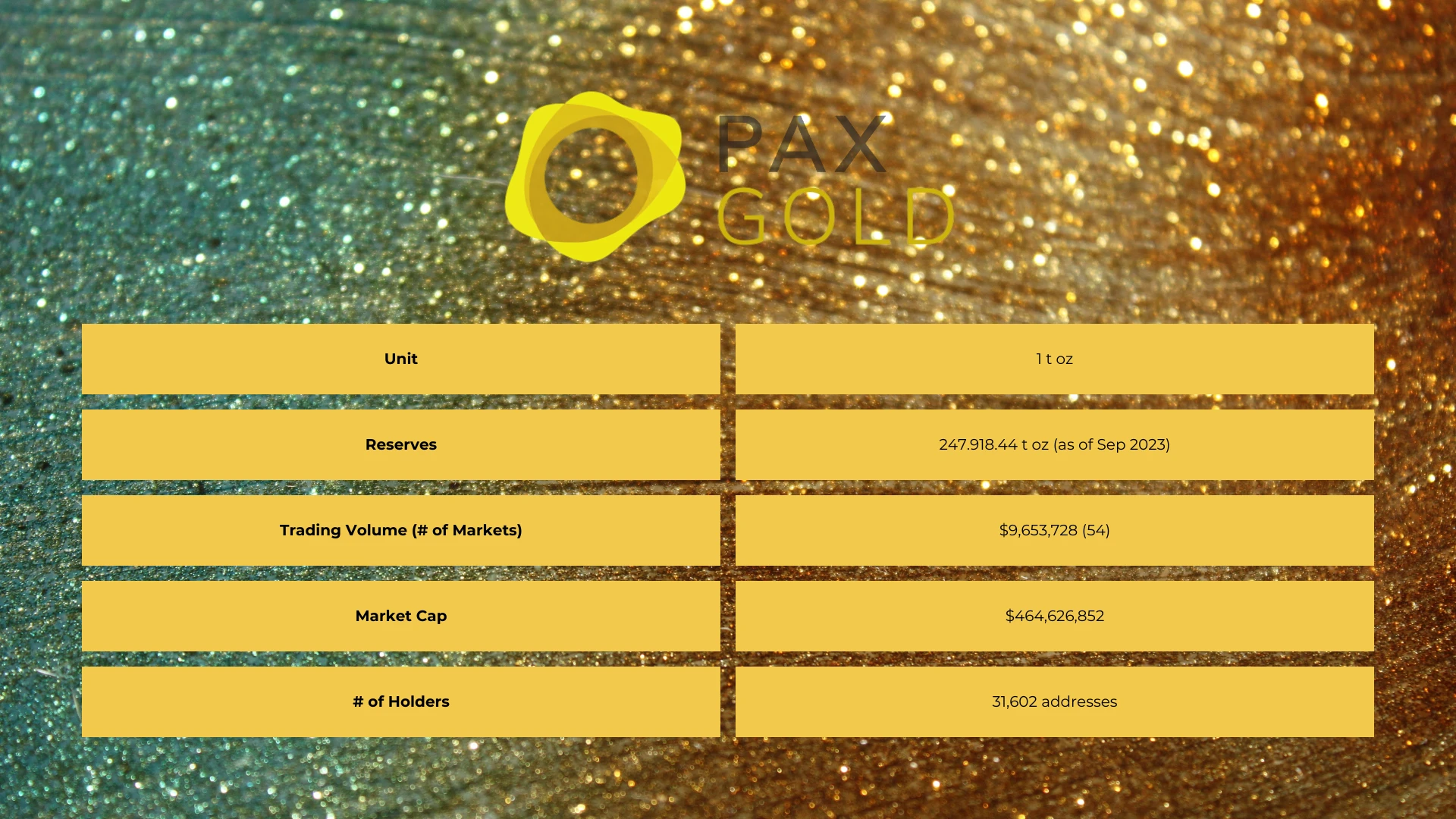

Pax Gold (PAXG)

Another gold-backed token from a well-known crypto company, Pax Gold is an ERC-20 token issued by Paxos. Paxos is also behind stablecoins such as USDP (previously PAX) and PayPal USD (PYUSD), and they used to issue Binance USD (BUSD) which was closed down by the US authorities as an alleged security.

Each PAXG token represents ownership of one fine troy ounce of gold in a 400 oz London Good Delivery gold bar. Paxos also offers the option to redeem PAXG for USD at the current exchange rate at any time. The company is open to serving retail clients with direct purchases starting at only 0.01 PAXG.

PAXG is also traded on major cryptocurrency exchanges and can be redeemed for physical gold by institutional clients. According to CoinGecko, it has a better turnover: PAXG is listed on more markets than XAUt and has more trading volume. It outperforms XAUt in all regards except the market capitalization.

