Ether (ETH) is one of the most popular crypto assets, and as of 2023, it operates on the energy-efficient Proof-of-Stake consensus. But to most holders, staking is better known as a source of passive income, and contributing to the Ethereum network is a nice afterthought. In this guide, ChangeHero will review the top providers for ETH staking these days and argue why popular does not equal best.

Key Takeaways

- Ethereum (ETH) staking is an activity of depositing 32 ETH or more into a contract to start validating the blocks. In return, validators receive compensation, also known as block or staking rewards.

- Today, there are several ways to stake Ethereum: running a validator node solo, outsourcing it to a cloud-based node, or contributing to pooled staking.

- Among the pools, the best conditions are provided by StakeWise and Guarda Wallet. Those who can afford a full node can leave the setup to Blockdaemon, Coinbase Cloud, or Avado. Staking ETH with Lido Finance and Binance Staking is very popular but for a few reasons not recommended.

Quick Guide to ETH Staking

In case you are not familiar with the topic, staking in crypto means locking crypto assets in the protocol to participate in maintaining the blockchain. It is a key mechanism in the Proof-of-Stake consensus, which rewards validators for honest work in proportion to the amount they contributed.

The term “staking” comes from the game theory roots of this consensus algorithm. Essentially, you make a bet that you can verify transactions: when you do it successfully, you win, but you can also lose.

Since 2022, Ethereum has been using the Proof-of-Stake consensus mechanism. It has quite a high entry barrier — 32 ETH — and locks the stake, so the assets cannot be used.

Moreover, the Ethereum network has strict requirements for validators, and if they behave dishonestly or go offline, their stake gets slashed and they lose their assets. On the flip side, all these requirements and penalties ensure that Ethereum’s security and integrity are not compromised.

Validators are responsible for storing data, processing transactions, and verifying new blocks in the chain. To compensate for the work, validator nodes receive staking rewards: rather than scale with the stake size, they directly correlate with the amount of work done fairly. Anyway, since it is the amount of work that depends on the size of the stake, there is a direct correlation with the rewards.

This is why options like staking-as-a-service or pooled staking are quite popular. They are available even if you do not have 32 ETH to spare, or if you are not willing to get technical to set up a device that would be reliably online 24/7.

Further in this guide, we will go deeper into the intricacies of each option and compare how you can stake Ethereum. Keep reading for the list of the best providers to stake ETH in 2023!

What Options Do You Have to Stake Ethereum?

