Contents

Bitcoin’s volatility can be off-putting to some investors but in the hands of capable traders turns into an instrument to profit from. We are talking about a type of contract that lets them bet on the fact that BTC’s price will change: options! Read our introduction to the basics of options trading and how this fascinating instrument applies to Bitcoin and crypto.

Key Takeaways

- An options contract is an agreement that gives a holder the right but not the obligation to buy or sell an asset at a predetermined price on a specified date.

- Options are a type of financial instrument that derives its value from the price of the underlying asset, or a derivative. Their pricing is different from other derivatives backed by the same asset and is calculated with the intrinsic value of the underlying asset and time until expiration in mind.

- There are various types of options and strategies associated with them. Call options are the right to buy and put options — to sell the underlying asset. Both calls and puts can be sold or bought.

What are Options Contracts?

In trading, options contracts or options are a type of derivative financial asset. This asset is a contract that gives the right but not an obligation to buy or sell a certain asset at a specified price and date. The price specified in the option contract is called strike price. The day when the contract ends is an expiration date.

Options are derivatives which means that the value of these financial instruments is derived from another, underlying asset.

Options vs. Spot trading

Unlike spot trading, options are more complex and require a bit more knowledge and experience. A spot trade is a straightforward deal between a buyer and seller with the asset delivery on the spot. Options trading involves a delayed sale or purchase of this asset, which may not even happen.

As a derivative asset, options can be traded even without owning the underlying asset. Although, more often than not traders use them in addition to a spot position in the underlying asset as a hedge against volatility.

Options vs. Futures contracts

A more nuanced distinction differentiates options from futures contracts. They are indeed similar: a futures contract is also an agreement to buy or sell an asset at a specified price and on a given date.

The phrase “right but not the obligation” in the definition of options underscores the difference between these two kinds of contracts. In a futures contract, unless it is a perpetual one, on the expiration date the holder will have to fulfill the conditions of the agreement. Holding the options contract gives you the choice to deliver or let it expire, literally the option to do either. As for the difference between perpetual futures and options, the latter eventually expire.

Due to the nature of the contract and the obligation to close the deal, future contracts track the price of the underlying asset more closely than the options’ price. The estimated value of the asset is represented by the futures’ mark price. Options’ prices are formed differently and rather than follow the price of the underlying asset, represent the value of the contract itself.

How does Options Trading Work?

As a derivative contract, there are special markets dedicated to trading options. Traders who want to wager on the probability of an asset’s price changing are matched on these platforms.

The price of an option is calculated with several things in mind: how long until the expiration date? By how much the underlying asset’s price is expected to change? How valuable is the contract, depending on the probability of this change until expiry? For instance, the longer it is until the expiry and the more realistic the price move, the higher the value of the option. As the time approaches the deadline, it becomes less probable that the price of the original asset will change, so the value of the options contract decays.

What happens on the expiration date? If the conditions have been met, the agreement is exercised, but if not, the contract expires worthlessly. In other words, the losses are limited to the premium, which is another difference from the futures contract. This is why options are a popular choice for hedging against volatility and arguably, an even lower-risk asset than stocks.

Speaking about premium, what is it exactly? Options contracts have intrinsic value and time (extrinsic) value. Together, they are known as a premium. Intrinsic value is the difference between the strike price and the current market price of the underlying asset. Extrinsic, or time value is the value added by the time until expiration, during which the price move should occur. The premium is never equal to zero because however small, there is always a possibility of this change.

According to Investopedia, the ratio at which options are exercised, traded out, and expire worthlessly is about 10/60/30. It is more common to close a position with a trade order than to see it play out.

Can you trade crypto options?

A standard stock options contract tracks 100 shares of an underlying stock. Since options contracts can work with other types of assets, there are crypto options as well.

If you want to trade Bitcoin options, you should find a suitable trading platform that supports these contracts first. Even if you don’t have the funds to buy BTC, you can bet on the probability of its price increasing soon, let’s say, in a month.

You find a deal that would let you buy Bitcoin a month later at the current price. To get this right, you pay a premium that the contract seller is asking for. The time comes, and Bitcoin has grown in price: now you can exercise your right and buy it for a bit cheaper. You paid the price of BTC a month ago plus the premium. If the total premium is lower than the amount by which Bitcoin has appreciated, you profit.

