Bitcoin is more and more frequently touted as a hedge against inflation, and in 2021 it is even getting recognition as a legal tender. Does it mean that Bitcoin as digital gold could become the basis of a new standard for money? Our team takes a deep dive into the narrative to find out!

Gold and Properties of Money

When we are thinking about the history of money, most likely, we will remember the role of gold. It is a valuable metal which was used for luxury goods and money for a long time. This is easily understandable. Gold fulfills all properties of ideal money:

- Fungibility (ability to be interchangeable);

- Durability;

- Divisibility;

- Portability;

- Cognizability;

- Scarcity.

Of course, even gold does have some limitations. It is hard to transfer large quantities of it and it is one of the easiest metals to wear down. This is why gold used to be widely adopted as a standard for national currencies around the world. Does Bitcoin as digital gold imply that it could be a basis for digital currencies? Before answering that, let’s review what else makes gold valuable.

Why is Gold Valuable?

Gold used to be a basis for monetary systems for its scarcity and applications. It was adopted for its scarcity, resistance to corrosion and cognizability. Aside from being used primarily as money, gold was used in production of goods. Gold can be used in jewelry, and in modern times in electronics, chemistry and medicine. Paper money at first served as checks that could be redeemed for gold, especially in gold standard economies. As production of gold depleted and money lost redeeming quality to inflation, gold standard was retired for fiat.

History of Bitcoin

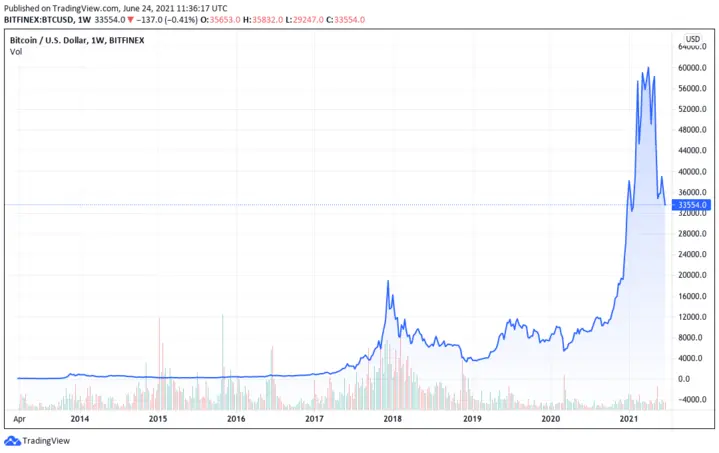

Before Bitcoin and cryptocurrencies, digital currencies were going the path of legacy monetary systems: first electronic money were representations of fiat currencies. The cypherpunk movement in the 1990s was figuring out how to create a monetary system which did not need a central authority. They used cryptography to digitally replicate properties of money, and that is how pseudonymous Satoshi Nakamoto designed Bitcoin in 2008. In the first years it was used and mined by fellow cryptography enthusiasts. First transactions and trading activity started in 2010. Bitcoin price started accumulating, opening at $0.30 in 2011 and closing 2013 at $770. 2014 was the first bull run of BTC, and first Bitcoin news appeared in the mainstream media.

BTC in 2014 peaked at $1,175 but sharply corrected afterwards and was trading sideways for three years. Similar cycle repeated in 2017, and that time BTC reached a peak of $19,891. By then, even despite the best efforts of developers to make BTC better suited for daily transacting, “Internet money” narrative died out. Instead, focusing on provable scarcity, a new narrative formed: Bitcoin as digital gold and safe haven asset. Has Bitcoin reached a peak in 2021? It is still hard to say, as models suggest it can still reach $100k this year but not everyone agrees. What is certain, though, is that the amount of fiat money parked in BTC overall grows through these cycles.

Bitcoin vs Gold

As Grayscale analytics put it, Bitcoin cannot be valued in the same way as stocks because it does not generate cash flow. Instead, to estimate its value, it is reasonable to use supply/demand and relative valuation — as it is done for gold. What arguments are made in favor of Bitcoin vs gold?

- Bitcoin is scarce: the protocol has a rule that there can only be 21 million units;

- Bitcoin is resistant to inflation: its emission slows down roughly every 4 years, making it disinflationary;

- Like gold can be used in electronics and chemistry, Bitcoin itself has value as the first real application of blockchain technology, for example, for peer-to-peer value transfers.