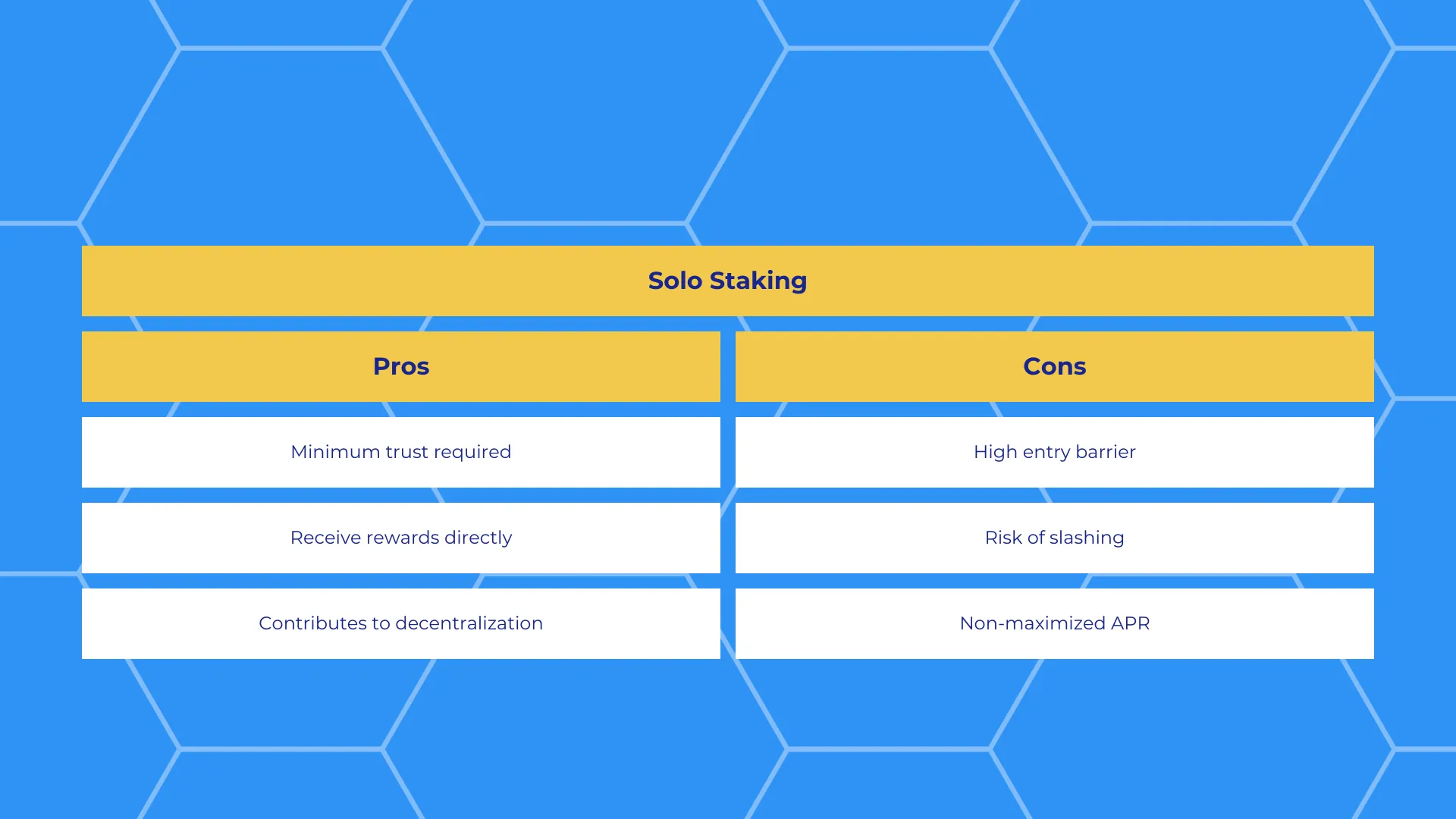

Solo Staking

The least trust-reliant and secure way to stake Ether is to run a validator node. As we mentioned, you will need to have at least 32 ETH and a machine that can run the software and be online 24/7.

This method is considered the gold standard because it is the most trustless and direct. You receive staking rewards and transaction fees directly from Ethereum, without any intermediaries.

There is also no counterparty risk, since your private keys and assets remain under your direct control. However, none of the methods are risk-free, including solo staking.

If for some reason your node fails to notice an invalid transaction or goes offline, your stake will be at risk. Make enough mistakes like that, and you will be kicked out of the validator roster, in addition to losing your ETH.

The reward rate for solo staking comes up to 3.87% APR, according to Staking Rewards. The minimum 32 ETH (~$58,220) will yield $135.07 in a month and $1,643.32 after 365 days.

Delegator-as-a-Service

Alternatively “staking-as-a-service”, this method outsources node maintenance to a trusted provider. You still need the full 32 ETH but the rewards your validator node receives are also directly credited to you.

Some companies came up with an offering to provide the plug-and-play hardware. Basically, you would be home solo staking on pre-made hardware while still remaining in control of keys and assets.

In addition to the solo staking risks, this method implies a counterparty risk to a degree. To give the provider the ability to stake on your behalf, you will need to entrust them with your signing keys.

The silver lining is that the withdrawal keys remain in your possession. There is also a lower risk of setting something up wrong, which otherwise can result in slashing, thanks to the assistance from the provider.

On Staking Rewards, the APY estimations for this method range from 3.52% to 5.09%. The figures on the high end should be taken with a grain of salt because they include pooled mining in the calculation.