If the opposite happens, and BTC’s price has remained the same or gone lower, you do not have to buy it. You can let your contract expire, having spent only the premium for the Bitcoin options.

Useful Option Trading Terminology

Call options & Put options

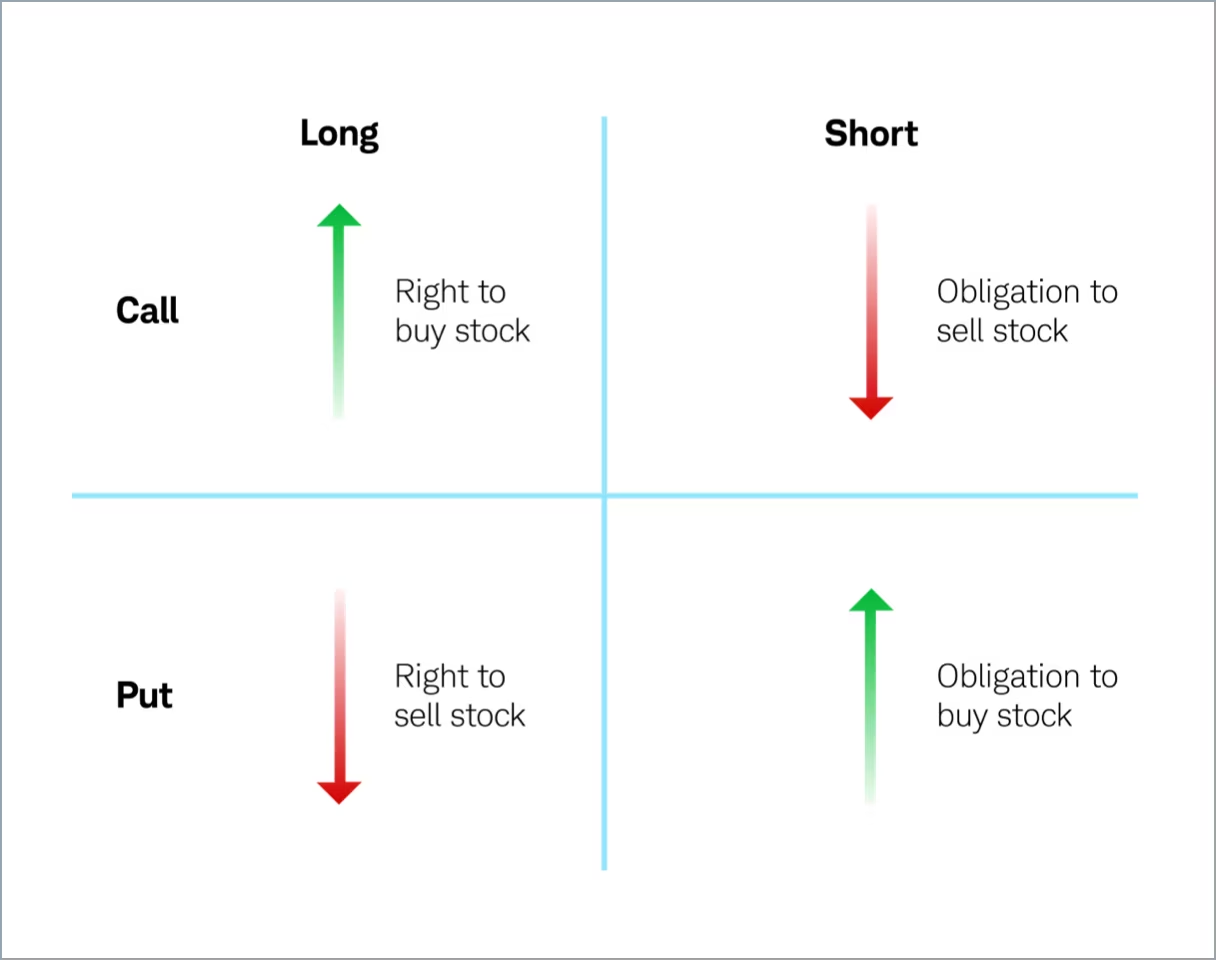

The two main types of options are call options and put options. Call options are contracts to buy the asset while put options imply their sale. Both call options and put options can be bought or sold (i.e. you can go long or short). In regards to options, buyers are called holders and sellers are writers. Holders have the choice to exercise their rights given by the contract but writers are obliged to make good on the promise. As a result, risks for options holders are limited by the premium but writers’ risks are almost unlimited.

