On April 12, 2023, around 10:30 pm the Shapella upgrade was activated on the Ethereum mainnet. It consisted of the Capella hard fork that added new things to its consensus layer and the Shanghai upgrade to the execution layer. The major change introduced by it was the withdrawal of staked Ether. Let’s unpack the event and analyze its aftermath.

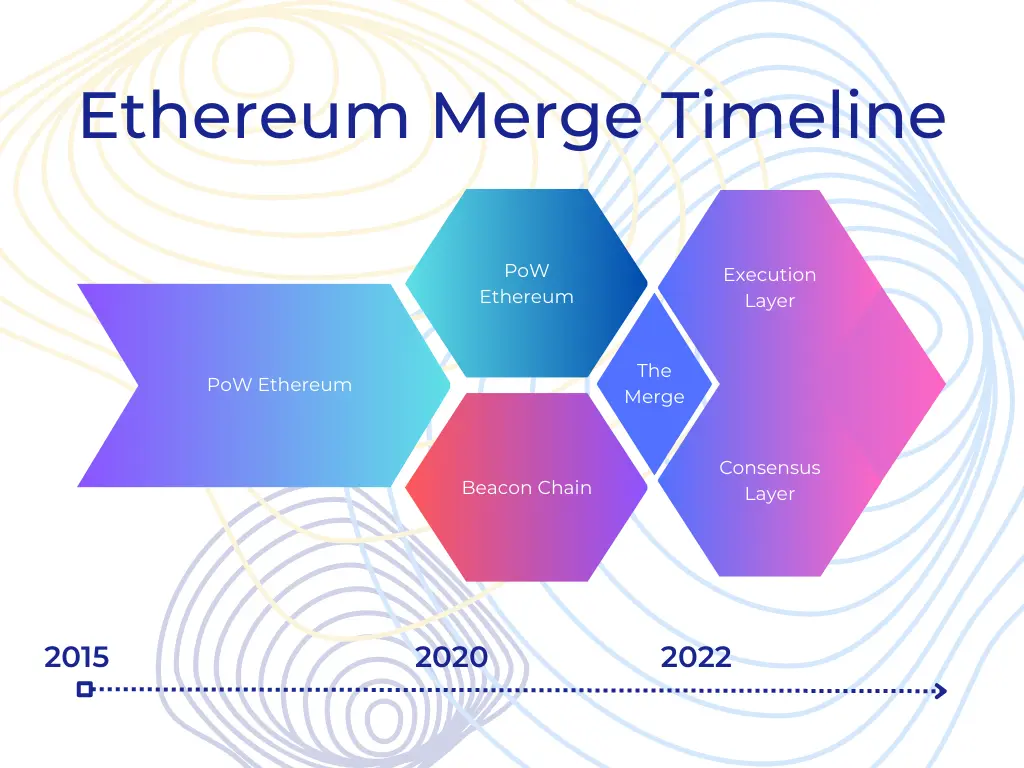

Timeline of the Merge

The Shanghai upgrade became the final step in completing the transition from Proof-of-Work to Proof-of-Stake that started in 2020.

The first milestone in this journey was the launch of the Beacon chain mainnet. At the time, it was also known as Ethereum 2.0. This was a completely independent chain from the PoW Ethereum network, with its own set of rules and validators. Notably, it did not have a way to withdraw staked assets from the very beginning, and nodes had to trust Ethereum developers that they will eventually merge this chain with the mainnet and enable staking withdrawals.

In a little while, the Ethereum Foundation proposed an alternative naming convention for the new network structure. They retired the names Ethereum 2.0 and ETH 2.0 because it created the impression that the new chain will make the old one obsolete or replace it. In reality, their plan was to merge the two coexisting chains, and thus, the upgrade came to be known as The Merge.

Almost two years later, in September 2022, the developers achieved an incredible feat and activated The Merge, making the Beacon chain the consensus layer and the PoW chain the execution layer of Ethereum while replacing the consensus mechanism with Proof-of-stake at the same time. The most impressive thing was that it all happened without any downtime or outages.

Nevertheless, the Proof-of-Stake transition was still not complete: ETH unstaking was not available until now. After the Shanghai upgrade on April 12, 2023, the validators can finally unstake ETH partially or entirely.

Shapella Upgrade

Despite colloquially being known as the Shanghai hard fork, the actual name of the upgrade is Shapella. It is a portmanteau word made of the combination of Shanghai and Capella, which are the names of hard forks on the execution and consensus layers respectively. The full list of Ethereum improvement proposals included in the upgrades beyond the most noteworthy ones can be found in the Foundation’s blog.

Since the two are a package deal, network validators should update both the beacon node and a validator client. Developers of Ethereum smart contracts should keep an eye on deprecated opcodes but otherwise, these hard forks do not introduce breaking changes. ETH holders also don’t need to take any special steps or actions.

How ETH Withdrawals Work

The network validators will have two options to collect the rewards. There are full and partial withdrawals enabled after the upgrade. A node operator should check whether it has an active withdrawal address, which could be provided when setting up a node. If not, they will need to migrate their withdrawal credentials. The withdrawal transaction and a withdrawal address setup are one-time and irreversible.

By initiating a full withdrawal, the validator essentially quits. It doesn’t happen instantly, since the validator is put into the queue and their placement depends on the size of the stake. The queue uses the same formula as the validation approval process, meaning the more active validators there are on the network, the faster the exit from the Beacon chain.

To collect any excess ETH and continue participating in the consensus, the user has to initiate a partial withdrawal. The partial withdrawals are also put in the queue but are processed faster than the full ones. These rewards will be immediately available for spending.

In other words, there is a buffer to prevent mass withdrawals of staked ETH. The unlocking coins will enter circulation gradually.

The Impact of the Ethereum Shanghai Upgrade

The impact of the Shapella hard fork on the crypto market and ETH is divisive. While for Ethereum users and developers this is an important milestone, other investors predict sell pressure from the previously staked Ether entering the market. After all, at the time of the upgrade, 14% of the total ETH supply was locked behind staking.

JPMorgan is one of the most bearish voices in the room. Their analyst Nikolaos Panigirtzoglou cited the amount of ETH to enter the market this week — more than Ξ1 million — as well as a possibility for “troubled entities” to derisk by unstaking ETH in the coming weeks. He could have been referring to a bankrupt crypto lender Celsius which is speculated to exit its staking position.

Bank of America and Coinbase, on the contrary, believe it will only increase ETH’s volatility by a few percent. On-chain data analytics service Glassnode provides data to back their claims.

Tech-focused media outlet Wired highlighted a surprising consequence of the Merge completion. They claim it can reignite the debate on the environmental impact of Bitcoin, providing weighted arguments from both sides.

Conclusion

After Ethereum’s Shanghai upgrade, the Merge is officially complete. However, the development roadmap is far from being blank: the next stop is integrating rollups into the Ethereum blockchain! ETH users still have something to look forward to in the future.

Tune in to our social media — Twitter, Facebook, Reddit, and Telegram — to learn about news like this as they happen! And for more detailed coverage, keep an eye on our blog.