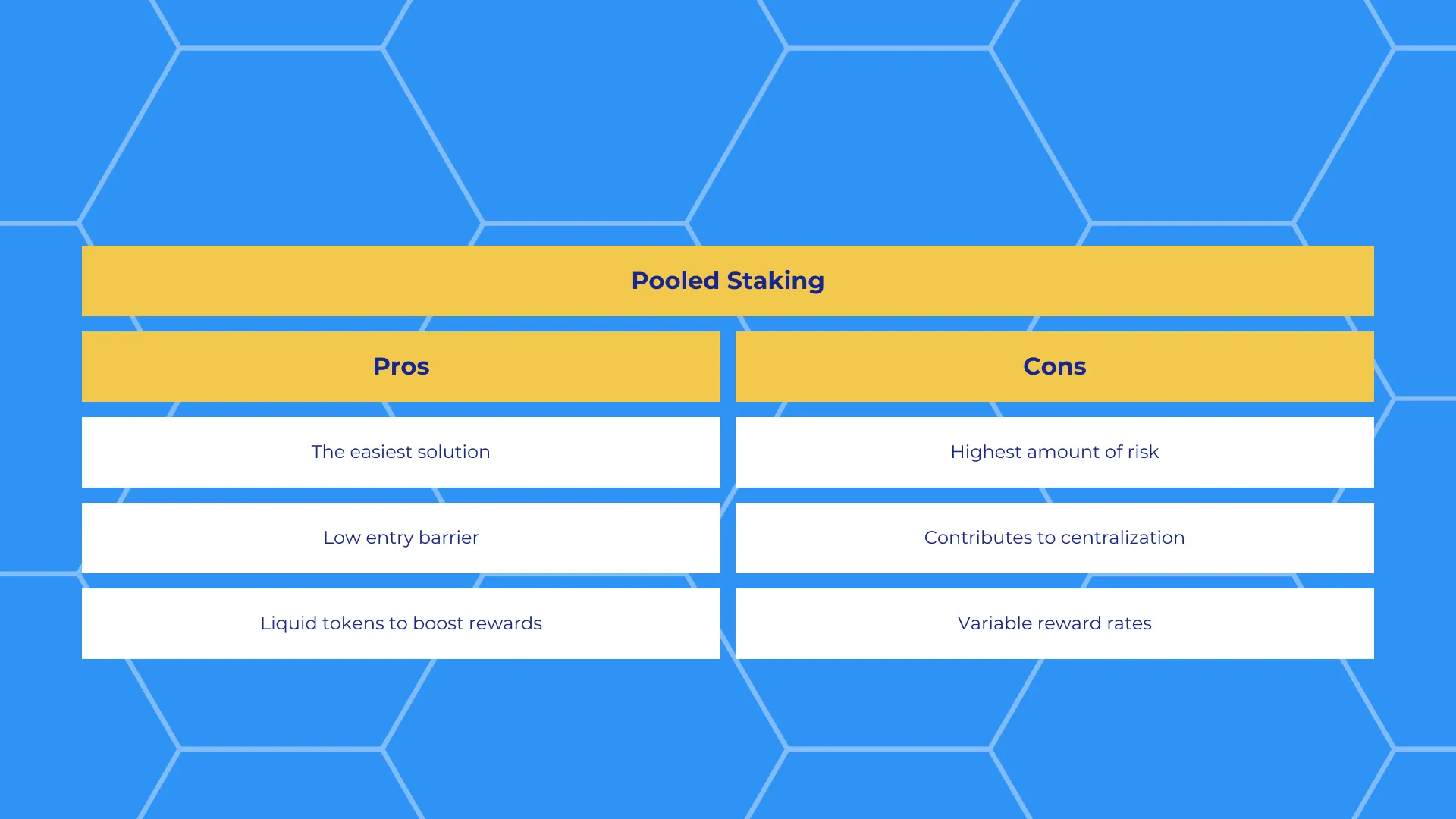

Pooled & Liquid Staking

Called “pooled staking” in the official Ethereum documentation, these solutions may be more familiar to you as “liquid staking”. These protocols provide you with a token that represents your staked ETH, and unlike the real deal, it is not locked and therefore, liquid.

Pooled staking is the most popular form of staking Ether because of its low entry barrier. Depending on the provider, there may be virtually no barriers to entry.

Exiting a staked position is also easier with liquid staking: you will not have to wait for seven to eight days. You will not even have to deposit ETH anywhere to participate in the pool: buying a staked ETH token or borrowing it should let you redeem the stake.

At the same time, this method concentrates the most amount of risks. In addition to the counterparty and execution risks, there is always a chance of a smart contract shortcoming within a protocol.

With a few exceptions, liquid staking also does not provide higher ETH staking rewards than solo staking. However, in capable hands, it can become more profitable thanks to the liquid tokens given out by these providers.

We recommend reading our guide to liquid staking of ETH if you would like to learn more about this method.

Where to Stake Ethereum (ETH)? The Best Providers in 2023

Now that we have gone over the methods of ETH staking, let’s get even more concrete. We reviewed seven providers for various staking methods with the highest ratings and the best conditions.

We will be referencing the 3.87% APR from solo staking as a benchmark. At the same time, lower Ethereum staking rewards do not necessarily mean a worse experience — these providers can be attractive due to having more lax requirements.

StakeWise — Up-and-coming Ethereum Staking pool

Reward rate: 3.75%

First up, we are going to review the most popular solution with the highest reward rate to date. Surprisingly, it is not the most well-known one — but the competition has created some attractive conditions for ETH stakers.

StakeWise offers stable uptime, DeFi integrations, and access to an informative dashboard. The APR at the time of writing is 3.7% after the 10% fee is accounted for.