How come? Another important pair of terms is naked vs. covered. Let’s explain it with an example: “writing a covered call” means selling a call option while having a corresponding amount of an underlying asset. If you do not have the underlying asset, your position is naked. Going short with options while not having the assets to fulfill the contract’s promise can cause losses due to the obligation to buy and deliver the asset for the market price.

Call options can be likened to a purchase with down payment. Alice wants to buy a house but only if the development of the area is successful. She can contract with Bob to buy one for $400,000 in three years. However, this arrangement has to benefit both, so Bob agrees to Alice’s proposal for a $20,000 fee. In options, this fee is a premium.

In case the conditions that satisfy Alice are met in two years and she decides to buy the house, she can close the contract and pay $400,000 (plus the $20,000 fee). However, if the desired area development will not have been reached until year four, their contract expires. Bob keeps the $20,000 premium and Alice will have to buy the house for the market price.

The usual analogy for put options is insurance. If Bob would like to sell his house in a year and protect it from damage in the meantime, he can contract Alice. They can agree to give Bob the right to sell his house for a set price even if its value goes below it for a premium. In case nothing happens, Bob will have only lost the premium but if something that brings the value of the house way down does happen, he gets to sell it for the price in the contract.

Spreads

Traders also can combine the positions to maximize profit or ensure it wherever the price moves. Buying or selling a call and a put of the same asset with the same strike price and expiration date is called a straddle. If the strike price is different, it is known as a strangle. In crypto options, straddles can be referred to as MOVE contracts.

There are also combinations with two or more positions of the same class, called spreads. Spreads limit both losses and gains, but can be good to combine speculation with hedging.

A vertical spread means selling one option to buy another, often with the same asset and expiration date but a different strike price. In a bull call vertical spread, you would buy a call option and simultaneously sell another call with a higher strike price. Its opposite, bear put vertical spread, involves buying a put and simultaneously selling another put with a lower strike price.

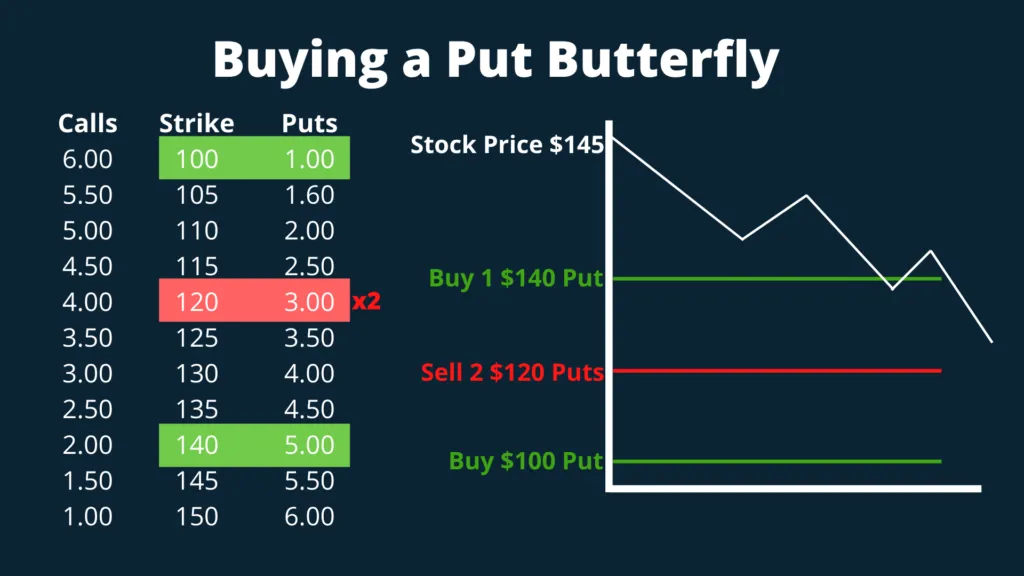

The combination of options with different expiration dates is also possible and is called a calendar, or time spread. One well-known example of it is butterfly spread: it involves three positions of the same type (call or put) with three strikes at an equal distance. Another important component of this spread is the ratio at which the options are bought or sold: it is always 1:2:1 (e.g. top bought, two of the middle sold, bottom bought). If a trader buys or sells two middle options but with a different strike price, also equally spaced, they are trading with the condor spread.

