Contents

Earlier in May 2022, the Terra protocol collapsed following a depeg of the UST stablecoin. The blockchain was halted but on May 25, a hard fork with two contentious solutions was made. Let us explain what each of the plans entails and discuss, whether any of the solutions: Terra Classic or LUNA 2.0 — will help in reviving the protocol.

Terra Revival and LUNA 2.0

Soon after the Terra blockchain was halted, the community started to come up with solutions to revive the ecosystem. As a result, two options received significant support to warrant their coexistence: keep the original blockchain running as Terra Classic and restart it with a split chain, nicknamed LUNA 2.0.

This is not a novel solution: in 2017, the Ethereum Foundation opted to split a branch from the Ethereum blockchain to mitigate the DAO hack and reimburse stolen funds. Since then, Ethereum Classic and (new) Ethereum have worked side by side.

The chain split proposal was posted by Do Kwon, the CEO of Terraform Labs (TFL), previously viewed as the face of the brand. There were proposals to carry on without affiliation to TFL, but the popular vote locked in the Do’s solution.

Terra Classic

The original blockchain resumed block production as Terra Classic. It will retain all existing smart contracts, including the stablecoins that made the platform so widely adopted in the first place.

TFL issued guidelines according to which the cryptocurrencies on this chain will use the naming ‘Classic’. As a result, the blockchain itself is called Terra Classic, its native token Luna Classic will be using a ticker LUNC, and the stablecoins will be named accordingly (UST → USTC).

TFL chose to preserve the classic chain due to the sheer amount of value created by all applications built on Terra. It does not mean the applications have to stay there, though.

Terra 2.0

Restarting the chain with the existing code would just be asking for the collapse to repeat itself. Therefore, significant changes were made to the codebase of Terra 2.0:

- No native stablecoins of Terra 1.0. Stablecoin contracts are in progress;

- No treasury module. The removal of native stablecoins made tax queries unnecessary;

- No native swap module.

- No native oracle. The lack of the swap module made it unnecessary. However, developers can still use third-party oracles if they need to.

The validator network is set to launch on May 28, giving a leeway for them to set up nodes.

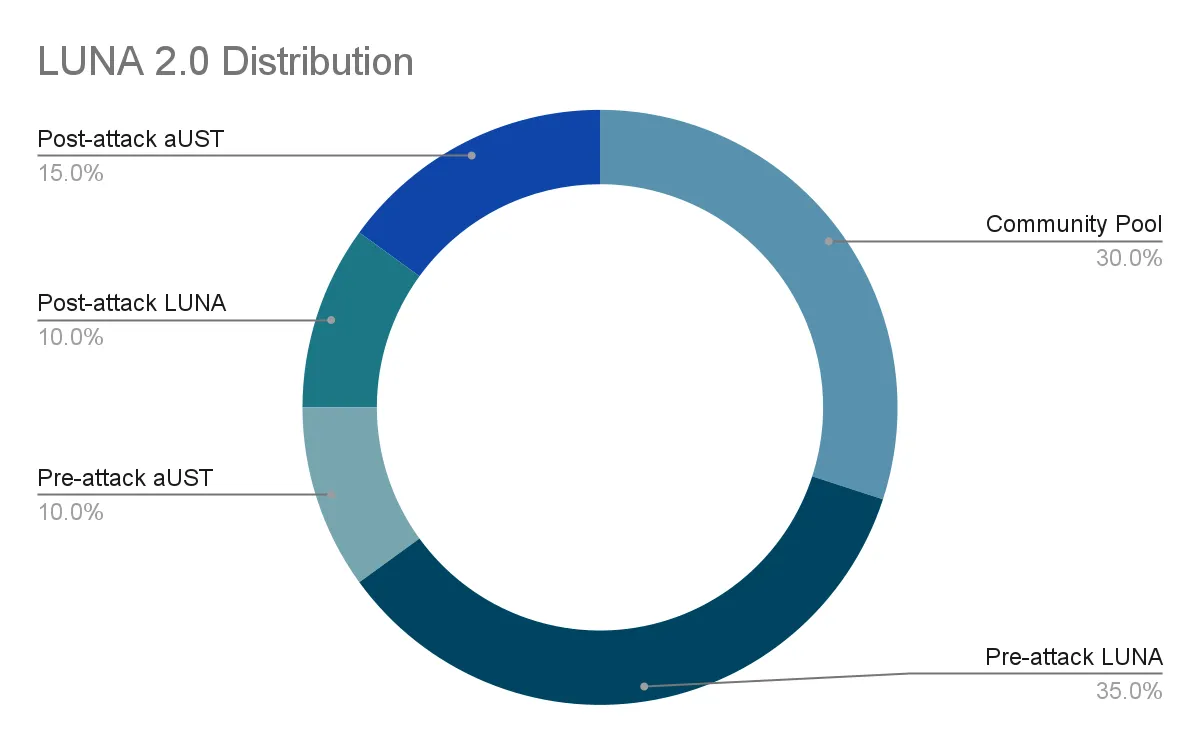

The new chain issued 1 billion native tokens LUNA at launch and airdropped them to LUNA 1.0 holders. Depending on when they get their tokens — before or after May 7 — the holders will be entitled to a share of the total supply of newly minted LUNA.

The aUST in the diagram stands for UST stablecoins locked in the Anchor Protocol, a yield farming platform that promised a 20% APY for deposits. The protocol did not generate enough revenue to justify these returns, and as users started to withdraw UST from it, it exacerbated the stablecoin’s collapse.

Most of the supply will not be unlocked immediately, and for pre-attack LUNA holders, the priority is given to balances with a sub-10k balance. This could probably be a response to allegations of bailout for large holders that emerged soon after the crash.

Is LUNA 2.0 a Scam or a Genuine Solution?

The vocal part of the community does not seem to be very welcoming to the solution. However, the proposal passed with a 65% approval rate, locking in the fork.

In large part, the discontent is explained by Do Kwon being behind a failed algorithmic stablecoin not once but twice. It would not be an overstatement to claim his reputation is at an all-time low.

So, when all is said and done, will this revival plan work? We asked our CMO Alex his opinion:

LUNA 2.0 is no better than the previous, failed project.

Whatever they have salvaged and come up with for the rewards or reimbursements could not be further from

transparent. Roughly half of the LUNA holders will not receive anything at all, and the rest of them

will have to wait for a couple of years.

I absolutely can’t tell if this is going to work. Not to mention, the CEO Do Kwon is now being

interrogated, so law enforcement is involved.

With LUNA2.0 being dead on arrival and half of the holders not getting reimbursed, it will go further down

from $5 to $2 tops. The collapse should have been halted before it went out of control, and LUNA 1.0 and

UST should have been saved — as I was saying before.

Now, LUNA 2.0 is nothing more than another coin for traders to flip, with no use other than that.

Conclusion

The tale of Terra and LUNA will definitely go down in the history of the crypto market. The revival seems to be shaping up to become another chapter in its downfall — but who knows for certain?

Make sure to check out more similar articles from our blog! If you want updates daily, why not sign up on our Twitter, Facebook, and Telegram?