Bitcoin also fulfills most properties of money like gold does:

- Durability: BTC doesn’t have physical representation, it exists as data, and is resistant to attacks on the network thanks to mining;

- Divisibility: 1 BTC can be split into 1,000,000,000,000 satoshis;

- Portability: BTC can be accessed from any location;

- Scarcity: there is a limited amount of BTC in existence.

Cognizability and fungibility of Bitcoin are the only more or less contentious points. Arguments can be made for “tainted” coins with history of being involved in illicit activity, which are not accepted by some operators. As for cognizability, as of 2021 Bitcoin is recognized as legal tender only in El Salvador. Thousands of vendors and retailers accept Bitcoin for goods and services.

Bitcoin vs Gold Correlation

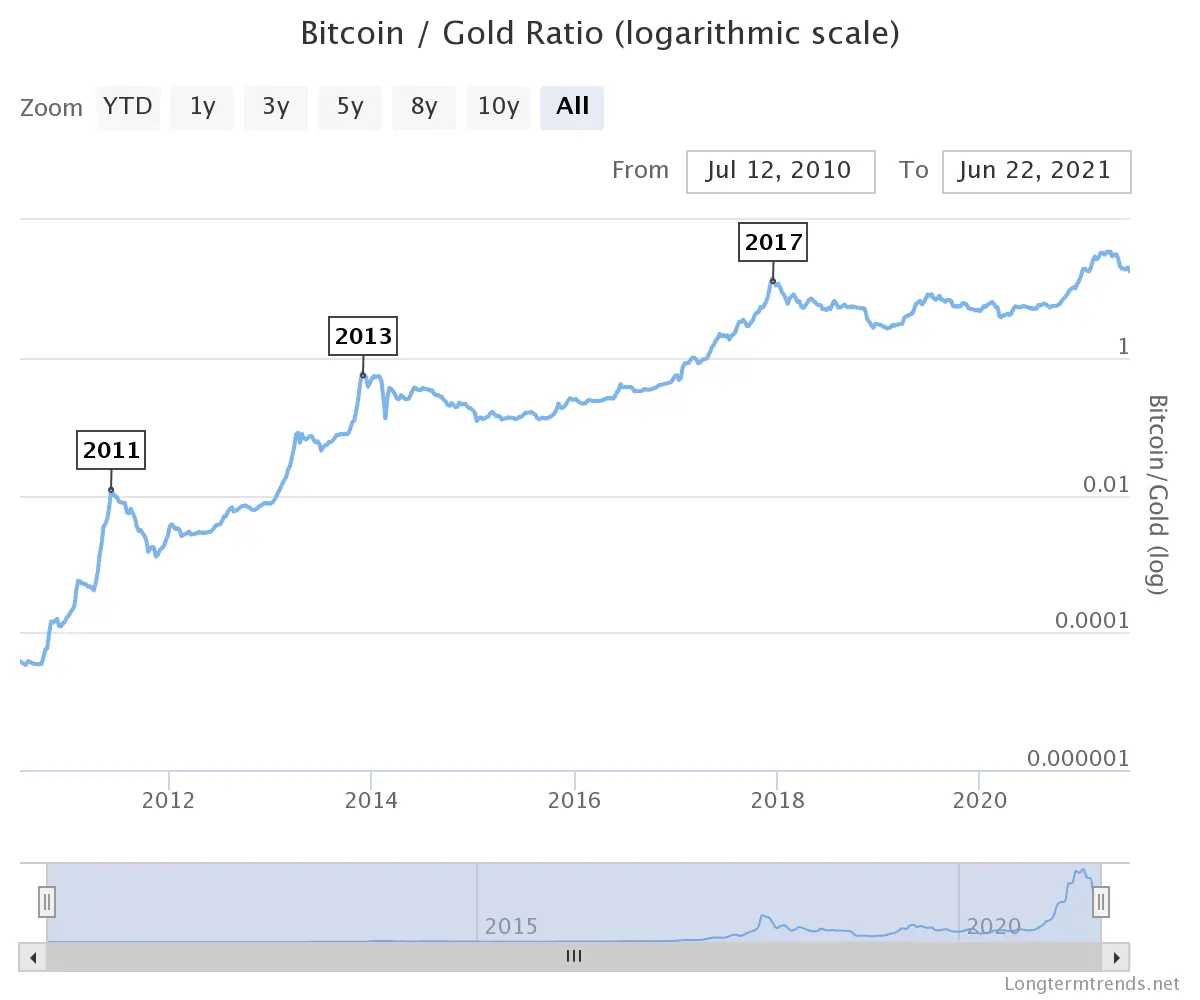

On this chart, the price of Bitcoin is weighed against how many ounces of gold it can purchase with 1 BTC. When it increases, Bitcoin outperforms gold, and vice versa.