American vs. European Options

The previous two sections were dense with information but this one is going to be simple. Think of it as a small break before we dive even deeper!

Whether the option is American or European has nothing to do with geography. An American option can be exercised any time before the expiration date. European options do not offer this luxury and can only be fulfilled on the date of expiration. This is also why European options carry lower premium costs.

Options can be short-term or long-term alike, normally up to three years. The longer the term until the expiration date, the higher the likeliness of the option to be American.

ITM, ATM, & OTM

These abbreviations mean in-the-money, at-the-money, and out-of-the-money respectively. These terms describe the relationship between the market price of the underlying asset and the strike price of the options contract. These terms refer only to a difference between these prices and ignore the premium.

Being in-the-money means that closing the contract would result in a profitable trade. However, if the profit is lower than the premium, you can still end up with a loss. Conversely, out-of-the-money means that the contract at the moment is unprofitable, even excluding the premium.

An at-the-money option’s strike price is equal to the current market price of the underlying asset. In addition to this translating to a loss due to the premium, these contracts also have no intrinsic value but still retain some time value. There is little point in buying or selling an ATM option because you cannot capitalize on a price move unless there is enough time until expiry.

The Greeks

We have already established that the price formation process in options contracts is different than price formation in the underlying assets. It is calculated with special formulas, and therefore, the factors that influence the price can be calculated, too. It even covers the separate kinds of risks, and since they were assigned Greek letters, they are collectively referred to as the Greeks.

Delta (Δ) tracks the option’s price sensitivity to the changes in the price of the underlying asset. It’s also interpreted as the probability of the options contract finishing ITM. Gamma (Γ) measures the delta’s sensitivity to these price changes. In other words, it is useful to track the changes in the premium.

Theta (θ) measures time decay, Vega shows the relationship between the option’s price and implied volatility of the underlying asset, and Rho — with the interest rate. These three Greeks generally decline as the contract approaches its expiration date.

Top Crypto Options Trading Platforms

Now that we’ve covered most basics, let’s get back to crypto options. Which trading platforms give you the opportunity?

- Centralized exchanges: Binance, Bybit, OKX, etc. Offer a wide choice of crypto derivatives but have KYC and regional restrictions.

- Crypto derivatives exchanges: Deribit, Bit.com. Due to its focus on derivatives, this is the most popular platform for trading Bitcoin options. BIT is also worth checking out for a wider variety of crypto options.

- Decentralized protocols: Opyn, Hegic, etc. These options trading platforms are some of the most innovative but least reliable in terms of price reference or liquidity and slippage. They are also built on smart contract blockchains, so are worth looking into if you want to trade ETH or its tokens. Trading Bitcoin options here is possible only through Wrapped Bitcoin (WBTC).

Before jumping on any of these platforms, do your research and learn all of their perks and pitfalls. Here is what you should expect in general from crypto options trading platforms:

- Maker and taker fees. As a reminder, the maker fee is taken for market orders, taker fee is charged on limit orders. In addition, some platforms charge a delivery fee on contract resolution.

- Minimal threshold on order size. Typically, the lowest limit you can find on a centralized platform is 0.01 BTC.

- Automatic executions for in-the-money contracts. Pay attention to the currency of settlement: it can be the underlying asset, a stablecoin, or fiat.

- Short-term contracts. It is not common for crypto options to be long-term because of the volatility of cryptocurrencies. Terms of contracts range from daily to bi-quarterly (6 months).

- Fixed increments for strike prices. Platforms can impose a limit to the precision of the strike price, for BTC it is normally $100 to $1,000 increments.

- Additional leverage of up to 100x. Not universally applicable to all platforms.

- Identification requirements: on most centralized exchanges, you will need to pass a KYC procedure to be able to trade options. Check in advance if the platform can offer derivatives trading to users from your jurisdiction.

Popular Trading Strategies for Crypto Options

In the previous sections, we have already mentioned some of the popular strategies for trading options as examples. Let’s go through them again and cover some new ideas.