Even though the reward rate is slightly below the solo staking rewards, it can be made up for with the protocol tokens’ help. StakeWise tokenizes staked ETH and rewards separately and issues sETH2 and rETH2 to participants respectively.

If sETH2 and rETH2 are not enough, how about liquidity mining for the governance token SWISE? All of them can be then locked in a Uniswap v3 liquidity pool right away for even more returns.

The documentation claims that the minimum amount to stake is 1 wei — for the curious, it is 0.000000000000000001 ETH. For simplicity, you may consider there being no minimal requirements at all.

Guarda Wallet — Multi-Asset Wallet with Liquid Staking

Reward rate: 3.25%

In 2023, there is no shortage of liquid staking solutions for Ethereum and other popular assets. However, a few of them can rival the convenience of creating a liquid stake right in the wallet app.

Crypto wallets and exchanges started offering staking a while ago but Guarda Wallet takes it a step further. They provide an integrated solution to stake ETH and receive GETH in return.

Although it is a service provided by a wallet, it is fully non-custodial, unlike other centralized options. Guarda does not store any of the keys on their side, including validator and withdrawal ones.

The ETH staking rewards, in comparison to the rest of the providers we reviewed, are on the lower side. The official website puts it around 3% while Staking Rewards estimates it to be closer to 3.25%.

In return, you get the most straightforward user experience that does not compromise the security of your funds or the network. To start, you will need 0.01 ETH minimum.