Pax Gold in Numbers

Kinesis Gold (KAU)

Kinesis Gold (KAU) is a part of the Kinesis Money platform which includes software and hardware wallets, a crypto debit card, and an exchange. Their value offering is providing clients with a hedge in precious metals and a promise to share profits.

Let’s discuss the former before pausing on the latter. The Kinesis platform is powered by tokenized gold, silver, and a native crypto token. The goal of Kinesis is to reintroduce currencies backed by precious metals into daily use. The tokens work on the proprietary blockchain, which uses the Stellar blockchain engine. As for the metal redemption, Kinesis offers both minting and delivery services at a transparent rate of 0.45% + $100 + delivery costs. The underlying physical gold and silver in Kinesis’ custody provided by their partner Allocated Bullion Exchange is held in a dozen locations worldwide.

Kinesis also promises something new that the two previous stablecoins don’t: yields. They claim that 57.5% of the transaction fees they collect get redistributed to token holders. Virtually any action on the platform generates profit: trading on the exchange, referring new users, holding the native token KVT, minting, or simply holding.

The platform made the right call by being transparent about the source and the amount of payouts generated as yields, so it does not seem too good to be true. Still, some information about the user base is lacking and it is not immediately clear if recruiting and network growth are the main drivers of profitability — which would make Kinesis similar to a pyramid scheme.

Another point to pay attention to is that aside from the Kinesis Exchange, KAU is traded only on two other exchanges. Depending on how you look at it, it could be a red flag or proof that Kinesis Gold tokens are not entirely centralized.

Kinesis Gold in Numbers

Comtech Gold (CGO)

Number four in our list of gold-backed tokens to watch in 2023 and forward is Comtech Gold (CGO). These tokens represent ownership of 1 g of gold on the XDC Network blockchain.

Comtech is based in Dubai and markets toward the MENA region, although it underscores that their services are available worldwide and give the locals access to a global market. Their partners responsible for security and custody of the physical gold TransGuard are also based in Dubai. They offer redemption services to all users and will even offer it proactively to anyone who holds 1,000 CGO.

All stats suggest that Comtech Gold is a local business: the token is traded only on four exchanges between a few hundred holders. At the same time, its transparency and due diligence public information is on par with the largest projects in the niche.

Comtech Gold in Numbers

tGOLD (TXAU)

Last but not least, we’ll review another multi-purpose platform that aims to make investing in precious metals accessible: Aurus. They offer gold-backed cryptocurrency tGOLD (TXAU), silver-based tSILVER, platinum-based tPLATINUM, and a native token for rewards AX.

Aurus has plenty of similarities with Kinesis but having their own blockchain is not one. Aurus’ tokens are governed by smart contracts on Ethereum and Polygon. It makes them publicly verifiable and more transparent. According to the information on the official website, the precious metals that back the tokens are stored in vaults in six locations and made in accredited refineries. The precious metal backing the tGOLD tokens is said to be allocated gold.

As for the similarities with the previously mentioned platforms, Aurus also offers network-activity-based rewards to the app and ecosystem users. Similarly, they are sourced from network fees and distributed to AurusX token holders. These native tokens have a limited supply and will enter circulation over the course of a few years. A large part of its supply is either set aside for ecosystem development or reserved for the team and subject to vesting.

tGOLD in Numbers

Conclusion

Any gold-backed cryptocurrency we reviewed today is doing well in 2023. In comparison to other crypto assets, they seem to be in less vogue but still find adoption among investors who value their benefits.

Do you think tokenizing gold is a good idea? Join and discuss it on our Telegram, X (Twitter), Reddit, and Facebook. For more content to explore the crypto world, read the insightful content on our blog.

Frequently Asked Questions

Is there a cryptocurrency backed by gold?

Yes, gold-backed cryptocurrencies are digital tokens that are backed by physical gold reserves. These tokens are designed to provide the benefits of both cryptocurrencies and precious metals, offering a digital representation of gold ownership. Examples include XAUt and PAXG.

Is Bitcoin a Gold-Backed Cryptocurrency?

No, Bitcoin is not backed by gold or any other physical asset. Bitcoin is a decentralized digital currency that operates on a peer-to-peer network, based on cryptographic technology. Its value is derived from factors such as supply and demand, market speculation, and its utility as a medium of exchange and store of value.

How Do Gold-Backed Cryptocurrencies Work?

Gold-backed cryptocurrencies work by linking the value of a digital token to a specific amount of physical gold. The physical gold stored is usually held in reserves by a custodian or a trusted entity. The token holders can then redeem their digital tokens for the equivalent amount of gold, providing a level of stability and security to the cryptocurrency.

Disclaimer

This article is not a piece of financial or investment advice. No price prediction is guaranteed to provide exact information on the future price.

When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration and analysis of your own research and at your own risk.