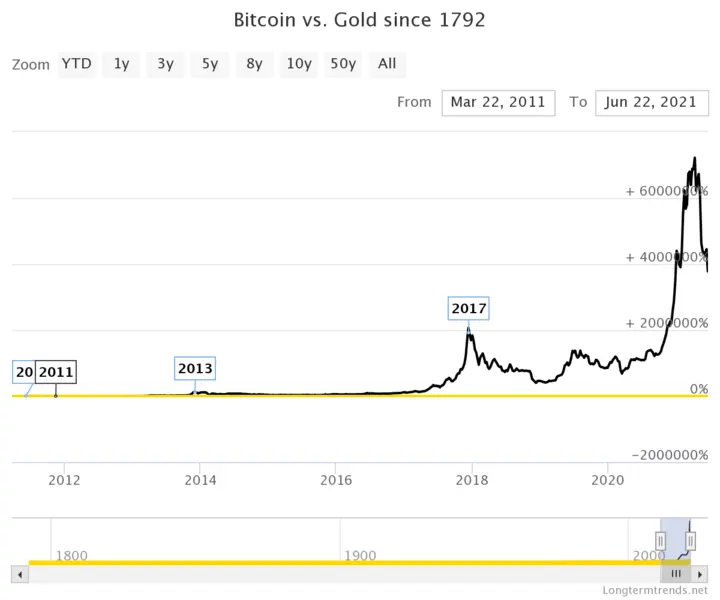

The linear chart makes it even more obvious how Bitcoin outperforms gold. A counterargument is made that Bitcoin’s volatility disqualifies it as a reliable store of value. Returning to the previous chart, however, a conclusion that BTC appreciates long-term can easily be drawn. At the same time, gold has been trading in the $1,000–1,600 range for a decade without such drastic rises.

Tweets about Bitcoin as Digital Gold

"No other asset in history has ever crashed more than 80% three times, only to come back every time and make new all-time highs. Each time #Bitcoin persists through FUD, crash, etc., it gains value as the ultimate resilient hard asset." - @AlistairMilne

— Documenting Bitcoin 📄 (@DocumentingBTC) June 22, 2021

Some investors take the volatility counterargument and turn it to further prove the point of Bitcoin as digital gold. Alistair Milne, for example, said that Bitcoin deserves the title not in spite of but thanks to persevering through turbulent markets.

#bitcoin = 35 ounces of gold .. going to 100 ounces? pic.twitter.com/NLSU64lSjc

— PlanB (@100trillionUSD) March 30, 2021

An author of a stock-to-flow model application to Bitcoin, blogger PlanB made the Bitcoin/gold ratio chart and projected where to next. In that model by 2025, one BTC should buy you 1,000 ounces of gold, driven by demand.

It doesn't matter if I use #gold myself. There are entire industries that need and use gold. So when I a store gold I am storing it to sell it in the future to others who actually use it. Gold retains its properties. No one uses Bitcoin now, and no one will use it in the future.

— Peter Schiff (@PeterSchiff) May 21, 2021

Of course, there is also an opposite point of view: one of the most known sceptics of Bitcoin vs gold is Peter Schiff. He argues that Bitcoin does not have a real world use unlike gold, but that is what the point of it being digital.

Conclusion

The Bitcoin community is now closely watching whether more countries adopt BTC as legal tender. In that case, Bitcoin as digital gold will finally be recognized worldwide. Interested in more context around the latest news and Bitcoin updates? Keep an eye on our blog and subscribe to ChangeHero on social media: Twitter, Facebook, Reddit and Telegram.

FAQs

Is Bitcoin digital gold?

Bitcoin proponents are comparing Bitcoin to gold because of the scarcity and value of both assets. Due to its purely digital nature, Bitcoin is dubbed digital gold.

Will bitcoin become digital gold?

Bitcoin as digital gold is arguably already valid, but it could be further validated by making Bitcoin more fungible and cognizable. Protocol updates and legal adoption respectively could help with that.

Which is better: Bitcoin or gold?

Both assets fulfil their own purpose, so comparing them requires specification. Bitcoin wins in portability and accessibility but gold is more cognizable and fungible.

Does Bitcoin kill gold?

Since Bitcoin and gold can exist as separate safe haven assets, Bitcoin cannot kill gold. Instead, investors and governments can adopt Bitcoin as digital gold.