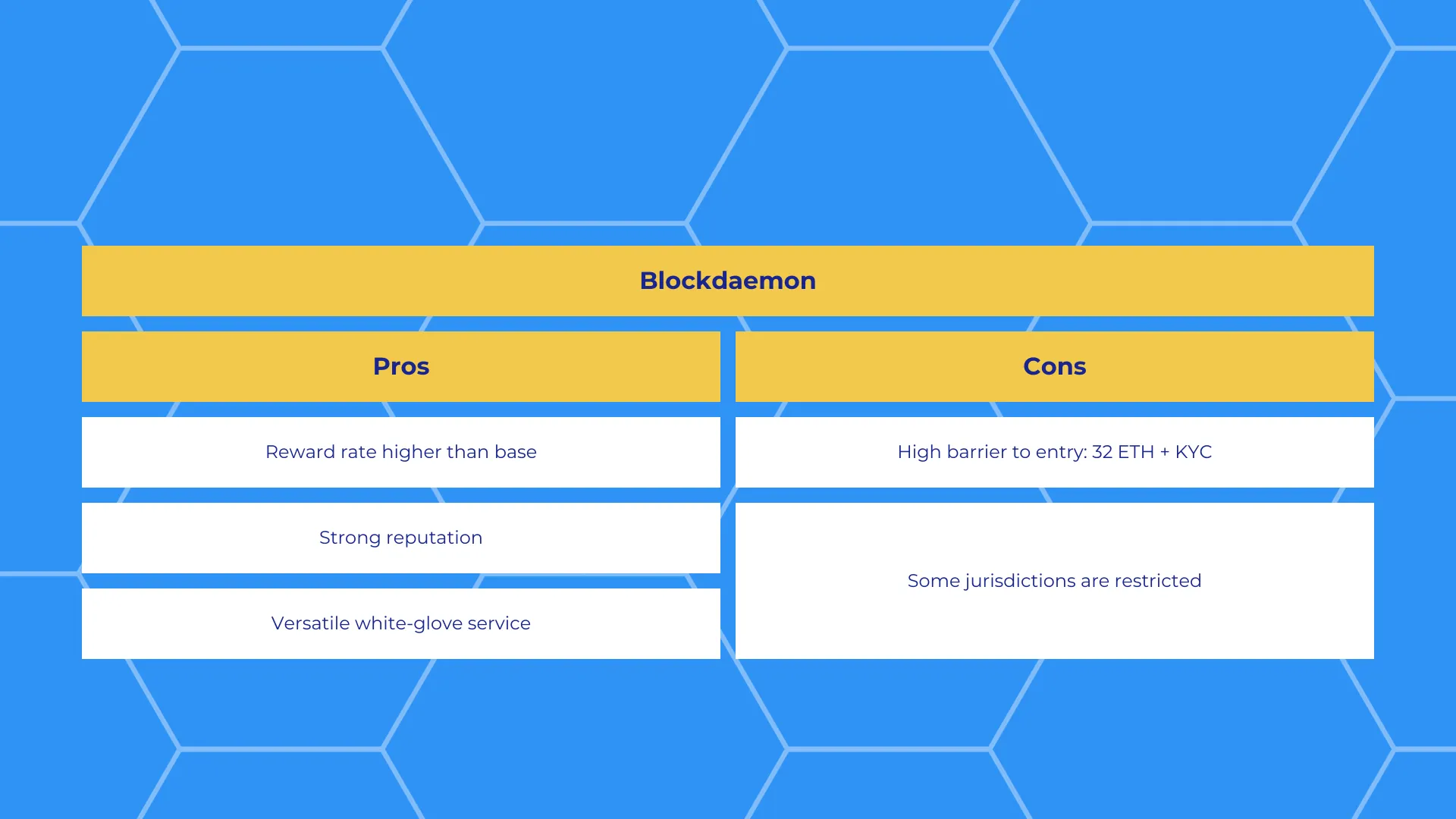

Blockdaemon — Validator-as-a-Service with the Best Staking Rewards

Reward rate: 4.38%

Our next reviewed provider is a long-standing player in the node operator market. This offer is for those who have 32 ETH to spare but would like to reduce the risks of slashing and custody while getting the most out of staking.

Blockdaemon has been working since 2017 and by now has built up a reputation for its commitment to security and reliability. In addition to node and cloud services, they now offer staking for dozens of top protocols.

How do the validator-as-a-service providers like Blockdaemon manage to ramp up the rewards from running a validator? For one, by using MEV-boost, among other things.

MEV stands for “maximum extractable value” and is a term used to describe techniques for arranging transactions in the blocks so that the profit is maximized. MEV has a somewhat controversial reputation with the DeFi crowd because it encompasses techniques that are considered to be attacks, such as frontrunning.

For stakers, though, it gives a competitive advantage that does not necessarily facilitate dishonest behavior. In addition to that, Blockdaemon gives an option of liquid staking, albeit their solution is geared towards institutional investors.

In short, Blockdaemon is transparent that their solution is not for everyone. At the same time, they provide some of the best conditions for staking Ethereum while outsourcing the most troublesome parts.

