The Graph and its coin have been flying under everyone’s radar but today are making news headlines. The indexing solution’s migration to Arbitrum is confirmed to be in its final stages. The ChangeHero team reviews GRT news and The Graph price predictions to find out: how high can The Graph coin go?

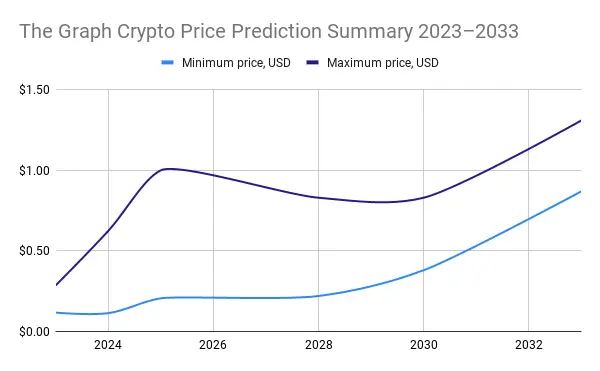

The Graph Crypto Price Prediction Summary 2023–2033

- The Graph is an important building block for the decentralized web. It allows developers to easily access and query data from blockchains, which is essential for building decentralized applications. The GRT token is used to incentivize node operators and pay for querying data;

- The outlook on The Graph is not extremely bullish. The reason is a solid but niche use case and the focus of the team on building value. Experts don’t see GRT beating its historical record price anytime soon;

- The Graph coin GRT can exceed $1 in a few years. However, no one expects it to reach $10.

What are The Graph and GRT?

Due to their design, it is challenging for blockchains to use real-world data directly — and vice versa. It could be done with the help of infrastructure providers but most of them are centralized. The Graph is the first decentralized indexing protocol for blockchain data. It allows developers to easily access and query data from distributed networks, such as Ethereum and IPFS. The Graph is built on a decentralized network of nodes, incentivized to index and serve data.

Developers can use The Graph to build decentralized applications (dApps) that require real-time data from blockchains. For example, a dApp that displays real-time transaction data on the Ethereum blockchain could use The Graph’s subgraph to fetch and index that data.

GRT Token

The Graph’s native token is called GRT. It is used to incentivize node operators to index and serve data on the network. Node operators must stake GRT to participate in the network, and they earn rewards in GRT for indexing and serving data.

GRT is also used to pay for querying data on The Graph. Developers must pay a small amount of GRT to query data, which is used to pay node operators for serving it.

If you are completely unfamiliar with this exciting project and want a more detailed introduction to GRT, we recommend reading our Beginner’s Guide before this article.

GRT Price History

GRT Price In 2020–2021

The price of The Graph token (GRT) started at around $0.15 when it launched in December 2020. It remained stable for the first few weeks, but then steadily rose in January 2021. By mid-February, the price of The Graph had reached an all-time high of around $2.80, representing an 18-fold increase. The growing demand for decentralized finance (DeFi) applications, which rely heavily on blockchain data indexing services like The Graph, was one of the primary factors that contributed to this rapid price increase. Additionally, the overall bullish market sentiment also likely contributed. However, the price of GRT experienced significant volatility throughout 2021. After reaching its all-time high in mid-February, the price of GRT declined rapidly to around $0.60 by mid-March, likely due to the broader market correction and profit-taking by investors.

GRT Price In 2022–2023

2022 went down into the history of crypto as another challenging year in a cycle. It started with the GRT price at $0.6445 and saw it drive down to $0.055. Despite positive network growth, there was hardly a chance for The Graph (GRT) price to override the overall crypto market trend. Globally, there was a market-wide correction after a 2021 bull run. To add insult to injury, declining values led to some projects collapsing: first Terra (LUNA), then CeFi lenders such as Celsius and BlockFi, then FTX in late 2022.

This year so far has been better but not significantly. In early 2023, GRT jumped to $0.2 for the first time since May 2022. The impetus for this action was the launch of The Graph on Arbitrum, an Ethereum layer-two blockchain. Since then, The Graph’s price pulled back and skidded to the levels we are seeing today.

At the time of writing, the current price of GRT is $0.09918 and the token ranks 41st by market capitalization according to CoinMarketCap.

What Influences the Price of GRT?

Demand for Indexing

Indexing is one of the essential steps in software development that makes data from a database easier to access. Blockchains can be thought of as distributed databases, except they are also able to run software, too.

The demand for GRT tokens is expected to increase as more developers and users begin to use The Graph to access blockchain data. And an increase in demand for GRT should drive up the price of the token.

As the usage of The Graph network grows, the amount of data being indexed and served by nodes will also increase. This increased usage of the network could lead to higher rewards for node operators, which in turn could lead to more users running nodes and staking GRT tokens. This increased staking could further drive up the price of the token as well.

Overall, the usage of The Graph gateways can have a significant impact on the price of the GRT token. Increased demand for GRT, increased staking of GRT, and increased usage of the network could all contribute to higher prices for the token.

Network Growth and Competition

The Graph is not the only indexing solution that offers a departure from centralized infrastructure providers. Covalent provides a unified API for accessing blockchain data across multiple networks, while Moralis provides a backend-as-a-service platform for building decentralized applications. Another provider, QuickNode makes access to Ethereum and Binance Smart Chain nodes fast and reliable.

This is not to mention that centralized blockchain infrastructure providers Alchemy and Infura still have the lead. There is a reason the blockchain trilemma implies that by sacrificing decentralization, better scalability and security can be achieved. Unless The Graph offers some edge that makes it even more attractive than these providers, the demand will be growing but not skyrocketing.