If you already own Bitcoin, you can hedge your investment with a covered call or protective put, depending on which market move you expect. By selling a call on BTC you own, you gain the premium but in case the contract is exercised, you will have to sell the Bitcoin. A protective put is used to guard against a market downturn. If your BTC protected by this order goes down in price, the put’s value will increase and offset the loss. You can account for both scenarios by going for a protective collar: writing a covered call to buy a put from the proceeds.

Vertical spreads, such as long call or short put spreads, limit the range in which the asset price has to stay to be profitable but also offset risks and expenses. On the other hand, if a large market move is expected, options traders go for a long straddle or strangle. If the market is not expected to move much, it is the time for butterfly or condor spreads to shine.

We have barely scratched the surface of the diversity of options trading strategies, so if you feel inclined, take it from here and research them in more depth. Always remember that each of these strategies comes with its own set of conditions to be profitable and, of course, risks to consider.

Pros and Cons of Options Contracts

Benefits of Bitcoin Options Trading

Compared to stock options, Bitcoin options can offer a few advantages. For one, the market is open 24/7 and the volatility is generally higher in the crypto market. Higher volatility means leveraged price exposure, especially in options. Wherever the crypto market moves, and it moves a lot, covered calls can generate income through premiums, which are paid upfront. One’s opportunity to hedge their crypto portfolio against the market’s volatility can translate to nice premiums for the other side of the trade! Even the prospect of Bitcoin’s implied volatility increasing can turn into a source of revenue instead of a headache.

Risks of Bitcoin Options

The benefits can be very enticing but the risks are also evident from how the options contracts work. Let’s spell it out once more to let them sink in.

The length of this guide, even though it has been boiled down to bare essentials, suggests that options trading is very complex. Multiply that by the intricacies of trading crypto, and the conclusion is that crypto options trading is not for beginners.

Options trading is appreciated as a way to hedge against risks but this does not mean this is risk-free. You can lose the premium paid for an unsuccessful trade, and leverage can amplify these losses. Volatility can present as many problems as opportunities: as the option shifts between ITM and OTM, its price also fluctuates, while extrinsic value decays.

Shorting with a naked call poses risks that can be mentioned once again. When you sell, or write an option, you give up your right to choose to exercise the contract to someone else. If it is a call option, you take up the obligation to buy BTC at the market price if the holder so chooses. And since the put risk is limited by the downside (BTC’s price cannot go to zero or lower), call risks are near unlimited because theoretically, Bitcoin’s price can go up indefinitely.

The trading platforms for crypto options also present a few challenges in comparison to stock exchanges. The high volatility in crypto assets is partly due to the lower liquidity in the crypto market. Another downside of crypto exchanges is the regulatory landscape and security concerns: even though recently it has gotten better, it is still far from perfect. What is common between most options trading platforms, stocks, or crypto, is the trading fees they take, which can diminish returns and worsen losses.

Conclusion

Even though options in crypto were almost directly adopted from the stock market, this market’s volatility proves to make Bitcoin options a challenging but potentially rewarding financial instrument. And now that Bitcoin ETFs received recognition, we can hope that other regulated crypto derivatives are on their way.

Are you already curious to learn more about the crypto market? Then subscribe to ChangeHero on X, Facebook, Reddit, and Telegram! Once you want to dive into another topic, please feel most welcome to our blog.

Frequently Asked Questions

Are there options on Bitcoin?

Yes, just like stocks or other types of financial assets, option contracts can be backed by Bitcoin and other cryptocurrencies. They are commonly traded on large centralized crypto exchanges and crypto derivatives trading platforms.

What is the largest Bitcoin options exchange?

According to the Coinglass data, at the time of writing, the leading Bitcoin options exchange in terms of open interest is Deribit.

Are crypto options profitable?

In comparison to regular option contracts, crypto options carry higher risks but have the potential to bring higher rewards. At the end of the day, though, the profitability ratio of successful to losing trades in crypto options is probably the same as in stocks.

What are the options for selling Bitcoin?

If you already have Bitcoin, you can sell it in a spot market on a crypto trading platform, OTC desk, or off-ramp provider. You can also use it to back a position when trading derivatives, such as options. Shorting Bitcoin with a naked position is also technically possible but not advised in case of failure to deliver to the buyer and unlimited risks for the seller.

Disclaimer

This article is not a piece of financial or investment advice. When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration and analysis of your own research and at your own risk.