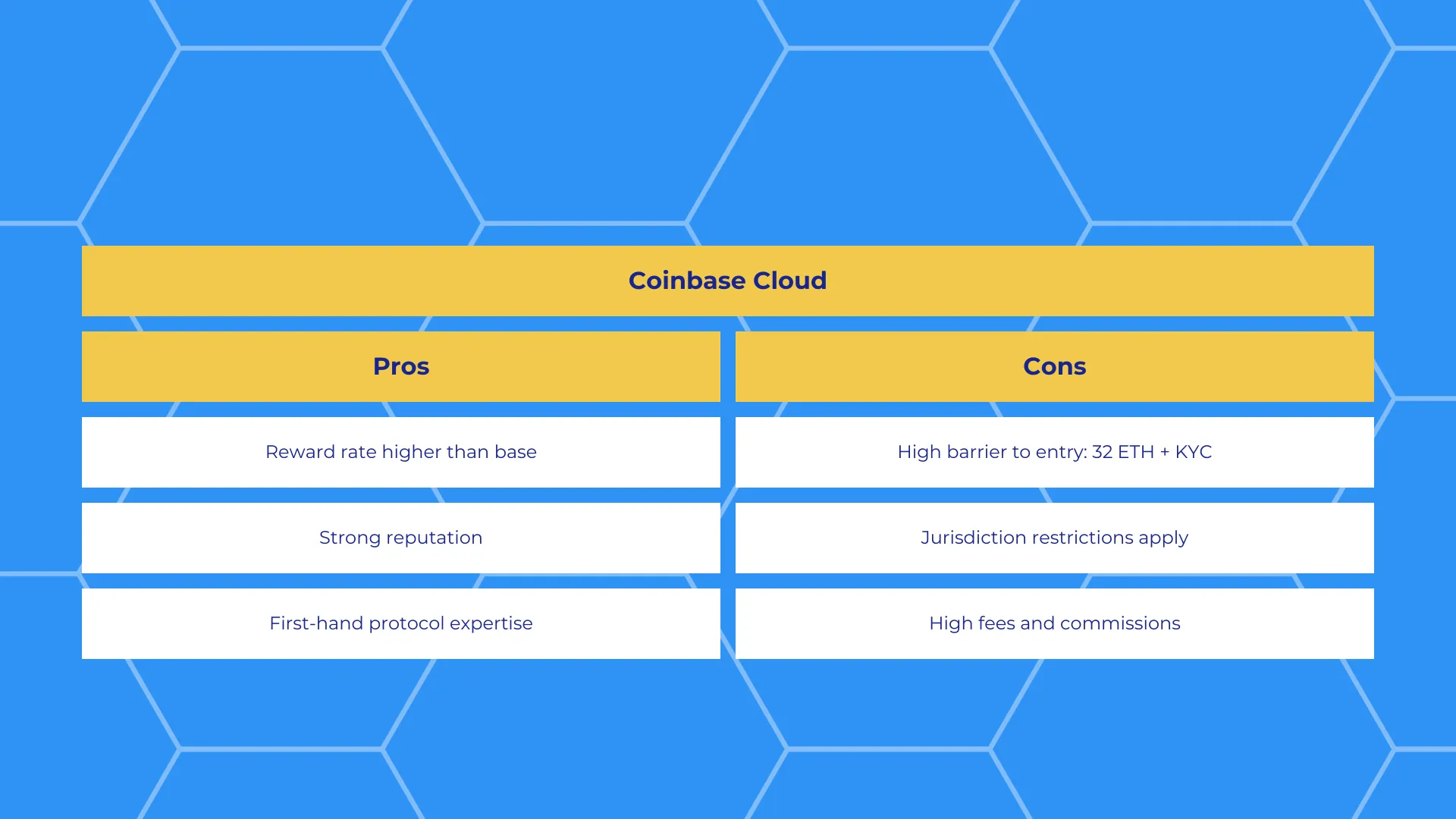

Coinbase Cloud — Reputable provider with competitive staking rewards

Reward rate: 3.99%

One of the direct competitors for Blockdaemon would be a more familiar name: Coinbase Cloud. This branch of one of the best-known blockchain companies also offers node and cloud services but with an explicit focus on staking.

In addition to Ethereum, Coinbase Cloud supports 15 networks. You have the option to delegate some of your assets to a pool or run a validator on their hardware.

You’ll notice that the reward rate for their solution is slightly lower (3.99% according to Staking Rewards). This comes as a result of their higher maintenance fees: up to $100 a month.

At the time of writing, the public pool for Ethereum seems to not be available. For the time being, the only option for staking ETH with Coinbase Cloud is to outsource a validator node.

Why do we recommend this validator-as-a-service if there are so many caveats? Because in addition to having a higher than base reward rate, Coinbase is also known for its role in the industry.

Avado — Supercharge Solo staking rewards

Reward rate: 5.09%

Avado is an interesting solution that lets you do solo staking while taking care of the hardware. They offer plug-and-play devices with suitable processors and memory to run the validator node software.

By using MEV-boost, these machines can improve the reward rate, although, for a full node, it will remain only slightly higher than the base. The 5.09% reward rate that Staking Rewards attributes to this method comes from liquid staking in RocketPool from the Avado device.

In other words, Avado is not just a hardware seller but they provide the full set of Ethereum staking services. From cloud hosting to staking ≥17.5 ETH, they can assist you in more ways than one.

The devices range from $900 to $6,900 depending on the processor and disc space. Rather than incurring monthly costs, this method will let you pay upfront once and reap the full future rewards.