The Graph is not native to Ethereum only, as it’s supported both on alternative L1s and Ethereum’s L2s. We have already mentioned Arbitrum, but before that, The Graph launched on Polygon. As for Ethereum’s counterparts, The Graph can fetch data from Near, Avalanche, and Solana as well. More networks on the table can also lead to an increased demand for GRT, which could drive up the price of the token.

Token Distribution

The tokenomics of GRT directly influences its price, and the good news is that the initial vesting has concluded. There are no token unlocks expected anytime soon.

At the same time, GRT strongly relies on emission rewards to keep a revenue stream for indexers. In other words, GRT has no cap on the max supply and experiences inflation. There is a token burn in place but its effects will only restrain inflation, not override its pressure on the GRT price completely.

Our The Graph (GRT) Price Analysis and Forecast

What could be inferred from the technical analysis of the GRT to USD daily chart, in addition to the factors we analyzed above? For one, the relative strength index has touched the lower edge of the undervalued area, meaning that it would take extreme selling pressure to bring the GRT price lower. This is not definitively the bottom, since there are hardly any signs of a trend reversal.

To reclaim a local high, GRT would need to push through four resistance levels — a scenario not likely in the short term under normal circumstances. If we entertain this idea, the next stop after the $0.2 would be touching $0.3. We could sooner see GRT going for $0.1134 and $0.1317. The current long-term support level is $0.907.

The Graph Price Prediction 2023

Even despite the GRT price movements being in a slump somewhat, analysts still hope for a positive price action this year. The Graph has already proved that by shipping updates and expanding to more networks demand and investor confidence can be boosted.

For example, CryptoNewsZ still does not consider its earlier 2023 GRT coin price forecast as invalidated. The minimum price that is fair for GRT in their opinion is $0.117. At its very best, it can rise to $0.285 by the end of 2023. Their colleagues at CoinPedia give a similar The Graph price prediction for 2023. The highest price it should be able to reach is $0.251.

In the statement by Bitcoin Wisdom, they commend The Graph for its commitment to building value and readiness to serve future use cases, such as artificial intelligence (AI). At the same time, their GRT price forecast for 2023 does not see it trading outside of the $0.120525–0.150657 price range.

The Graph Price Prediction 2024, 2025

YouTube channel InvestAnswers takes a deep dive into The Graph in their series titled Should I Buy? The answer is as straightforward as it can be: this asset is worth your attention at the very least. In the next cycle, they expect it to overtake $1, and it may seem bold. Mind you, this would be a 7x price increase, and GRT has made larger strides before.

The Graph price prediction by CoinCodex is less bullish. They don’t expect GRT to overtake its ATH anytime soon. $0.6232 will be the highest The Graph price can go in 2024, and in June its price will go back to $0.1182.

By analyzing past price data, technical indicators of GRT, and social media activity, Coin Arbitrage Bot provides the following The Graph forecast: in a year, it will gain 19.66% and be worth $0.11356. By the end of 2024, its value will increase by 116.83% to $0.20577. In 2025, the GRT price will further go up to $0.36092, gaining 280.32%.

GRT Price Forecast 2028, 2030, 2033

The Graph is not the project to buy into for a quick buck: the team is focused on results. These projects are supposed to shine the brightest in the long term, so let’s look at how experts evaluate GRT’s future prospects.

AMBCrypto is not too optimistic about the future price movements of GRT, predicting very conservative gains. In 2028, it is expected to be in the range between $0.22 and $0.34. In 2030, this range will move up to $0.38–0.58. By 2033, a whole decade from now, they don’t see GRT trading above $1.31. While it may seem too pessimistic for so long in advance, it is worth remembering that GRT is an inflationary token, so these figures are in line with the supply dilution.

The algorithm of Bitnation projects the same growth curve for all cryptocurrencies, expecting the value of the whole crypto market to gradually grow. By 2028, to this tune, the GRT value will rise to $0.614586–0.674062. In 2030, the trajectory continues to $0.812839–0.872315.

Last but not least, PricePrediction.net gives an equally tempered forecast of future results for GRT. In 2028, its predicted price range is expected to be between $0.72–0.83. As for 2030, it will reach the coveted dollar mark and trade for $1.49–1.83. Nevertheless, for so many years in advance, this is a modest estimate.

Conclusion

The Graph is far removed from the picture of a hype-generating coin. Due to this, it can fly under the radar but this project is worth checking out. Now, especially with the pivot of tech and crypto to AI, it could be poised to overtake many of its competitors.

How accurate do you think these price forecasts and predictions are? Let us know on Twitter, Reddit, Facebook, and Telegram, and subscribe while you are at it! For more content to help you navigate the crypto world, try browsing our blog.

Frequently Asked Questions

How much will GRT coin cost in 2025?

GRT’s projected price in 2025 varies depending on sources, with forecast price targets ranging from $0.20577 to over $1.

Will The Graph crypto reach $10?

GRT is an inflationary token, and its max supply increases by ~3% each year. For GRT to reach $10 for one token in 2023, its fully diluted market capitalization has to flip Tether USD and exceed $100B.

How much is GRT worth in 2030?

There are differing price predictions for GRT’s 2030 price target, with estimates spanning from $0.38 to $1.83 across multiple sources.

Disclaimer

This article is not a piece of financial or investment advice. No price prediction is guaranteed to provide exact information on the future price.

When dealing with cryptocurrencies, remember that they are extremely volatile and thus, a high-risk investment. Always make sure to stay informed and be aware of those risks. Consider investing in cryptocurrencies only after careful consideration and analysis of your own research and at your own risk.