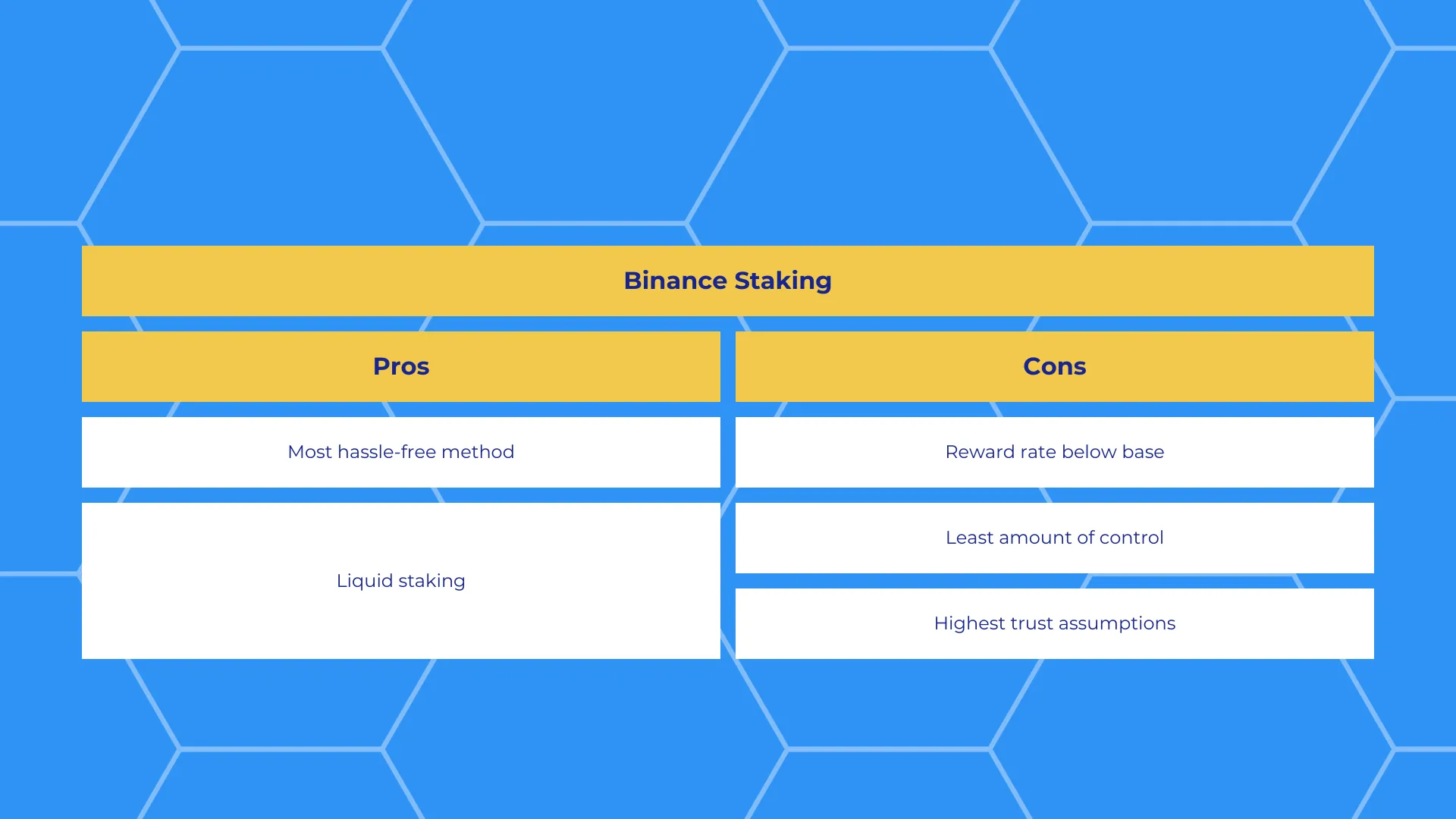

Binance Staking — Catch-all ETH Staking Solution

Reward rate: 3.56%

For the sake of completeness, we should mention the Ethereum staking methods most popular with users. After all, it is for a reason!

Staking ETH on centralized exchanges, such as Binance, is a decent way to make your Ether on the exchange’s balance work. Unlike staking from self-custody, it does not require you to connect a wallet or transfer ETH for a fee anywhere.

As long as you understand that this method has the highest trust assumptions and therefore, lets you have the minimal amount of control over your funds, this is an option to consider.

In the case of Binance, your staked ETH will become an equal amount of BETH. However, to use those for anything other than swapping BETH back to ETH, it needs to be wrapped to WBETH.

Binance does not calculate the reward rate itself but rather uses the one defined by the protocol. It collects a fee from the pool’s earnings, so the APR for this method will always be below the base level.

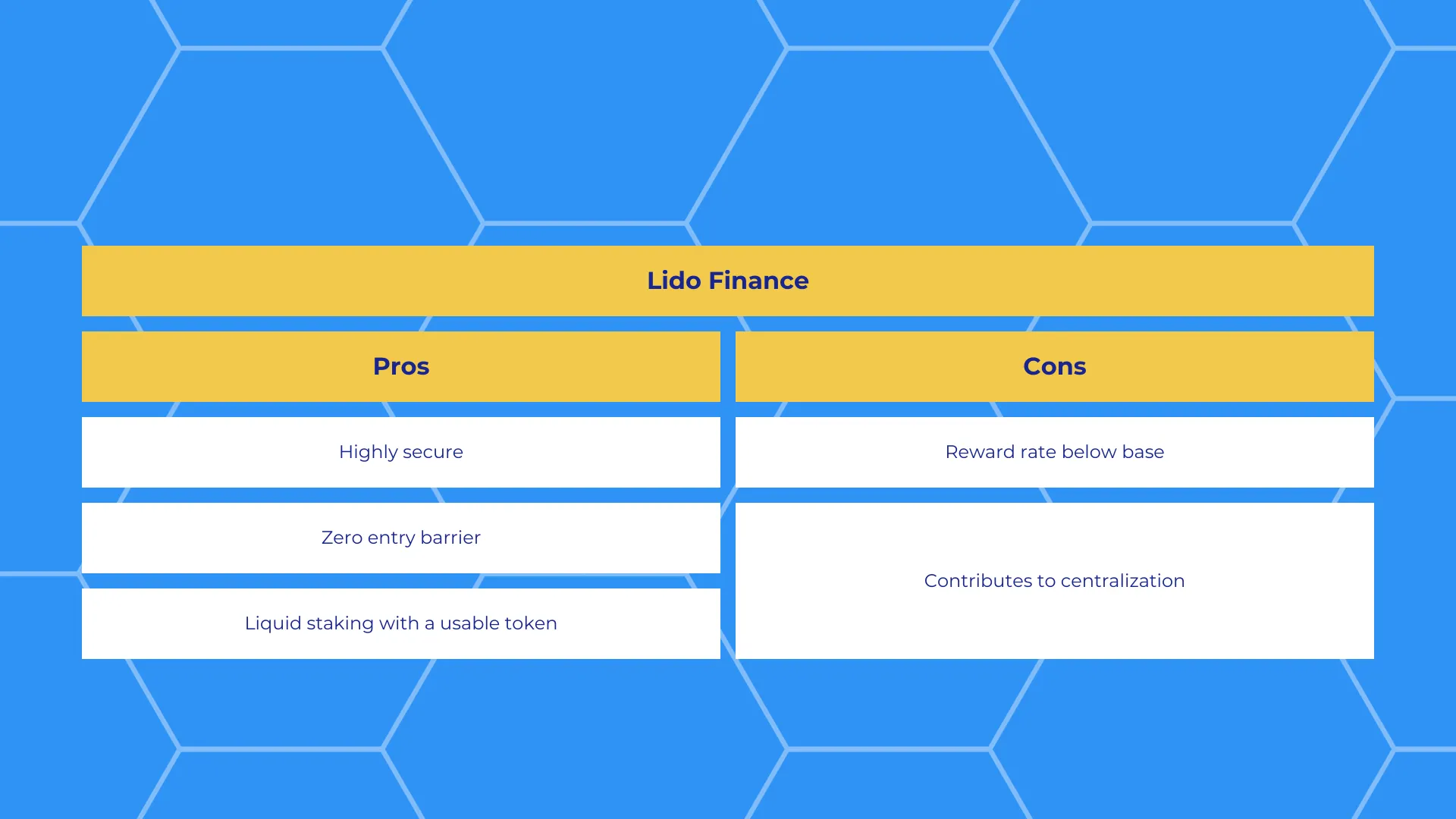

Lido Finance — Largest liquid staking provider

Reward rate: 3.58%

And finally, the go-to solution for liquid staking of Ethereum, Lido Finance. Its relevance is self-evident: the protocol exercises a whopping 31.6% of network control, and the market cap of stETH, according to some sources, puts it in 7th place among all crypto assets.

The concentration of staked Ether led to users being actively discouraged from using Lido Finance. The service itself is fine, and even the official Ethereum knowledge base recommends it.

Lido Finance has great, battle-tested security, is non-custodial, and relies mostly on open-source smart contracts instead of trust. It has an arbitrary lower limit, like StakeWise, but stETH is far better recognized in the DeFi sphere.

Nevertheless, we include Lido Finance only to acknowledge its place in the Ethereum ecosystem. If you intend to take the validator role seriously and contribute to the network in a positive way, it would be better to go for less centralized solutions.

Conclusion

Staking Ethereum is a great way to help the network and earn rewards on top. Just remember that the former comes before the latter, and pick the providers accordingly.

Check out our blog for even more insightful articles on all things crypto. To stay in touch with news and updates, subscribe to ChangeHero on Telegram, X (Twitter), Reddit, and Facebook.

Frequently Asked Questions

Is staking Ether risky? What is the safest way to stake Ethereum?

None of the ETH staking methods are risk-free. Solo staking at home is considered to be the gold standard but there is always a chance of setting things up wrong. Outsourcing a stake reduces this risk but introduces counterparty and smart contract risks.

Should I stake my Ethereum on Coinbase?

Some centralized exchanges give you the option to stake Ethereum in your balance. By doing it, you will actually pool your assets with the assets of other users and let the exchange stake it on your behalf. It is considered the easiest way to stake but from the security perspective, self-custody is always better.

Who is the largest ETH staking provider?

At the time of writing, Lido Finance is the largest ETH staker with 31.6% of all Ether staked. Users are encouraged to use other providers to improve the degree of decentralization of the Ethereum network.

Is it worth it to stake Ethereum? How much do you make staking Ethereum?

Depending on the method, staking ETH will net you 3~5% a year. The APR is dynamic and adjusted according to the number of validators. Additionally, due to the ETH price volatility, the value of rewards can change as well.